- Sweden

- /

- Communications

- /

- OM:HMS

HMS Networks (OM:HMS) Earnings Growth Surges 26.6%, Challenging Valuation Concerns

Reviewed by Simply Wall St

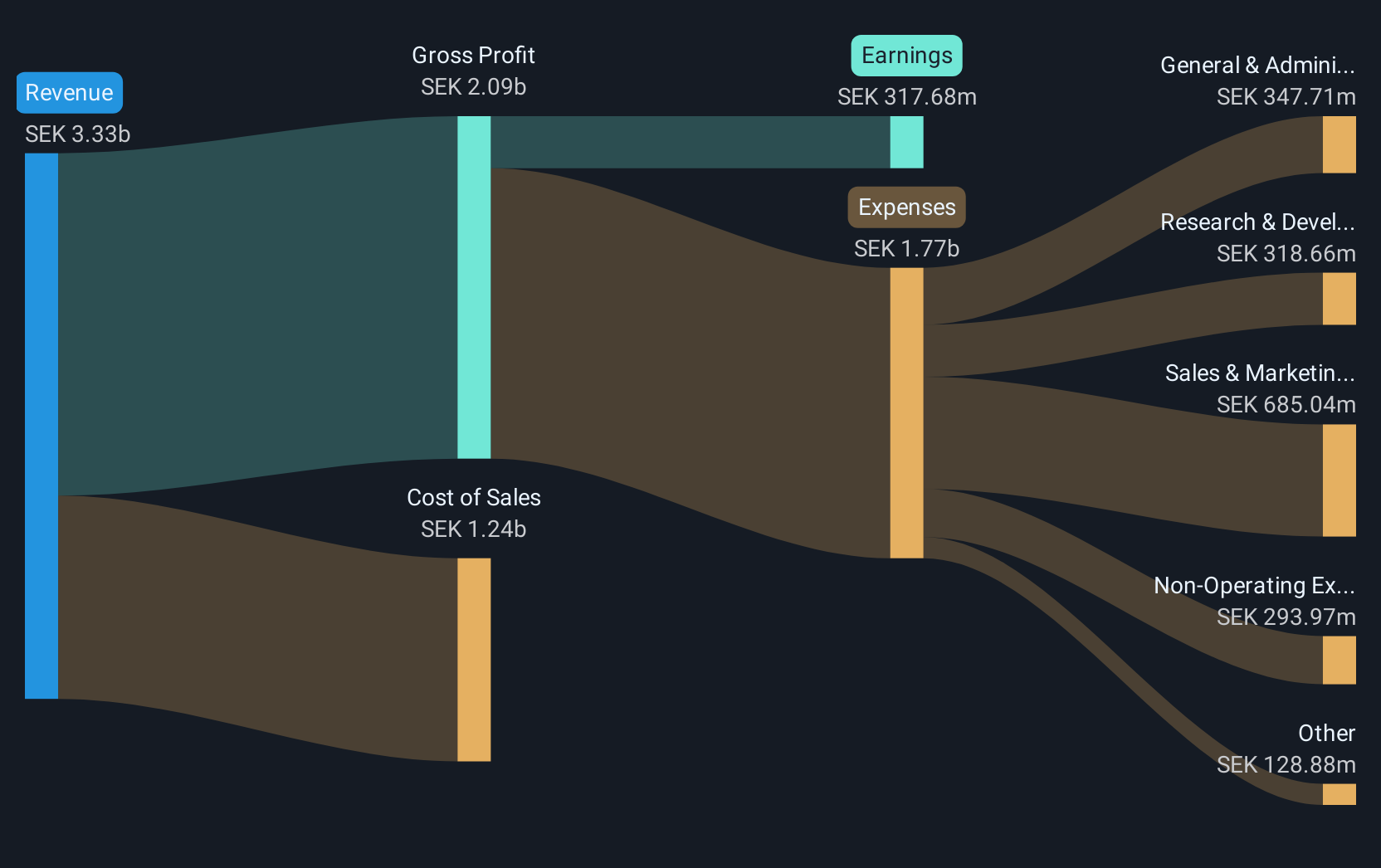

HMS Networks (OM:HMS) delivered stand-out results, posting 26.6% earnings growth for the year, well above its own 5-year average of 7.4% per year. Net profit margins improved to 12.7% from 11.5% last year, signaling stronger profitability, and both revenue and annual earnings are forecast to outpace the broader Swedish market’s growth rates. Despite this robust operational momentum, HMS now trades on a 56.8x price-to-earnings ratio, a significant premium compared to peers and industry benchmarks, with the current share price above the estimated fair value of SEK371.01. Investors eyeing HMS are weighing record growth trends against premium valuation levels.

See our full analysis for HMS Networks.Now, let's see how these headline numbers compare with the widely followed narratives and investor expectations. Some assumptions may be reinforced, while others could face a challenge.

See what the community is saying about HMS Networks

Order Recovery Drives Future Outlook

- Analysts estimate HMS Networks’ revenue will climb 15.4% annually over the next three years, with order intake already showing 12% organic growth as large customers ramp up their purchasing.

- According to analysts' consensus view, the successful integration of Red Lion and PEAK-System and a company-wide restructuring into accountable divisions are expected to boost operational efficiency, positioning HMS to leverage the recent jump in orders.

- Analysts point to the company’s full-accountability model for R&D, sales, and marketing. This model could translate fresh order momentum into long-term revenue and margin gains.

- The positive consensus includes expectations that operational changes and acquisition benefits will enhance both revenue and market share in the coming years.

- Consensus narrative notes that investments in North American manufacturing and pricing strategies to offset tariffs may defend profitability even as macroeconomic headwinds continue.

- Protecting gross profit margins is seen as a strategic edge, helping to ensure earnings growth despite volatile material and logistics costs.

- The consensus highlights that supply chain resilience and competitive pricing are critical to maintaining HMS’s growth lead over the broader Swedish market.

- Curious how the latest earnings reinforce the consensus that operational shifts may unlock new value? 📊 Read the full HMS Networks Consensus Narrative.

Organic Sales Show Risks Beneath Growth

- Recent reporting points to a 17% decline in organic sales, which may indicate underlying weakness in HMS Networks' core business, independent of acquisitions.

- Bears argue that persistent supply chain challenges and cautious customer behavior in Europe could undercut HMS’s ambitious growth targets in future periods.

- Tariffs on goods between global regions inject cost uncertainty. Inflation in production and logistics potentially reduces net margins.

- Analysts warn that even with acquisitions bolstering overall figures, ongoing weakness in organic sales and economic softness could affect future earnings quality and growth trajectories.

Valuation Well Above Fair Value and Peers

- At SEK495.0, HMS trades at a price-to-earnings ratio of 56.8x, significantly above the European communications industry average (38.2x), peer group average (26.1x), and a DCF fair value of SEK371.01.

- Consensus narrative notes that for HMS to justify its current share price, earnings would need to meet high analyst targets. This would require SEK1.0 billion in earnings by 2028 and a future PE of 28.4x, which is half today’s multiple.

- The current premium pricing places heavy pressure on the company to deliver on both forecast profit and margin expansion to close the valuation gap.

- The consensus view is that while HMS boasts robust operational momentum, investors are required to balance these growth signals against a considerable valuation stretch, especially given the fair value and industry benchmarks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for HMS Networks on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your perspective and craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your HMS Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust growth, HMS Networks faces concerns around premium valuation and softening organic sales. These factors could signal challenges in sustaining future performance.

If you’re concerned about high pricing or value traps, use these 871 undervalued stocks based on cash flows to spot opportunities trading well below fair value with stronger upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)