As European markets experience a mixed performance, with the pan-European STOXX Europe 600 Index ending slightly higher amid hopes for increased government spending, investors are keeping a close eye on developments. In such times of economic uncertainty and evolving trade dynamics, penny stocks—often smaller or newer companies—continue to attract interest due to their potential for growth and affordability. Though the term "penny stock" might seem outdated, these investments can still offer significant opportunities when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.035 | SEK1.95B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.39 | SEK226.26M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.92 | SEK238.49M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.65 | PLN123.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.50 | €52.64M | ✅ 4 ⚠️ 2 View Analysis > |

| I.M.D. International Medical Devices (BIT:IMD) | €1.49 | €25.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.20 | €62.85M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.5M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 435 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Inin Group (OB:ININ)

Simply Wall St Financial Health Rating: ★★★★☆☆

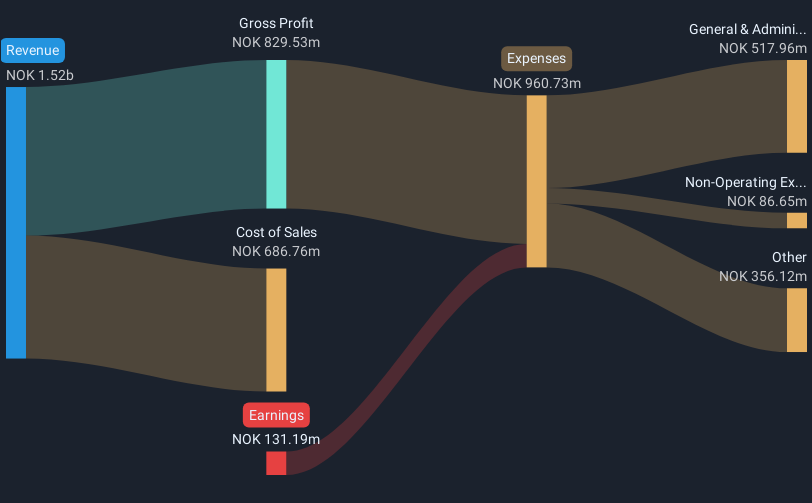

Overview: Inin Group AS is an investment company that specializes in infrastructure and industry services across Norway, Sweden, and internationally, with a market cap of NOK288.97 million.

Operations: Inin Group AS does not have any reported revenue segments.

Market Cap: NOK288.97M

Inin Group AS, an investment company with a market cap of NOK288.97 million, has recently reported significant sales growth, with fourth-quarter revenue reaching NOK548.58 million compared to NOK321.87 million the previous year. Despite this growth, the company remains unprofitable and faces challenges such as high volatility and liabilities exceeding short-term assets (NOK545.8M). However, it benefits from a satisfactory net debt to equity ratio of 38.9% and a stable cash runway due to positive free cash flow growth of 53.8% annually. Recently acquired by Qben Infra for NOK17.8 million in February 2025, Inin Group shareholders now hold a substantial stake in the newly formed entity listed on Nasdaq Stockholm or First North Premier Growth Market.

- Get an in-depth perspective on Inin Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Inin Group's future.

Precise Biometrics (OM:PREC)

Simply Wall St Financial Health Rating: ★★★★★★

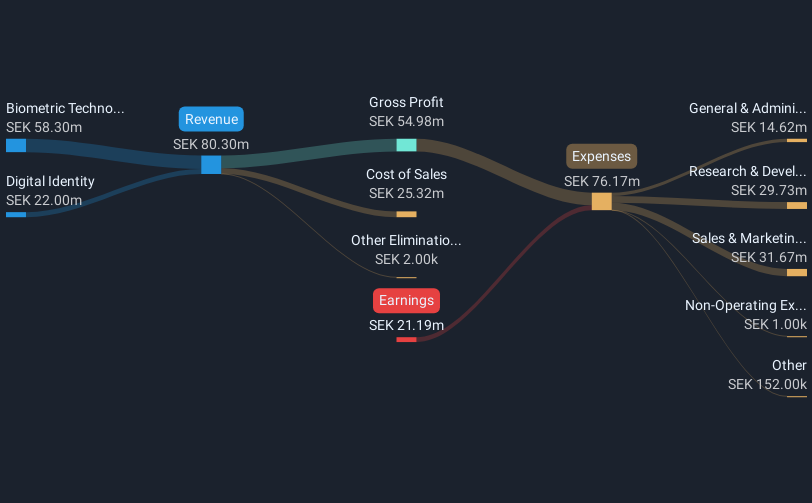

Overview: Precise Biometrics AB (publ) provides identification software for secure identity authentication across Sweden, Taiwan, Denmark, Finland, Norway, and internationally with a market cap of SEK359.81 million.

Operations: The company's revenue is divided into two segments: Digital Identity, generating SEK21.43 million, and Biometric Technologies, contributing SEK65.42 million.

Market Cap: SEK359.81M

Precise Biometrics, with a market cap of SEK359.81 million, is expanding its sales operations into Norway to capitalize on growing demand for its visitor management system. The company reported fourth-quarter sales of SEK21.79 million, slightly up from the previous year, while reducing net loss from SEK4.96 million to SEK1.3 million. Despite being unprofitable and having negative return on equity (-5.58%), Precise benefits from strong short-term asset coverage over liabilities and a debt-free balance sheet. Recent collaborations with Xiaomi highlight the company's technological capabilities in biometric authentication, potentially enhancing future revenue streams and market presence internationally.

- Click here and access our complete financial health analysis report to understand the dynamics of Precise Biometrics.

- Gain insights into Precise Biometrics' future direction by reviewing our growth report.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

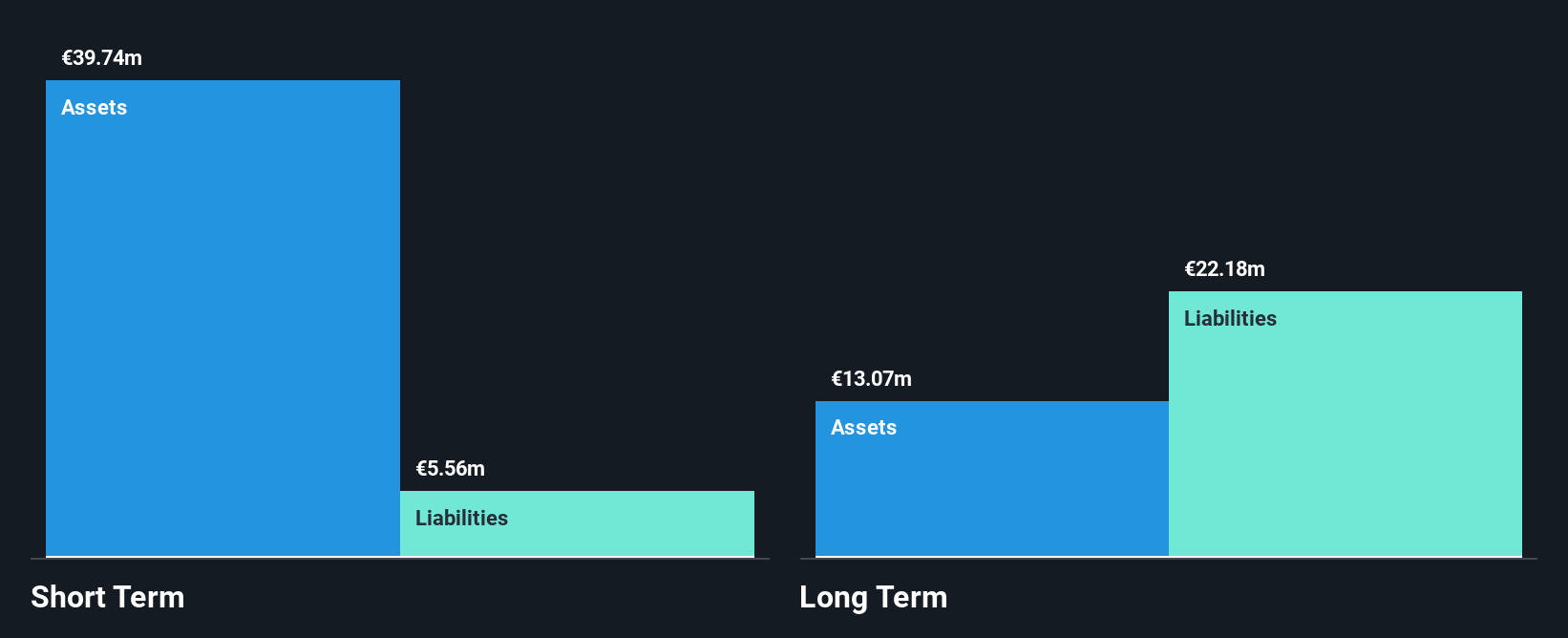

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, other European countries, the United States, and internationally; it has a market cap of €125.37 million.

Operations: Heidelberg Pharma AG has not reported any specific revenue segments.

Market Cap: €125.37M

Heidelberg Pharma AG, with a market cap of €125.37 million, remains pre-revenue while focusing on oncology and antibody targeted amanitin conjugates (ATAC). Recent earnings guidance anticipates 2025 revenue between €9 million and €11 million, down from 2024's €12 million. Despite continued losses, the company is debt-free and has strong asset coverage over liabilities. A recent amendment to its royalty financing agreement with HealthCare Royalty provides an additional US$20 million payment and extends its cash runway into 2027. Heidelberg's ongoing Phase I/IIa study for HDP-101 shows promise in multiple myeloma treatment efficacy.

- Unlock comprehensive insights into our analysis of Heidelberg Pharma stock in this financial health report.

- Examine Heidelberg Pharma's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Click this link to deep-dive into the 435 companies within our European Penny Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Heidelberg Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HPHA

Heidelberg Pharma

A biopharmaceutical company, focuses on oncology and antibody targeted amanitin conjugates (ATAC) in Germany, the United States, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)