- Switzerland

- /

- Building

- /

- SWX:ARBN

European Growth Companies Insiders Are Eager To Own

Reviewed by Simply Wall St

As uncertainty about U.S. trade policy weighs on investor sentiment, the European market has experienced mixed results, with the pan-European STOXX Europe 600 Index snapping a 10-week streak of gains. Despite these challenges, growth companies with high insider ownership in Europe are drawing attention as insiders demonstrate confidence by maintaining substantial stakes in their firms.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.8% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

We'll examine a selection from our screener results.

Intercos (BIT:ICOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intercos S.p.A., along with its subsidiaries, is engaged in the creation, production, and marketing of cosmetics and skincare products globally, with a market cap of approximately €1.27 billion.

Operations: The company's revenue is primarily derived from three segments: Make up Line (€619.80 million), Skin Care Line (€167.10 million), and Hair & Body Line (€278 million).

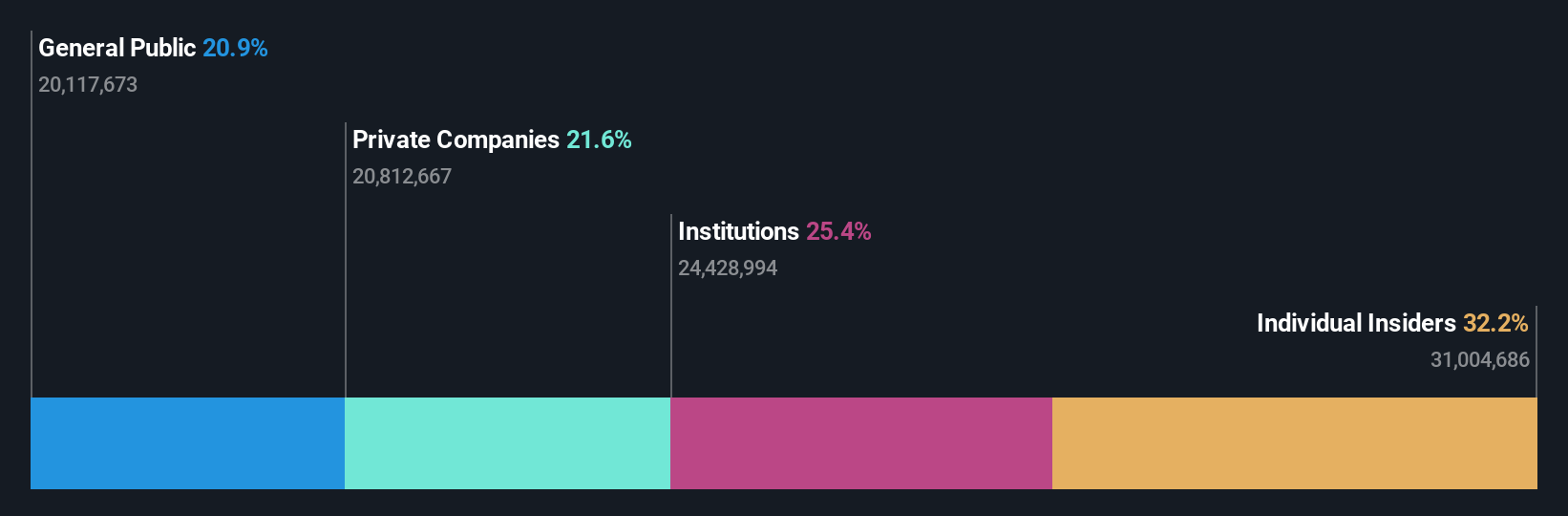

Insider Ownership: 32.2%

Intercos S.p.A. demonstrates potential as a growth company with high insider ownership, reporting EUR 1.06 billion in sales for 2024, up from EUR 988.2 million the previous year, though net income slightly declined to EUR 48.8 million. The company's earnings are forecast to grow significantly at over 20% annually, outpacing the Italian market's average growth rate of 7.7%. Despite low projected return on equity and slower revenue growth, analysts expect a notable stock price increase of around 37%.

- Navigate through the intricacies of Intercos with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Intercos' shares may be trading at a premium.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK22.81 billion.

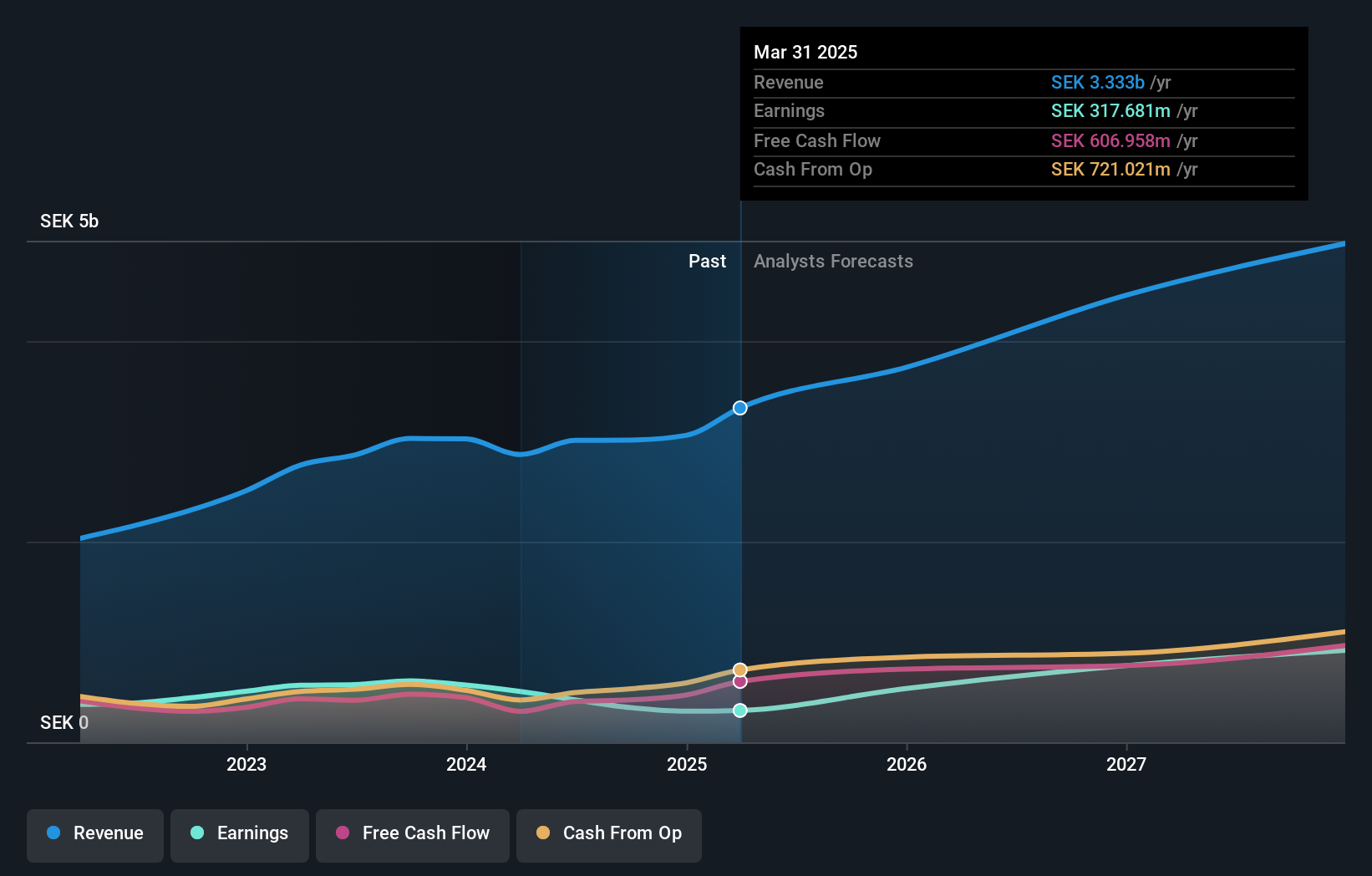

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to SEK3.06 billion.

Insider Ownership: 12.7%

HMS Networks, with significant insider ownership, is trading below its estimated fair value. Despite a high debt level and a recent decline in profit margins to 10.1%, the company forecasts robust earnings growth of 32.6% annually, surpassing the Swedish market's average. Revenue is expected to grow at 15.8% per year, though slower than some peers. Recent acquisitions led to dividend suspension as insiders modestly increased their holdings over the past three months without substantial selling activity.

- Unlock comprehensive insights into our analysis of HMS Networks stock in this growth report.

- Upon reviewing our latest valuation report, HMS Networks' share price might be too optimistic.

Arbonia (SWX:ARBN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arbonia AG supplies building components in Switzerland, Germany, and internationally, with a market cap of CHF747.30 million.

Operations: The company generates revenue from its Doors segment, including sanitary equipment, amounting to CHF553.77 million.

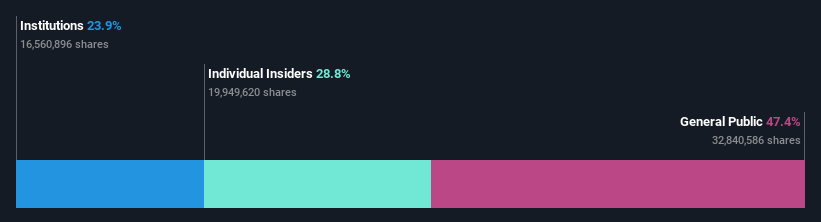

Insider Ownership: 28.7%

Arbonia, with substantial insider ownership, shows promising growth potential. Its earnings are forecast to grow significantly at 77.1% annually, outpacing the Swiss market. Recent financials reveal a return to profitability with net income of CHF 8.28 million for 2024, compared to a loss previously. While revenue growth is moderate at 7.3% annually, the company announced a special dividend and changes in management structure that may influence future strategy and performance positively amidst its volatile share price history.

- Get an in-depth perspective on Arbonia's performance by reading our analyst estimates report here.

- Our valuation report here indicates Arbonia may be overvalued.

Seize The Opportunity

- Get an in-depth perspective on all 221 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ARBN

Arbonia

Engages in the supply of building components in Switzerland, Germany, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives