The European market has shown resilience with the STOXX Europe 600 Index posting its longest streak of weekly gains since August 2012, buoyed by encouraging company results and gains in defense stocks despite uncertainties surrounding U.S. trade policy. In this environment, identifying high-growth tech stocks involves looking for companies that are not only innovative but also demonstrate strong adaptability to economic fluctuations and regulatory landscapes.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| Bonesupport Holding | 30.50% | 48.59% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Yubico | 21.27% | 26.82% | ★★★★★★ |

| Truecaller | 20.03% | 24.78% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Global Dominion Access (BME:DOM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Global Dominion Access, S.A. offers comprehensive services aimed at enhancing business process efficiency and sustainability on a global scale, with a market capitalization of €433.40 million.

Operations: Dominion generates revenue through three primary segments: Projects 360 (€307.50 million), Sustainable Services (€831.20 million), and Participation in Infrastructures (€14.30 million). The Sustainable Services segment contributes the largest portion of the company's revenue, highlighting its focus on long-term service contracts aimed at sustainability initiatives.

Global Dominion Access, a player in the high-growth tech sector in Europe, is navigating through unprofitability with strategic moves that forecast a promising future. Despite not covering interest payments well with earnings, the company's revenue is expected to surge by 50.9% annually, outpacing the Spanish market's 5.2% growth rate significantly. With earnings anticipated to grow at an impressive rate of 55.78% per year over the next three years, Global Dominion is setting a robust trajectory towards profitability. This growth is underscored by their active participation in key industry events such as the XXXI Santander Iberian Conference and their forthcoming fiscal year results announcement on February 26, 2025, which could provide further insights into their financial path and operational strategies moving forward.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market capitalization of SEK19.41 billion.

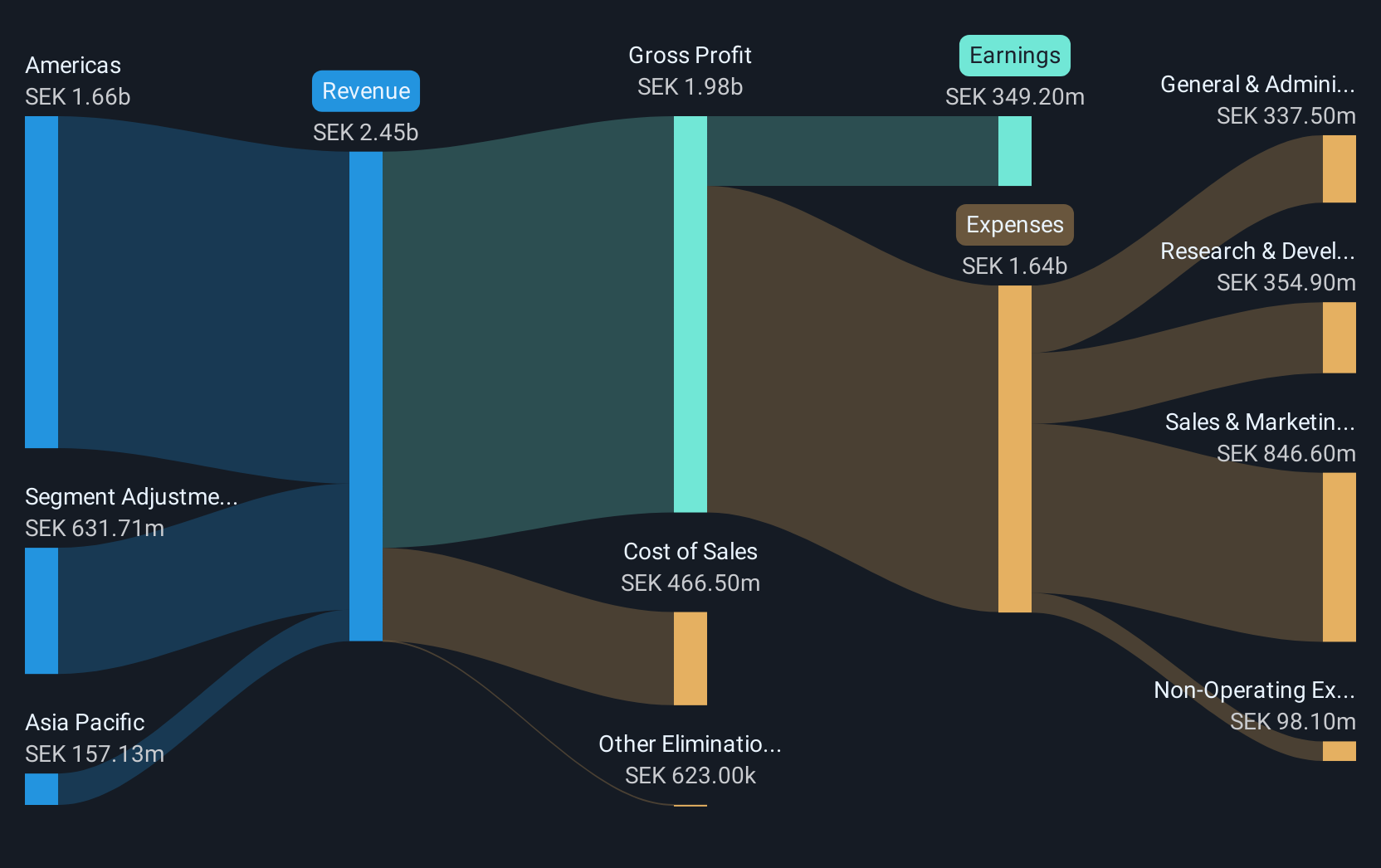

Operations: With a revenue of SEK2.33 billion from its Security Software & Services segment, Yubico AB specializes in authentication solutions for computers, networks, and online services.

Yubico, a trailblazer in enterprise security solutions, is significantly outperforming its sector with a remarkable earnings growth of 161.2% over the past year, dwarfing the software industry's average of 24.7%. This surge is propelled by robust demand for its FIDO2 security keys, as evidenced by a major deployment to T-Mobile US teams. With R&D expenses constituting 15% of their revenue—a substantial investment indicative of their commitment to innovation—Yubico continues to lead advancements in phishing-resistant authentication technologies. The company's strategic focus not only enhances cybersecurity frameworks for high-profile clients like T-Mobile but also positions it at the forefront of addressing critical digital threats on a global scale.

Cicor Technologies (SWX:CICN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cicor Technologies Ltd. is a global company that develops and manufactures electronic components, devices, and systems, with a market capitalization of CHF317 million.

Operations: Cicor Technologies Ltd. generates revenue through two main divisions: Advanced Substrates (AS), contributing CHF46.24 million, and Electronic Manufacturing Services (EMS), contributing CHF377.46 million. The company's business model focuses on developing and manufacturing electronic components, devices, and systems globally.

Cicor Technologies, navigating through a challenging landscape, still manages to project an impressive annual earnings growth of 32.9%. This growth is underpinned by strategic moves such as the potential acquisition of éolane's businesses, which could significantly enhance Cicor’s footprint in the electronic manufacturing services sector across diverse markets like aerospace and defense. Despite a recent dip in sales forecasts for 2024, indicating revenues between CHF 470 million to CHF 490 million, Cicor’s commitment to innovation is evident with R&D expenses consistently aligning with industry demands. The company's role as a key supplier for advanced electronic devices in European aerospace further solidifies its position in high-tech sectors, promising robust future prospects amidst evolving technological landscapes.

Make It Happen

- Gain an insight into the universe of 247 European High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Exceptional growth potential with excellent balance sheet.