Does NOTE (STO:NOTE) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in NOTE (STO:NOTE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide NOTE with the means to add long-term value to shareholders.

See our latest analysis for NOTE

How Quickly Is NOTE Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that NOTE has grown EPS by 39% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

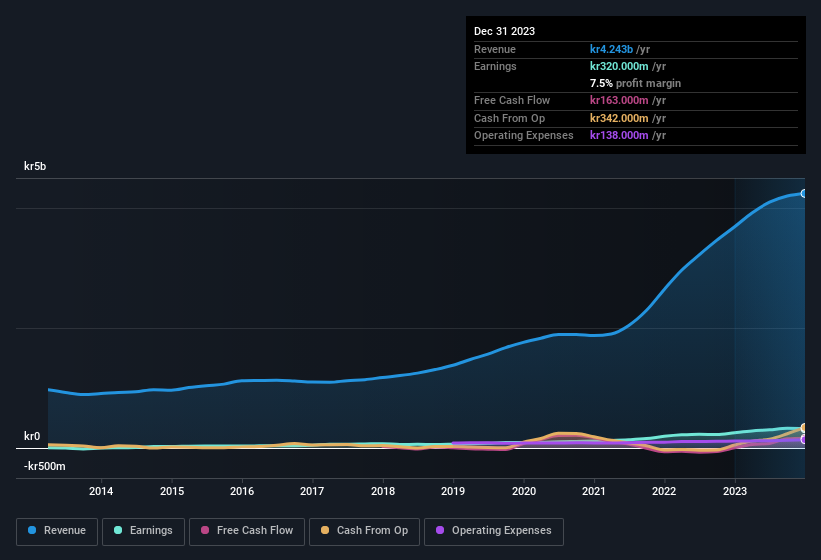

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for NOTE remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to kr4.2b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are NOTE Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth kr8.5m) this was overshadowed by a mountain of buying, totalling kr42m in just one year. This bodes well for NOTE as it highlights the fact that those who are important to the company having a lot of faith in its future. Zooming in, we can see that the biggest insider purchase was by Director Johan Hagberg for kr37m worth of shares, at about kr146 per share.

Along with the insider buying, another encouraging sign for NOTE is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth kr1.2b. Coming in at 31% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add NOTE To Your Watchlist?

NOTE's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe NOTE deserves timely attention. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if NOTE is trading on a high P/E or a low P/E, relative to its industry.

The good news is that NOTE is not the only growth stock with insider buying. Here's a list of growth-focused companies in SE with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NOTE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOTE

NOTE

Provides electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)