- Denmark

- /

- Hospitality

- /

- CPSE:AGF B

European Penny Stocks: AGF And 2 Other Hidden Opportunities

Reviewed by Simply Wall St

As the European market experiences a positive shift, with major stock indexes rising amid slowed inflation and easing monetary policies by the European Central Bank, investors are increasingly looking for opportunities in less traditional areas. Penny stocks, though often considered a relic of past market eras, continue to offer potential for growth due to their affordability and the possibility of discovering emerging companies with strong financials. In this context, we will explore three penny stocks that stand out for their financial strength and potential within the European landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.832 | SEK496.76M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.18 | €67.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.415 | SEK2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.60 | SEK219.02M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €303.74M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.68M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 446 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

AGF (CPSE:AGF B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AGF A/S operates in the sports and facilities sector in Denmark with a market capitalization of DKK384.63 million.

Operations: The company generates revenue from its sports segment, which accounts for DKK168.67 million, and its facilities segment, contributing DKK22.43 million.

Market Cap: DKK384.62M

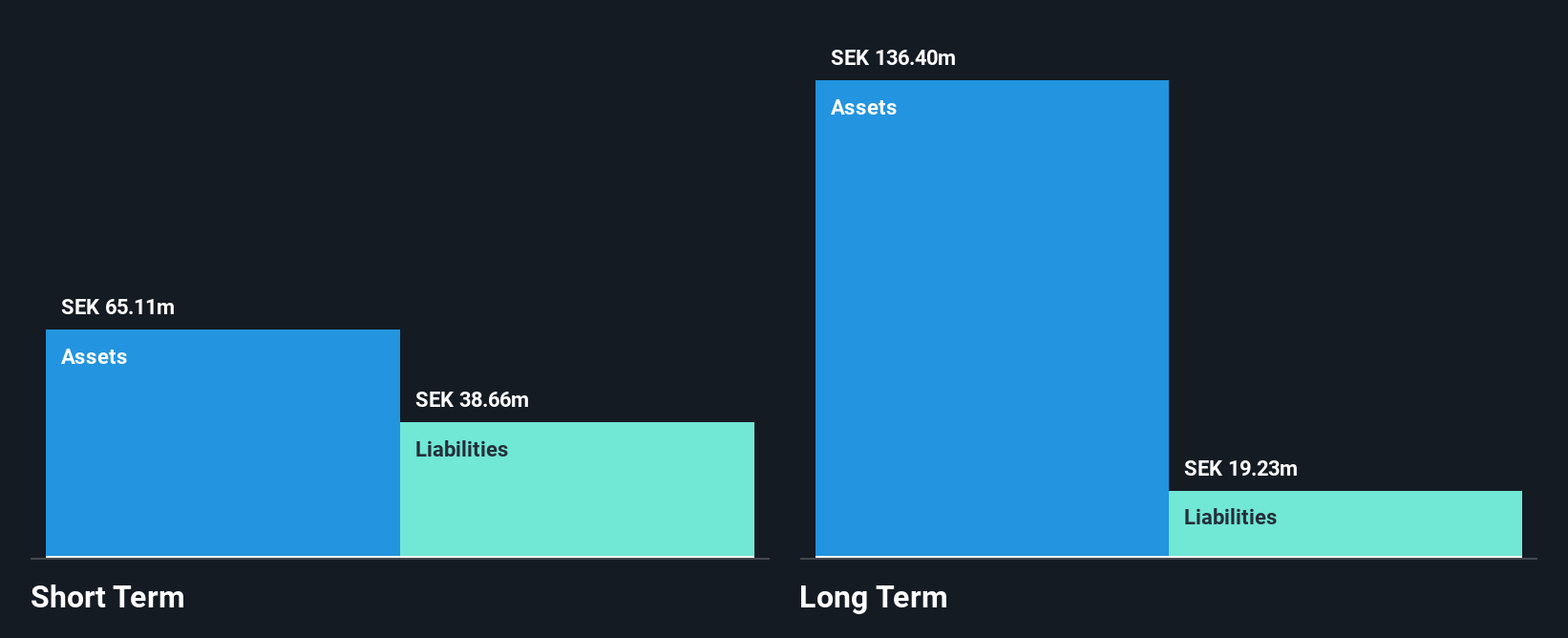

AGF A/S, operating in Denmark's sports and facilities sector, has a market cap of DKK384.63 million, with revenues from the sports segment at DKK168.67 million and facilities at DKK22.43 million. Despite significant earnings growth over the past five years, recent performance shows a decline in net profit margins to 3.1% from 41.3% last year and negative earnings growth of -92.3%. The company is debt-free with stable weekly volatility (5%) and experienced board and management teams averaging tenures of over nine years each. Short-term assets significantly cover both short- and long-term liabilities, reflecting financial stability amidst challenges.

- Get an in-depth perspective on AGF's performance by reading our balance sheet health report here.

- Gain insights into AGF's past trends and performance with our report on the company's historical track record.

Precise Biometrics (OM:PREC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Precise Biometrics AB (publ) is a company specializing in cybersecurity and biometric solutions, operating in Sweden, Taiwan, China, the United States, and internationally with a market cap of SEK306.58 million.

Operations: The company generates revenue through two main segments: Digital Identity, contributing SEK21.50 million, and Biometric Technologies, which accounts for SEK63.67 million.

Market Cap: SEK306.58M

Precise Biometrics AB, with a market cap of SEK306.58 million, has shown potential in its visitor management segment through recent product enhancements and geographical expansion into Norway. Despite being unprofitable and experiencing a net loss increase to SEK7.19 million for Q1 2025, the company remains debt-free with sufficient cash runway exceeding three years. The integration of its BioLive anti-spoof solution into India's Aadhaar program highlights technological advancements in biometric security. However, high share price volatility and an inexperienced board and management team may pose challenges as the company seeks to capitalize on growing demand for its solutions.

- Unlock comprehensive insights into our analysis of Precise Biometrics stock in this financial health report.

- Learn about Precise Biometrics' future growth trajectory here.

Cherry (XTRA:C3RY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cherry SE, along with its subsidiaries, manufactures and sells computer input devices in Germany and has a market cap of €22.96 million.

Operations: The company's revenue is primarily derived from Gaming & Office Peripherals (€71.07 million), Digital Health & Solutions (€27.27 million), and Components (€12.40 million).

Market Cap: €22.96M

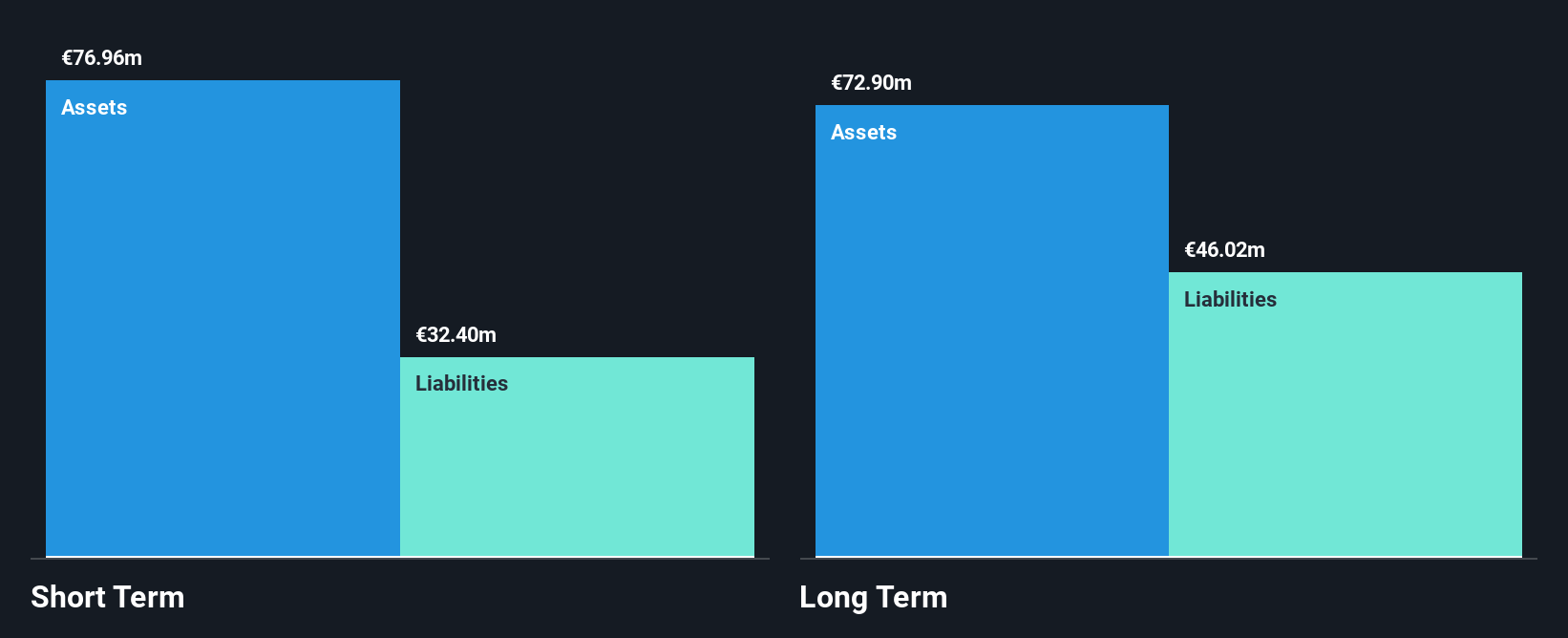

Cherry SE, with a market cap of €22.96 million, is navigating challenges as it restructures operations to improve financial health. The company reported a net loss of €5.77 million for Q1 2025, reflecting increased losses from the previous year. Despite this, Cherry SE maintains strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio significantly over five years. Recent restructuring includes transferring switch production to China and transforming the Auerbach site into a logistics hub for Europe. While share price volatility remains high, Cherry's innovative product launches in gaming peripherals could bolster future prospects amidst ongoing restructuring efforts.

- Click to explore a detailed breakdown of our findings in Cherry's financial health report.

- Review our growth performance report to gain insights into Cherry's future.

Make It Happen

- Take a closer look at our European Penny Stocks list of 446 companies by clicking here.

- Ready For A Different Approach? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:AGF B

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026