As global markets react to the recent Federal Reserve rate cut, smaller-cap indexes have shown notable resilience, although they remain below their previous peaks. In this context of shifting economic indicators and market sentiment, identifying high-growth tech stocks in Sweden can offer promising opportunities for investors looking to capitalize on innovative sectors.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.03% | 22.24% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Yubico | 20.52% | 42.35% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

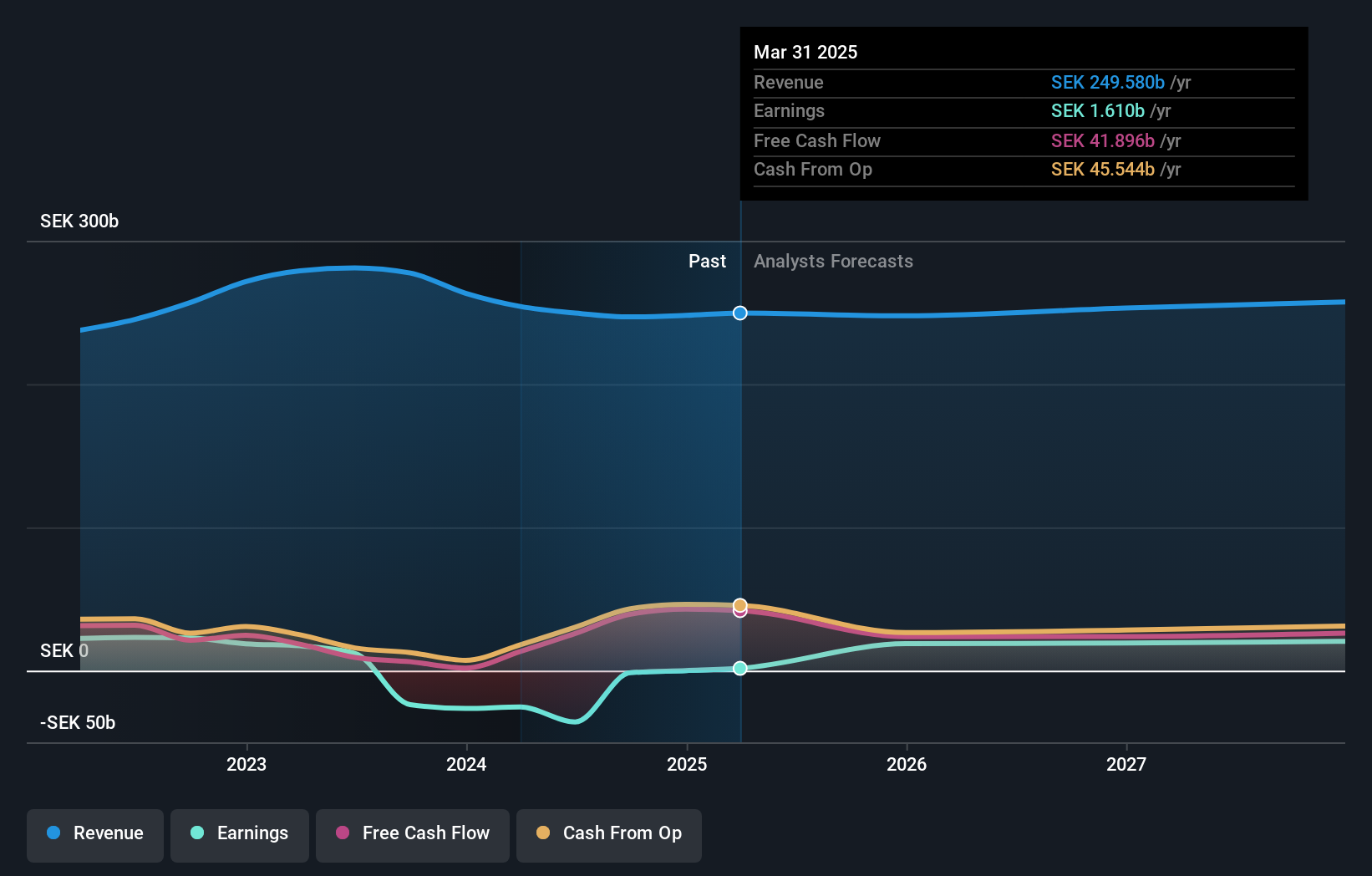

Overview: Telefonaktiebolaget LM Ericsson (publ), along with its subsidiaries, offers mobile connectivity solutions to telecom operators and enterprise customers across North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India; the company has a market cap of SEK262.28 billion.

Operations: Ericsson generates revenue primarily from three segments: Networks (SEK157.93 billion), Enterprise (SEK25.83 billion), and Cloud Software and Services (SEK63.35 billion). The company serves telecom operators and enterprise customers across multiple global regions, focusing on mobile connectivity solutions.

Telefonaktiebolaget LM Ericsson's recent strategic moves underscore its commitment to enhancing telecom and financial services globally. The collaboration with INFORM to integrate advanced anti-money laundering solutions into its mobile financial services platform is particularly noteworthy, reflecting a 2.6% annual revenue growth projection that outpaces the Swedish market average. Furthermore, Ericsson's involvement in a substantial $3.6 billion network equipment deal with Vodafone Idea marks a significant step towards expanding 5G capabilities and coverage, aligning with an expected earnings surge of 100.4% annually. These initiatives not only highlight Ericsson’s proactive approach in adopting cutting-edge technologies but also position it well for future growth amidst increasing demand for robust digital and financial service infrastructures.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that enable industrial equipment to communicate and share information worldwide, with a market cap of SEK20.53 billion.

Operations: HMS Networks AB (publ) generates revenue primarily from its Wireless Communications Equipment segment, which accounts for SEK3.01 billion. The company focuses on products that facilitate communication and information sharing among industrial equipment globally.

HMS Networks, amidst Sweden's bustling tech landscape, is navigating through a challenging phase with an earnings decline of 26.5% over the past year. However, it's poised for a rebound with projected annual earnings growth of 28.4%. This forecast outstrips the broader Swedish market's expectations by a significant margin. The company also demonstrates robust revenue prospects with an anticipated increase of 15.3% per year, surpassing the national average growth rate of just 0.8%. Despite recent setbacks reflected in its second-quarter net income dropping to SEK 34 million from SEK 116 million year-over-year, HMS Networks is strategically positioned to harness these growth trajectories while continuing its share buyback program, having recently completed the repurchase of 25,000 shares for SEK 11.23 million.

- Click here to discover the nuances of HMS Networks with our detailed analytical health report.

Evaluate HMS Networks' historical performance by accessing our past performance report.

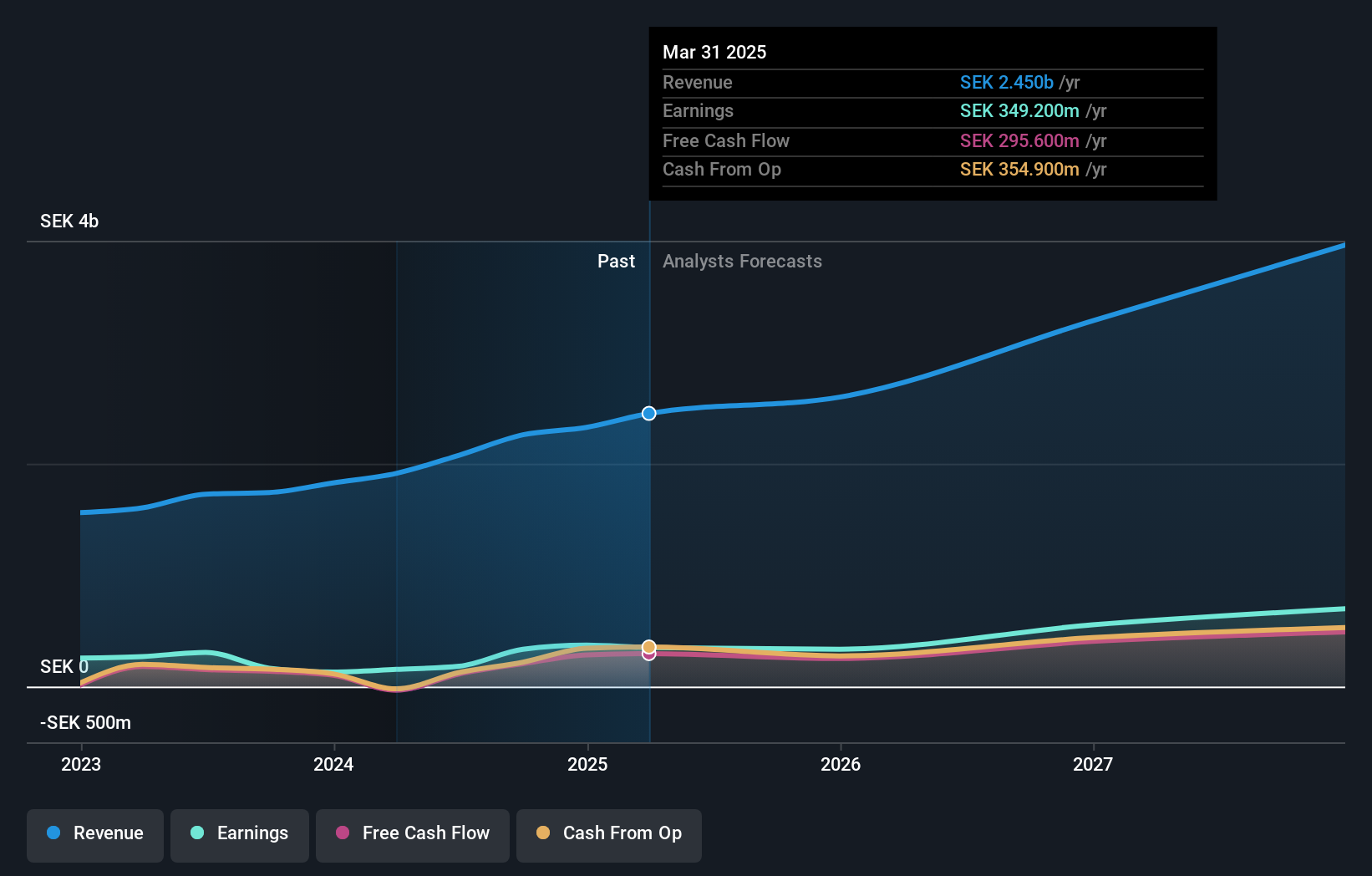

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB provides authentication solutions for use in computers, networks, and online services, with a market cap of SEK22.00 billion.

Operations: Yubico AB generates revenue primarily from its Security Software & Services segment, amounting to SEK2.09 billion. The company focuses on providing authentication solutions for computers, networks, and online services.

Yubico, a Swedish tech firm, is making significant strides in the cybersecurity sector with its innovative authentication solutions. The company reported a robust revenue growth of 20.5% year-over-year, reaching SEK 1.13 billion in the first half of 2024, propelled by strong demand for its security products. Notably, Yubico's commitment to innovation is underscored by its R&D expenses which surged to SEK 42.3 million, reflecting an aggressive strategy to stay ahead in technology advancements and market competition. This investment has facilitated notable developments such as the MilSecure Mobile application for secure web browsing on mobile devices used by defense personnel, enhancing Yubico's product offering and market position despite a challenging competitive landscape marked by rapid technological changes.

- Dive into the specifics of Yubico here with our thorough health report.

Review our historical performance report to gain insights into Yubico's's past performance.

Seize The Opportunity

- Discover the full array of 82 Swedish High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives