- Sweden

- /

- Commercial Services

- /

- OM:NORVA

European Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

Amidst the backdrop of fluctuating European markets, where tariff uncertainties and economic forecasts have stirred investor sentiment, growth companies with high insider ownership are drawing attention. In such an environment, stocks with substantial insider stakes might signal confidence in their long-term potential and resilience against market volatility.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.8% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's dive into some prime choices out of the screener.

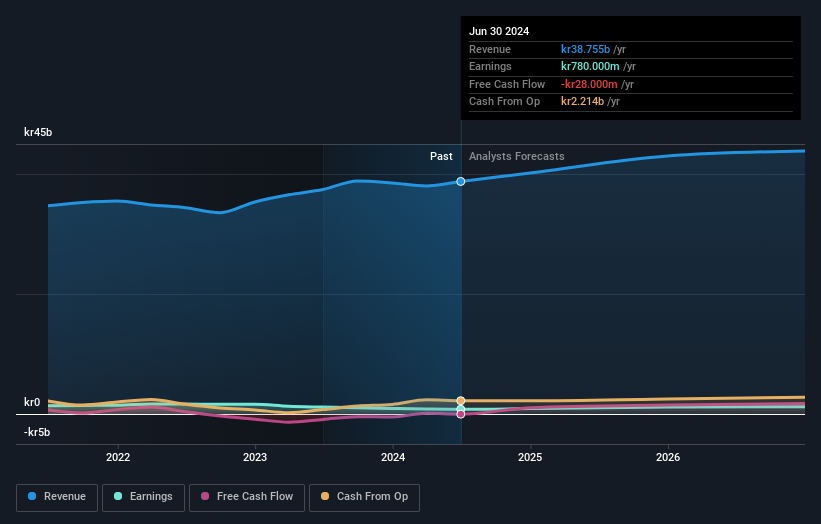

Bilia (OM:BILI A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership, operating in Sweden, Norway, Luxembourg, and Belgium with a market cap of SEK12.43 billion.

Operations: The company's revenue segments include SEK899 million from Fuel, SEK7.19 billion from Car sales in Norway, SEK19.82 billion from Car sales in Sweden, SEK2.38 billion from Service in Norway, SEK6.64 billion from Service in Sweden, SEK3.69 billion from Car sales in Western Europe, and SEK710 million from Service in Western Europe.

Insider Ownership: 17%

Earnings Growth Forecast: 19.2% p.a.

Bilia's growth potential is underscored by a forecasted annual earnings increase of 19.2%, outpacing the Swedish market. Despite this, interest payments aren't well covered by earnings, and profit margins have declined to 1.7% from last year's 2.4%. The company recently announced a SEK 800 million fixed-income offering and adjusted its dividend to SEK 5.60 per share for 2024, reflecting higher payout ratios than historically observed but aligning with policy.

- Delve into the full analysis future growth report here for a deeper understanding of Bilia.

- The analysis detailed in our Bilia valuation report hints at an deflated share price compared to its estimated value.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK3.60 billion.

Operations: The company's revenue is primarily derived from its Main Markets segment at SEK2.86 billion, followed by Other Markets at SEK1.97 billion, and Business Development and Services contributing SEK14 million.

Insider Ownership: 37.8%

Earnings Growth Forecast: 26.8% p.a.

HANZA's growth is highlighted by a forecasted 26.8% annual earnings increase, surpassing the Swedish market average. Despite this, profit margins have decreased to 2.3% from 5.2%. Revenue is expected to grow at 11.4%, outpacing the local market but below high-growth benchmarks. The stock trades at a significant discount to its estimated fair value, yet recent financials show declining net income and reduced dividends of SEK 0.80 per share for 2024, down from SEK 1.20 previously.

- Dive into the specifics of Hanza here with our thorough growth forecast report.

- The analysis detailed in our Hanza valuation report hints at an inflated share price compared to its estimated value.

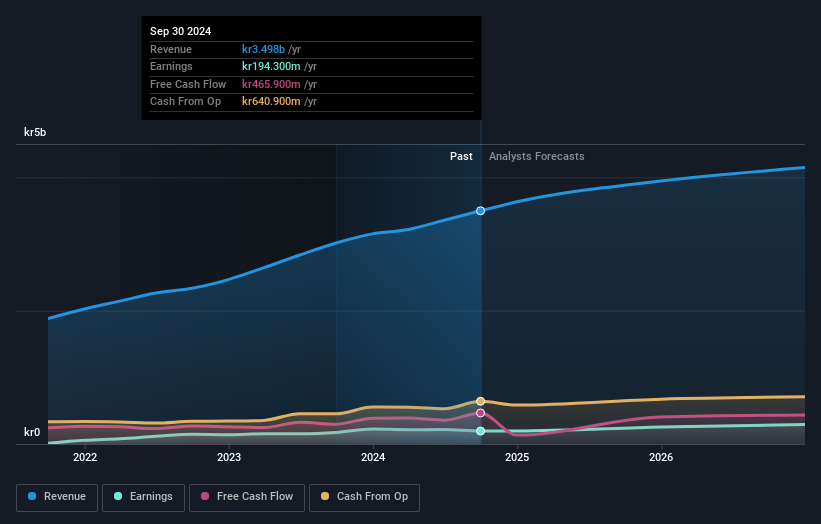

Norva24 Group (OM:NORVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norva24 Group AB (Publ) operates in Northern Europe, offering underground infrastructure maintenance services with a market cap of SEK4.18 billion.

Operations: Norva24 Group generates revenue from its underground infrastructure maintenance services in Northern Europe, with a revenue segment of NOK3.63 billion in Waste Management.

Insider Ownership: 10.5%

Earnings Growth Forecast: 21.1% p.a.

Norva24 Group shows promising growth potential with forecasted earnings expected to increase by 21.1% annually, outpacing the Swedish market. Despite a decline in profit margins from 7.2% to 4.9%, revenue is projected to grow at 6.1% per year, faster than the local market average but below high-growth benchmarks. Recent buybacks reflect strategic capital management, while leadership changes may impact future operations as they transition under new interim leadership in Norway following Tore Hansen's departure as CEO of Norva24 Norway.

- Navigate through the intricacies of Norva24 Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Norva24 Group is priced lower than what may be justified by its financials.

Seize The Opportunity

- Embark on your investment journey to our 219 Fast Growing European Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Norva24 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORVA

Norva24 Group

Provides underground infrastructure maintenance services in Northern Europe.

Good value with reasonable growth potential.