3 European Stocks Estimated To Be Up To 44.6% Below Intrinsic Value

Reviewed by Simply Wall St

Amid ongoing concerns about U.S. trade tariffs and monetary policy uncertainties, European markets have experienced a mixed performance, with the STOXX Europe 600 Index ending slightly lower and major indexes either down or flat. In this environment of fluctuating economic signals, identifying stocks that are trading below their intrinsic value can present opportunities for investors seeking potential long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €32.15 | €64.13 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK164.64 | 49.5% |

| Net Insight (OM:NETI B) | SEK4.83 | SEK9.58 | 49.6% |

| JOST Werke (XTRA:JST) | €50.30 | €98.61 | 49% |

| Storytel (OM:STORY B) | SEK92.25 | SEK180.58 | 48.9% |

| Star7 (BIT:STAR7) | €6.20 | €12.36 | 49.8% |

| dormakaba Holding (SWX:DOKA) | CHF686.00 | CHF1359.67 | 49.5% |

| Neosperience (BIT:NSP) | €0.538 | €1.06 | 49.2% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €1.13 | €2.25 | 49.8% |

| Cavotec (OM:CCC) | SEK17.35 | SEK34.06 | 49.1% |

Let's dive into some prime choices out of the screener.

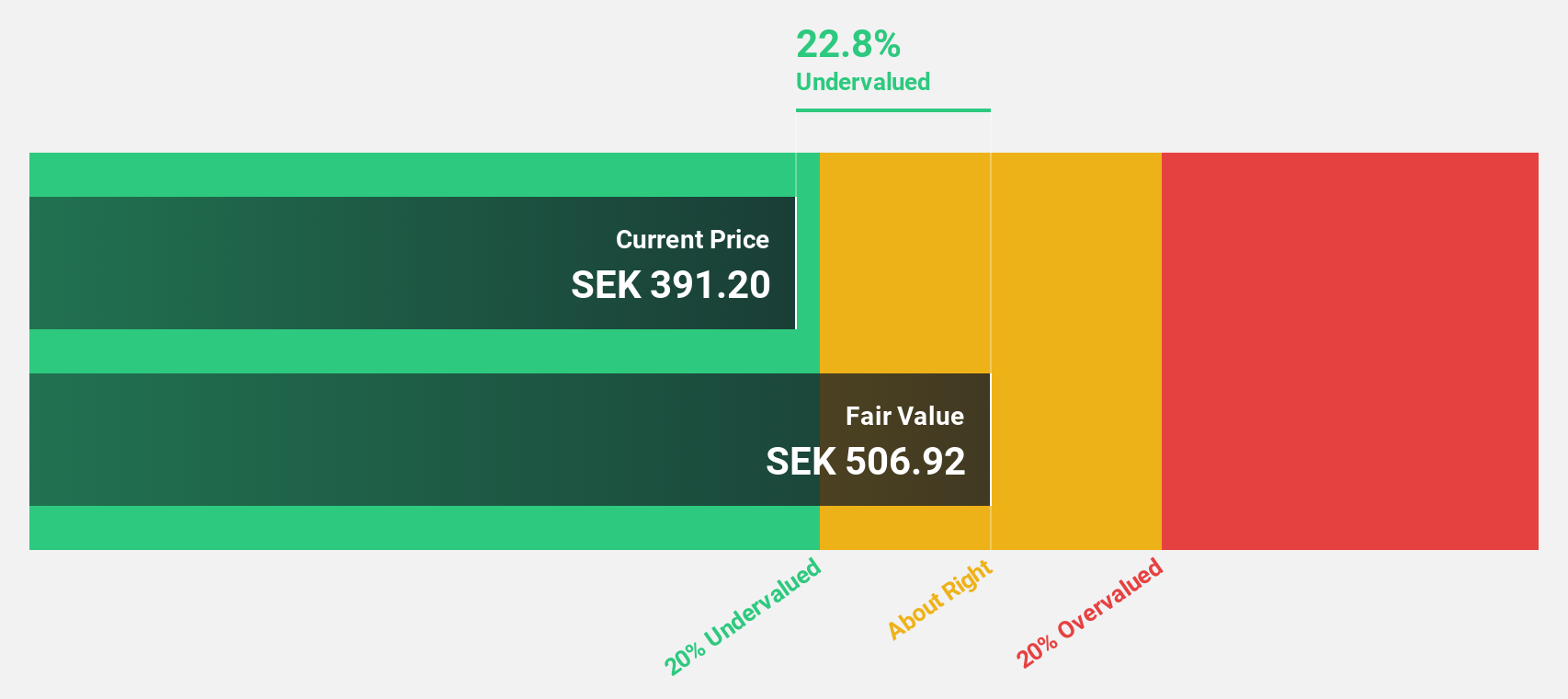

HMS Networks (OM:HMS)

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK23.68 billion.

Operations: The company generates revenue from its Wireless Communications Equipment segment, which amounts to SEK3.06 billion.

Estimated Discount To Fair Value: 25.2%

HMS Networks is trading at SEK472, significantly below its estimated fair value of SEK630.67, indicating undervaluation based on discounted cash flows. Despite a forecasted low return on equity and declining profit margins from 18.9% to 10.1%, the company anticipates strong earnings growth of 32.7% annually, outpacing the Swedish market's average growth rate. Recent acquisitions have led to a dividend suspension, while revenue and earnings are expected to improve in the latter half of 2025.

- Our earnings growth report unveils the potential for significant increases in HMS Networks' future results.

- Navigate through the intricacies of HMS Networks with our comprehensive financial health report here.

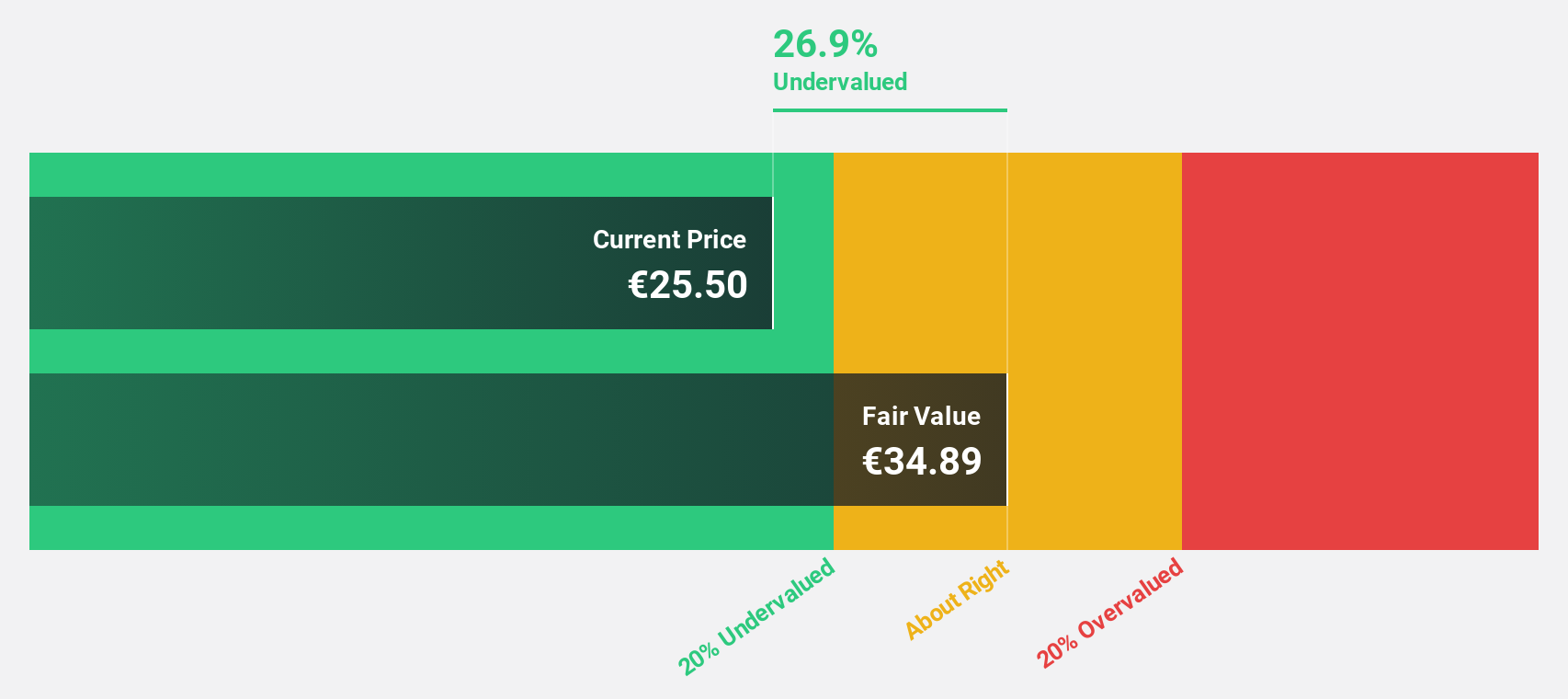

Kontron (XTRA:SANT)

Overview: Kontron AG provides internet of things (IoT) solutions in Austria and internationally, with a market cap of €1.53 billion.

Operations: The company's revenue segments include €1.16 billion from Europe, €294.77 million from Global operations, and €429.91 million from Software + Solutions.

Estimated Discount To Fair Value: 10.8%

Kontron is trading at €24.9, below its estimated fair value of €27.91, showing potential undervaluation based on cash flows. The company forecasts robust earnings growth of 20.1% annually, surpassing the German market average, though revenue growth is slower at 7.2%. Recent contracts in 5G automotive IoT and defense sectors bolster its position and future revenues. However, a dividend yield of 2.01% isn't well-supported by free cash flows, indicating potential sustainability concerns.

- In light of our recent growth report, it seems possible that Kontron's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Kontron's balance sheet health report.

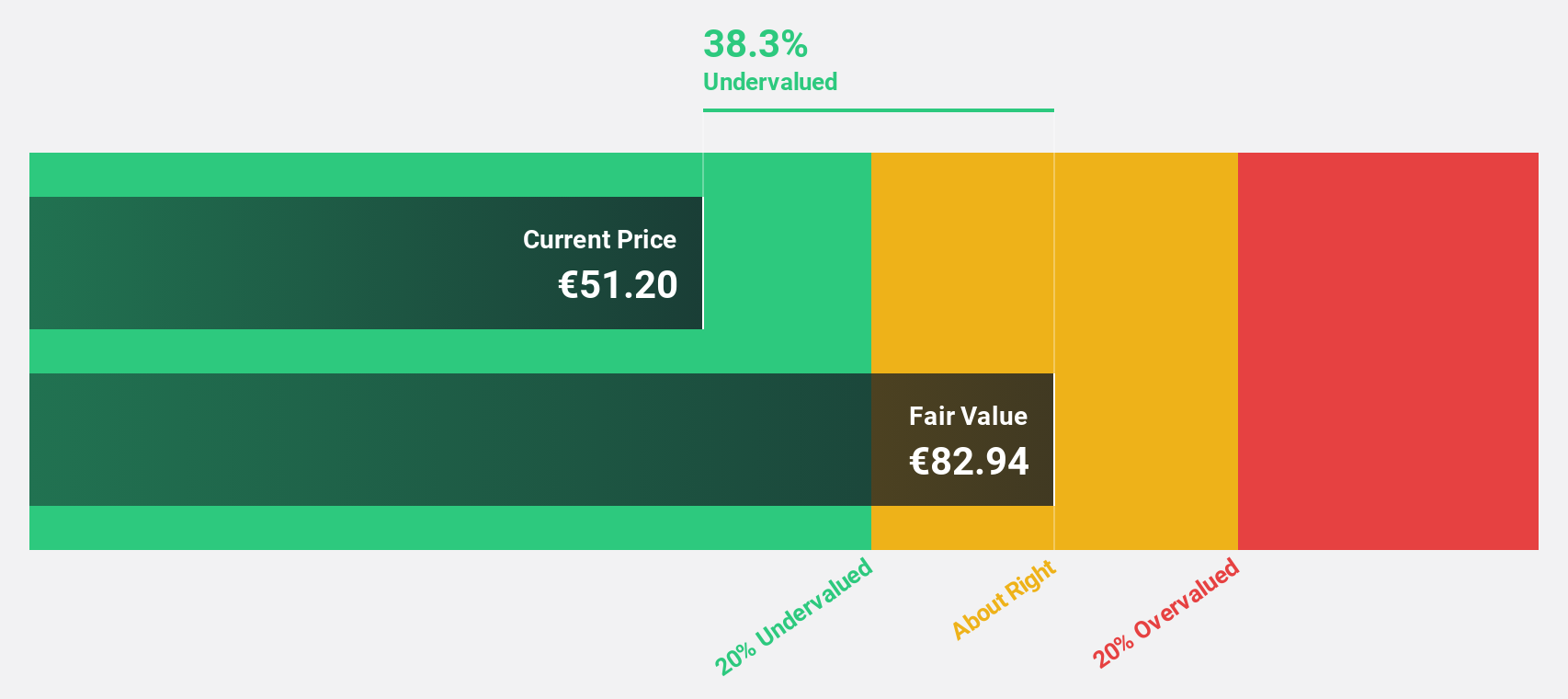

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA operates in the out-of-home media and online advertising sectors both in Germany and internationally, with a market cap of €3.24 billion.

Operations: The company's revenue segments include Daas & E-Commerce (€357.80 million), Out-Of-Home Media (€953.20 million), and Digital & Dialog Media (€878.30 million).

Estimated Discount To Fair Value: 44.6%

Ströer SE KGaA is trading at €56.15, significantly below its estimated fair value of €104.77, highlighting undervaluation based on cash flows. The company's earnings grew by 58.9% last year and are projected to grow annually by 19.3%, outpacing the German market average. However, revenue growth is slower at 6.4%. Recent discussions about divesting its advertising business could impact future valuations and require shareholder approval if a deal proceeds.

- Insights from our recent growth report point to a promising forecast for Ströer SE KGaA's business outlook.

- Unlock comprehensive insights into our analysis of Ströer SE KGaA stock in this financial health report.

Make It Happen

- Gain an insight into the universe of 201 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kontron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SANT

Kontron

Provides Internet of Things software and solutions in Europe and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)