- Sweden

- /

- Electronic Equipment and Components

- /

- OM:LAGR B

Our View On Lagercrantz Group's (STO:LAGR B) CEO Pay

Jörgen Wigh became the CEO of Lagercrantz Group AB (publ) (STO:LAGR B) in 2006, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Lagercrantz Group.

View our latest analysis for Lagercrantz Group

How Does Total Compensation For Jörgen Wigh Compare With Other Companies In The Industry?

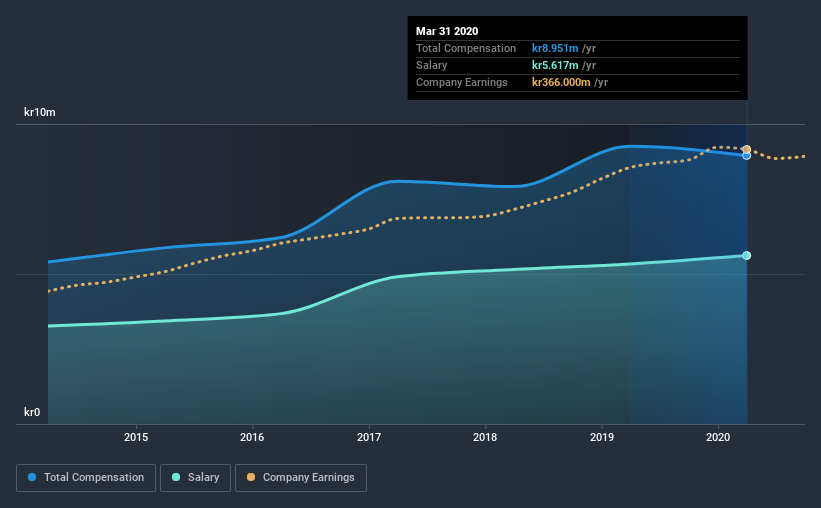

According to our data, Lagercrantz Group AB (publ) has a market capitalization of kr15b, and paid its CEO total annual compensation worth kr9.0m over the year to March 2020. We note that's a small decrease of 3.3% on last year. We note that the salary portion, which stands at kr5.62m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between kr8.3b and kr27b, we discovered that the median CEO total compensation of that group was kr8.9m. So it looks like Lagercrantz Group compensates Jörgen Wigh in line with the median for the industry. Moreover, Jörgen Wigh also holds kr177m worth of Lagercrantz Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | kr5.6m | kr5.3m | 63% |

| Other | kr3.3m | kr3.9m | 37% |

| Total Compensation | kr9.0m | kr9.3m | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Lagercrantz Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Lagercrantz Group AB (publ)'s Growth Numbers

Over the past three years, Lagercrantz Group AB (publ) has seen its earnings per share (EPS) grow by 9.2% per year. In the last year, its revenue is up 1.2%.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Lagercrantz Group AB (publ) Been A Good Investment?

Boasting a total shareholder return of 186% over three years, Lagercrantz Group AB (publ) has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As previously discussed, Jörgen is compensated close to the median for companies of its size, and which belong to the same industry. But the business isn't reporting great numbers in terms of EPS growth. At the same time, shareholder returns have remained strong over the same period. So while shareholders shouldn't be overly concerned about CEO compensation, we suspect most would prefer to see improved performance, before a bump in pay.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Lagercrantz Group that you should be aware of before investing.

Important note: Lagercrantz Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Lagercrantz Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:LAGR B

Lagercrantz Group

Operates as a technology company in Sweden, Denmark, Norway, Finland, Germany, the United Kingdom, Benelux, Poland, rest of Europe, North America, Asia, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)