- Sweden

- /

- Tech Hardware

- /

- OM:FRACTL

Fractal Gaming Group (OM:FRACTL) Earnings Surge 84%, Reinforcing Bullish Narrative on Profit Momentum

Reviewed by Simply Wall St

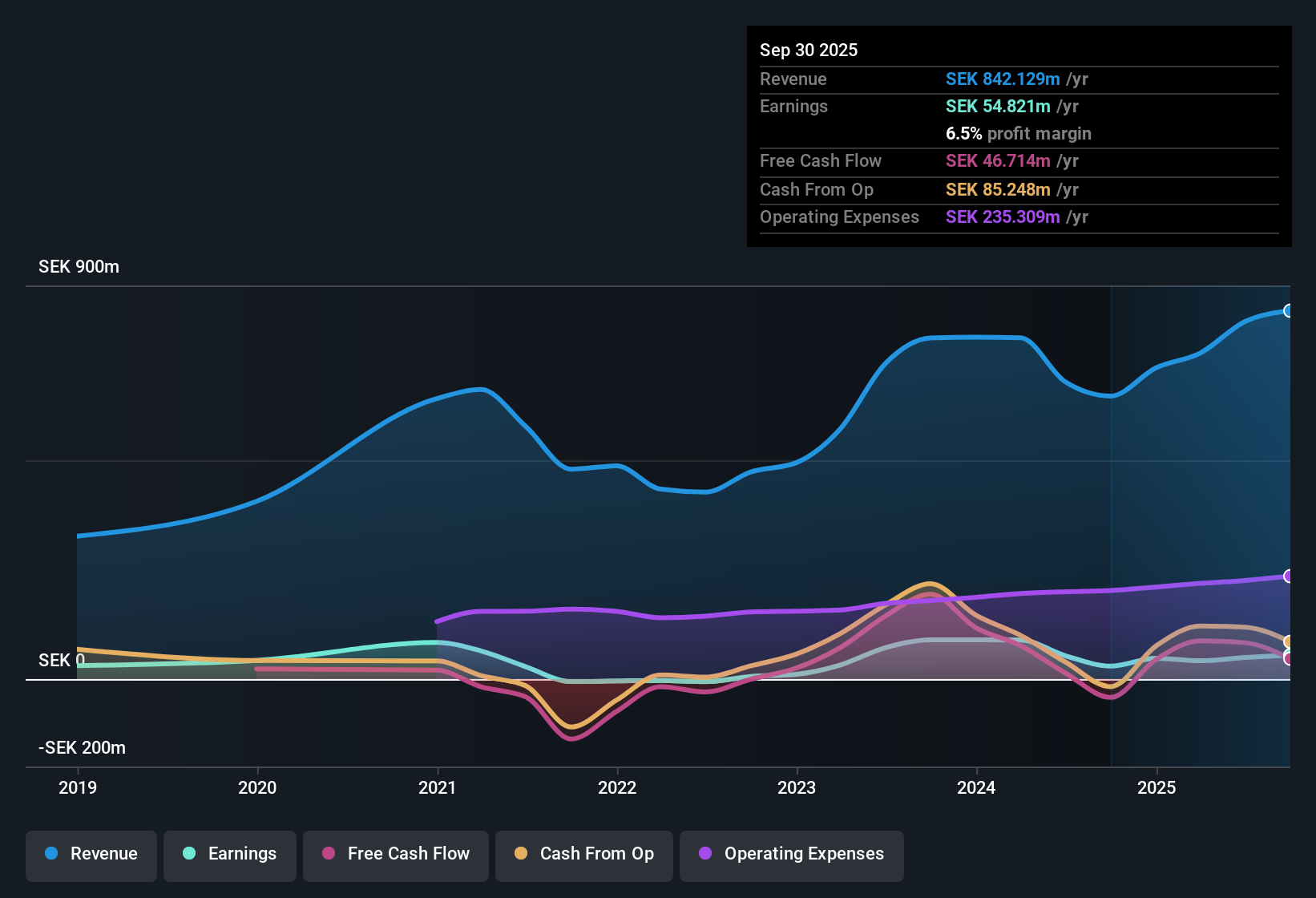

Fractal Gaming Group (OM:FRACTL) kept its momentum rolling, with earnings leaping 84% over the past year, far outpacing its five-year annual average of 16.3%. Net profit margin rose to 6.5% from last year’s 4.6%, while shares changed hands at SEK34.3, still beneath the discounted cash flow fair value estimate of SEK42.94. With future earnings expected to grow 24.1% per year and no listed risks, upbeat sentiment is underpinned by robust profit trends, improving margins, and compelling valuation.

See our full analysis for Fractal Gaming Group.Next up, we’ll see how these headline numbers compare to the most prevalent narratives in the market and within the Simply Wall St community, highlighting where the consensus holds and where surprises may shake things up.

See what the community is saying about Fractal Gaming Group

Direct Sales Channel Boosts Margins

- Net profit margin improved to 6.5%, up from 4.6% last year, supported by supply chain adjustments and growing direct-to-consumer sales, which help limit external cost pressures.

- Analysts’ consensus view sees ongoing gross margin gains as Fractal focuses on premium offerings and expansion into North America and APAC.

- Efforts to reduce reliance on intermediaries and optimize logistics are projected to lift net margins further, building on current margin expansion.

- Gross margin recovery is expected as price increases and supply chain relocation counter continued headwinds from tariffs and currency.

See why the consensus sees channel expansion as a leverage point in the full Fractal Gaming Group Consensus Narrative. 📊 Read the full Fractal Gaming Group Consensus Narrative.

Heavy PC Case Reliance Remains a Drag

- Nearly 90% of sales still come from DIY PC cases, exposing revenue to shifting consumer trends toward laptops and all-in-ones as the market matures.

- Analysts highlight that overdependence on desktop cases threatens future growth, especially as initial diversification efforts into headsets and chairs have delivered lower margins and less predictable sales.

- Rising operating and inventory costs tied to new product launches and warehousing could limit margin gains if the core market contracts or demand softens.

- Concerns mount that slow progress in broadening the product mix increases long-term risk even as current earnings look robust.

Valuation Stands Out Versus Peers

- Price-to-earnings ratio is 18.3x, below both the European tech industry average of 22.1x and a peer average of 34.3x, while the SEK34.3 share price sits beneath the DCF fair value of SEK42.94.

- Analysts’ consensus view is that Fractal’s attractive valuation and forecast 24.1% annual earnings growth give it an edge over sector peers, but delivery on product innovation and market expansion will be critical to closing the valuation gap.

- Expectations for a future PE of 23.3x on 2028 earnings suggest headroom for multiple expansion if growth is realized.

- The current discount to both peer averages and DCF fair value signals opportunity but raises the stakes for execution against analyst forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fractal Gaming Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your perspective and build your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fractal Gaming Group.

See What Else Is Out There

Fractal Gaming Group’s heavy dependence on desktop PC cases puts its growth at risk if shifting consumer trends reduce demand for its core products.

If you want to focus on companies demonstrating reliable revenue and profit expansion year after year, check out stable growth stocks screener (2091 results) to spot more consistent growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FRACTL

Fractal Gaming Group

Offers PC gaming products in Sweden an internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)