As global markets navigate a period of rate cuts and mixed economic signals, investors are closely watching the Federal Reserve's impending decision while noting the Nasdaq Composite's record-breaking performance. With inflationary pressures persisting and labor markets showing signs of cooling, identifying undervalued stocks becomes crucial for those seeking opportunities amidst market volatility. In such an environment, a good stock is often characterized by strong fundamentals and resilience to economic shifts, offering potential value even when broader indices fluctuate.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$123.38 | US$244.22 | 49.5% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1132.90 | ₹2237.94 | 49.4% |

| Business First Bancshares (NasdaqGS:BFST) | US$27.78 | US$54.95 | 49.4% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.18 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$46.66 | US$92.69 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.50 | CLP578.67 | 49.6% |

| BYD Electronic (International) (SEHK:285) | HK$40.30 | HK$79.63 | 49.4% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Constellium (NYSE:CSTM) | US$11.01 | US$21.77 | 49.4% |

| Gold Road Resources (ASX:GOR) | A$2.08 | A$4.15 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hanza (OM:HANZA)

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK3.36 billion.

Operations: The company's revenue is derived from Main Markets (SEK2.78 billion), Other Markets (SEK1.91 billion), and Business Development and Services (SEK17 million).

Estimated Discount To Fair Value: 49.2%

HANZA is trading at SEK77.05, significantly below its estimated fair value of SEK151.78, indicating it is undervalued based on cash flows. Despite a decline in profit margins and net income, HANZA's earnings are expected to grow significantly at 34.5% per year. The company recently secured a EUR 1.4 million annual contract with a German firm, highlighting its strategic partnerships and potential for revenue growth above the Swedish market average.

- Upon reviewing our latest growth report, Hanza's projected financial performance appears quite optimistic.

- Dive into the specifics of Hanza here with our thorough financial health report.

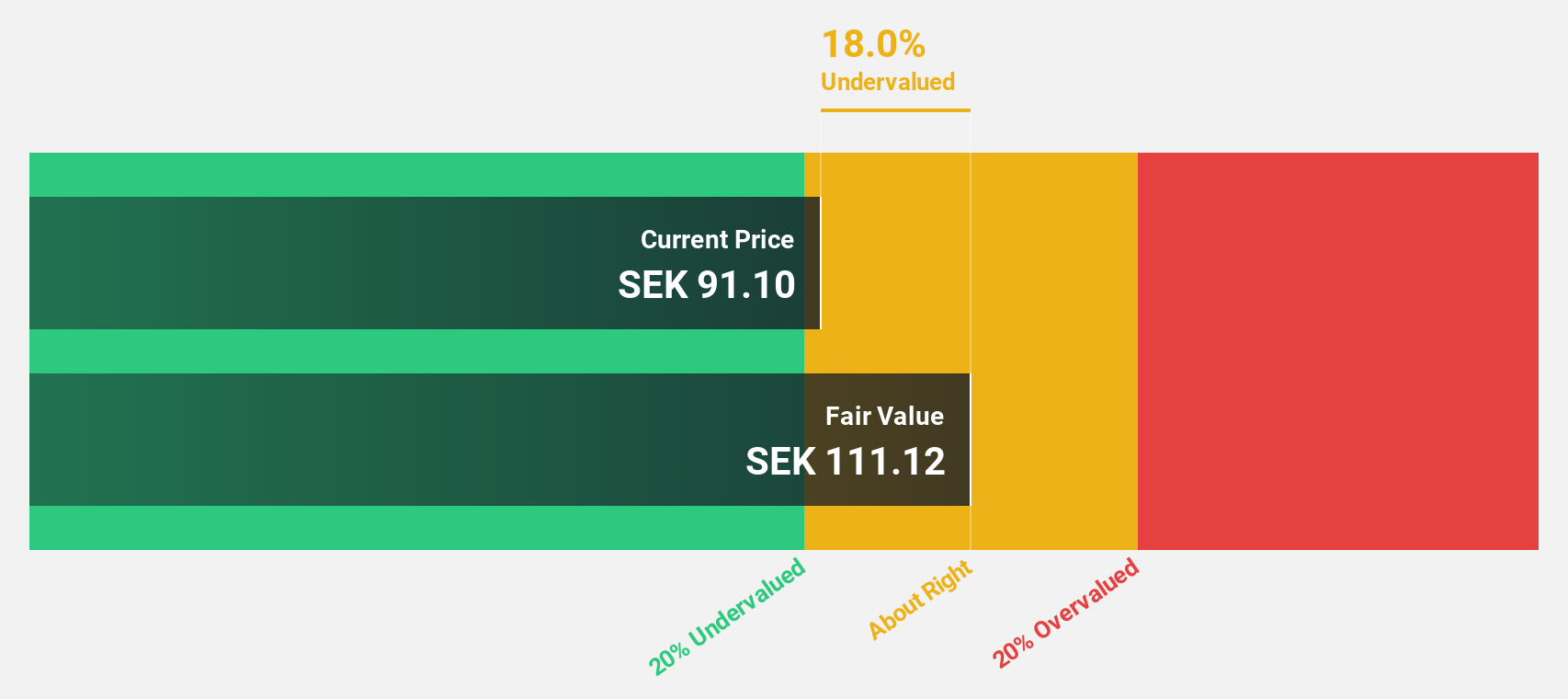

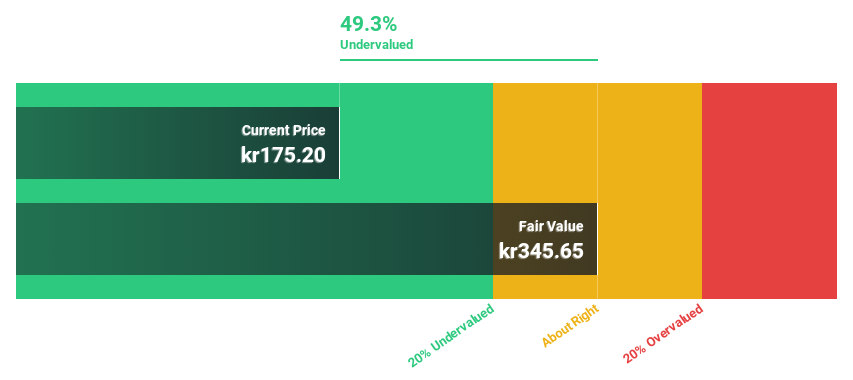

Nordic Waterproofing Holding (OM:NWG)

Overview: Nordic Waterproofing Holding AB (publ) develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure across Sweden, Norway, Denmark, Finland, the rest of Europe, and internationally with a market cap of SEK4.39 billion.

Operations: The company's revenue segments include Products & Solutions, generating SEK3.11 billion, and Installation Services, contributing SEK1.25 billion.

Estimated Discount To Fair Value: 47.1%

Nordic Waterproofing Holding is trading at SEK183, substantially below its estimated fair value of SEK345.65, suggesting undervaluation based on cash flows. Despite a high debt level and unstable dividends, earnings are projected to grow significantly at 23.55% annually, outpacing the Swedish market's growth rate. Recent acquisition by Kingspan Group increases strategic interest in NWG, while Q3 results show improved net income despite lower sales compared to the previous year.

- In light of our recent growth report, it seems possible that Nordic Waterproofing Holding's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Nordic Waterproofing Holding's balance sheet health report.

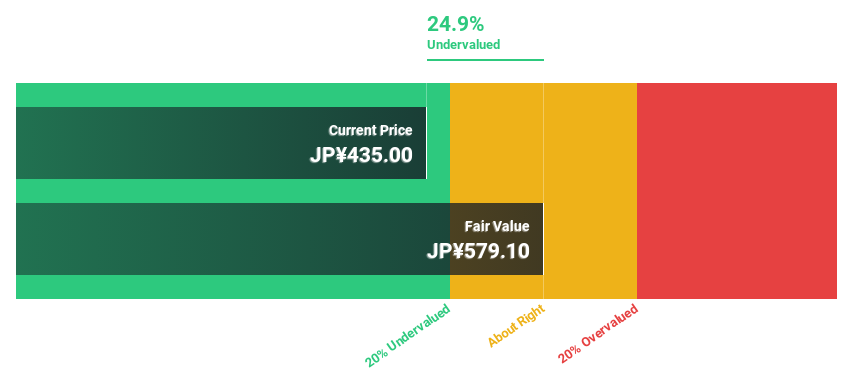

North Pacific BankLtd (TSE:8524)

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market cap of ¥179.88 billion.

Operations: The company's revenue segments include ¥112.17 billion from banking and ¥23.99 billion from its leasing business.

Estimated Discount To Fair Value: 18.2%

North Pacific Bank, Ltd. trades at ¥470, below its estimated fair value of ¥574.31, indicating undervaluation based on cash flows. The bank's earnings grew by 66.6% last year and are forecast to grow significantly at 20.8% annually, outpacing the Japanese market's growth rate. Despite a low return on equity forecast and an unstable dividend track record, recent dividend increases reflect potential improvements in shareholder returns amidst slower revenue growth expectations.

- The analysis detailed in our North Pacific BankLtd growth report hints at robust future financial performance.

- Get an in-depth perspective on North Pacific BankLtd's balance sheet by reading our health report here.

Taking Advantage

- Reveal the 880 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North Pacific BankLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8524

North Pacific BankLtd

Provides various banking products and services for individuals and corporations in Japan.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives