Yubico (OM:YUBICO) Valuation in Focus After Dashlane Partnership Sparks Passwordless Security Innovation

Reviewed by Simply Wall St

Yubico (OM:YUBICO) is drawing fresh attention after teaming up with Dashlane to roll out hardware-backed, passwordless authentication. The new integration uses YubiKey to provide truly passwordless, phishing-resistant logins for Dashlane users.

See our latest analysis for Yubico.

Despite Yubico’s headline-making partnership with Dashlane, investor sentiment has soured, with the stock experiencing a sharp drop. Its 1-day share price return stands at -26.40%, contributing to a year-to-date decline of -65.57%. Momentum has clearly faded since the start of the year, and with a 1-year total shareholder return of -68.77%, the market appears cautious even as the company forges ahead with innovative projects in passwordless security.

If the shift toward next-gen authentication technology has you watching the sector, now’s the time to broaden your perspective and check out See the full list for free.

With such a dramatic reset in Yubico’s share price, but clear evidence of ongoing innovation, the question remains: is the recent drop an overreaction that presents a compelling entry point, or are investors correctly pricing in the challenges ahead?

Most Popular Narrative: 39.4% Undervalued

With the widely-followed narrative placing Yubico’s fair value at SEK 144.33, there is a striking gap to the last close of SEK 87.44. This difference raises questions about whether the crowd is spotting value the market is missing.

The shift toward subscription-based sales (YubiKey-as-a-Service) is accelerating, particularly with large enterprise customers in the US and technology sectors. This positions Yubico for higher long-term revenue stability and margin expansion as recurring ARR flows through the P&L over coming years, even as this transition temporarily pressures reported sales and earnings.

Wondering what’s driving this bold valuation call? The narrative leans heavily on a transformative business pivot, ambitious growth strategies, and a forward-looking approach to earnings. Curious what financial leaps and margin assumptions fuel this outlook? Dive in to uncover the full story behind the numbers.

Result: Fair Value of $144.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing reliance on hardware and competition from software-based authentication could present challenges to Yubico’s growth path and undermine its valuation outlook.

Find out about the key risks to this Yubico narrative.

Another View: Are Multiples Sending a Different Signal?

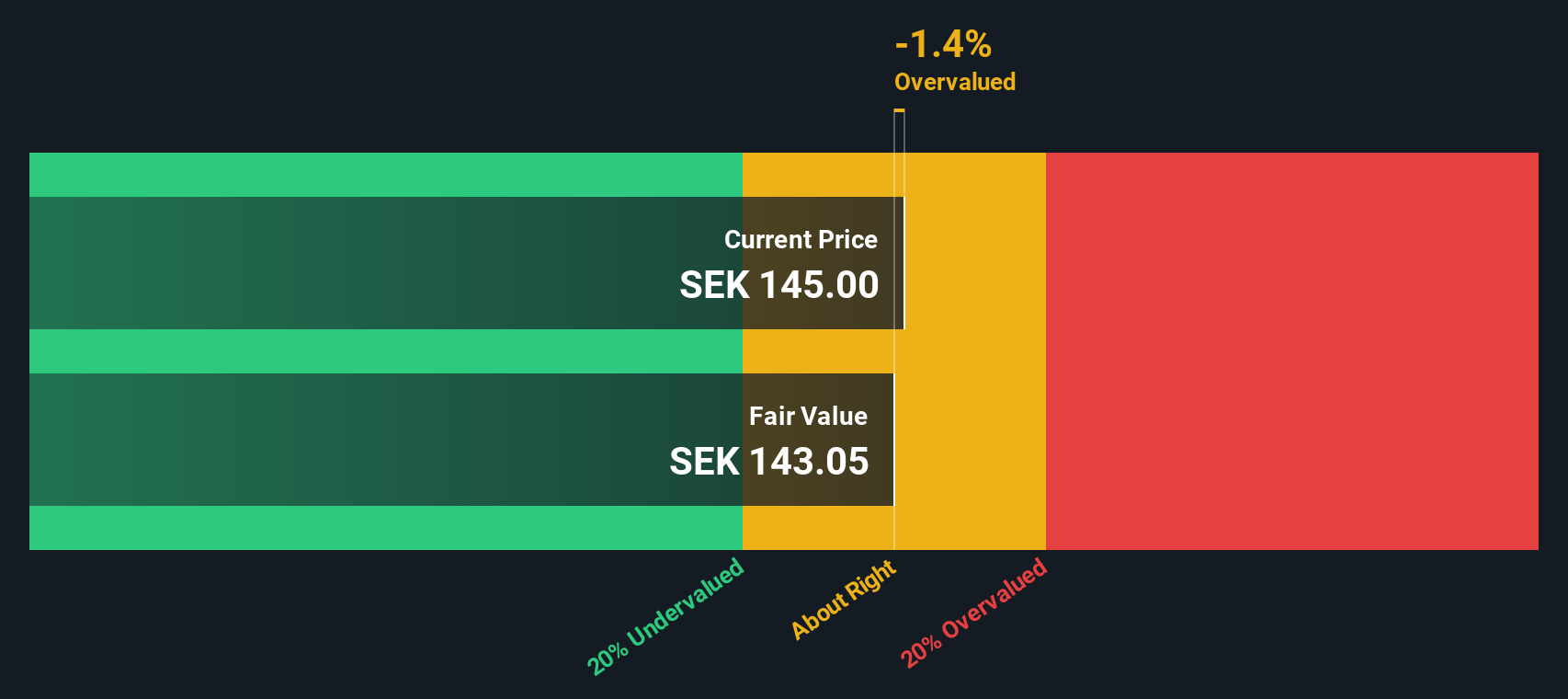

While the consensus crowd sees Yubico as undervalued, our DCF model tells another story. The DCF approach values the stock below its recent market price. This suggests it may actually be overvalued if future cash flow growth falls short. Which perspective holds more weight for you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Yubico Narrative

If the current narrative doesn’t align with your perspective or you prefer to dive deeper into the numbers yourself, why not craft your own in just a few minutes? Do it your way

A great starting point for your Yubico research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your potential. Kickstart your research with investment opportunities that could reshape your portfolio and put you ahead of the crowd.

- Take advantage of market underpricing and seize opportunities by checking out these 877 undervalued stocks based on cash flows offering strong cash flow fundamentals.

- Spot powerful growth themes in healthcare innovation and supercharge your watchlist with these 33 healthcare AI stocks packed with cutting-edge AI breakthroughs.

- Unlock the world of digital assets and rapid disruption by exploring these 80 cryptocurrency and blockchain stocks that are making waves in blockchain technology and cryptocurrency trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)