Micro Systemation (OM:MSAB B) Earnings Surge 204%, Reinforcing Bullish Growth Narratives

Reviewed by Simply Wall St

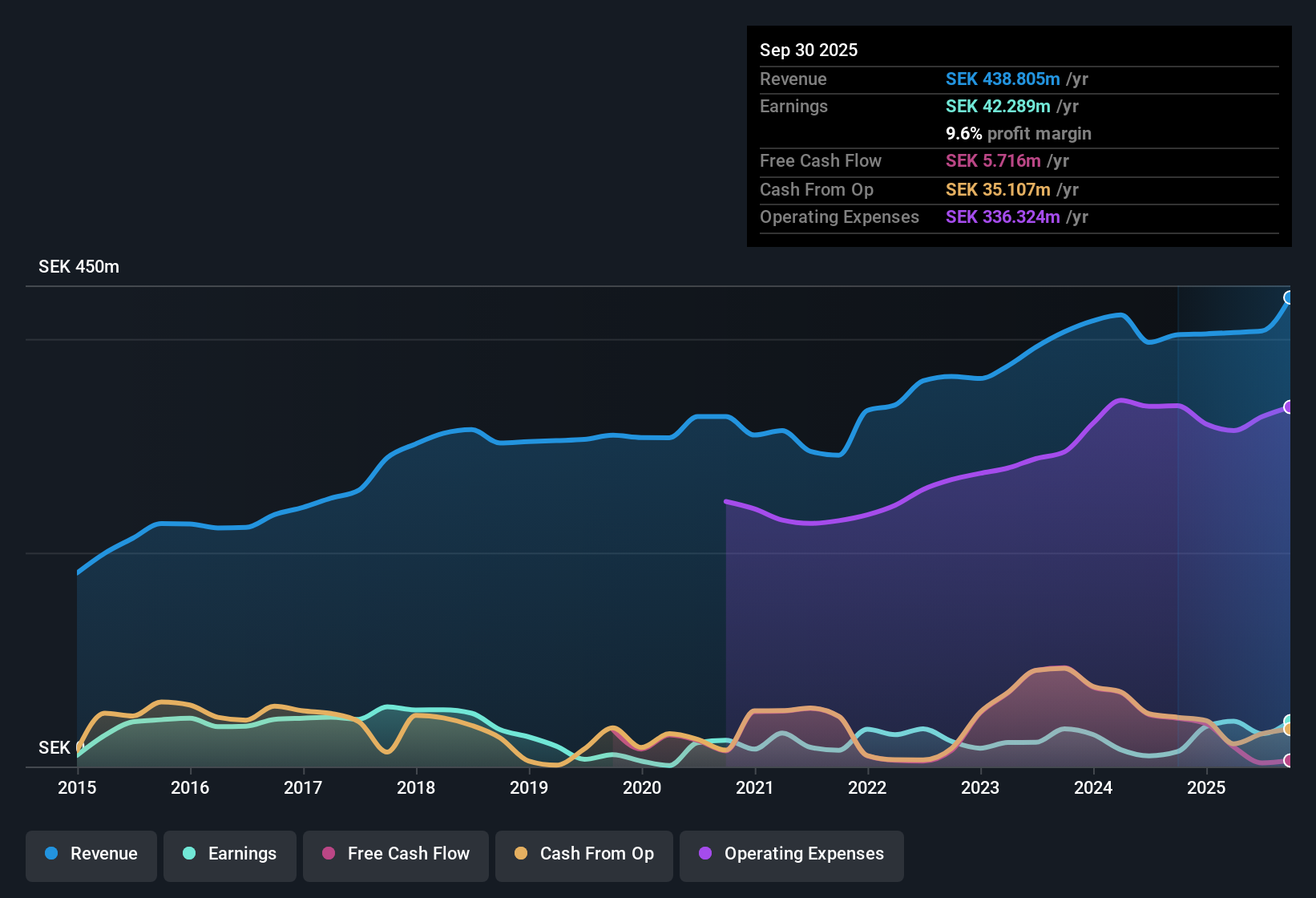

Micro Systemation (OM:MSAB B) delivered annual earnings growth of 204.3% in the latest year, significantly ahead of its 5-year average of 7.1%. Net profit margin improved to 9.6% from last year’s 3.4%. Ongoing growth prospects also remain strong, with revenue forecast to rise 10% per year and earnings expected to grow 26% per year for the next three years.

See our full analysis for Micro Systemation.Now, let’s put these headline numbers side by side with the stories circulating in the market to see which narratives are confirmed and which ones are challenged.

See what the community is saying about Micro Systemation

Recurring Revenue Lifts Predictability

- Subscriptions as a share of overall sales continue to rise, supporting more stable and predictable earnings, as highlighted by the growing focus on license renewals and subscription-based models over perpetual licenses.

- Analysts’ consensus view emphasizes that this increase in high-margin recurring revenue could rerate margins and earnings multiples, with

- profit margin now at 9.6%, up considerably from last year’s 3.4%, and

- forecasts indicating margin expansion to 12.8% in three years, helping drive valuation upgrades if revenue acceleration is sustained.

To see the full range of conflicting views and how analysts are weighing the promise of recurring revenue against ongoing risks, read the consensus narrative for deeper perspective. 📊 Read the full Micro Systemation Consensus Narrative.

Valuation Discount Narrows Versus Peers

- At a price-to-earnings (PE) ratio of 31x, Micro Systemation trades at a premium to the Swedish software industry’s 30.5x average, but remains at a notable discount to direct peers’ average of 57.2x and below its DCF fair value of SEK123.55. The current share price stands at SEK71.00.

- Analysts’ consensus view notes the current share price is just 1.4% above the analyst price target of SEK70.0,

- which suggests the market is largely pricing in present growth forecasts,

- but not the longer-term upside implied by the fair value estimate, leaving Micro Systemation room for future rerating if execution stays on track.

Diversification Offsets Policy Risks

- New contract wins in APAC and North America, aided by expansion into new regions and rising digital crime awareness, are diversifying revenue beyond the traditional core in Sweden and EMEA markets.

- Analysts’ consensus view highlights that while shifts in government budgets and tighter privacy regulations remain risk factors,

- the company’s push into geographies with accelerated law enforcement digitalization creates fresh topline growth opportunities,

- which may cushion revenue volatility associated with policy-driven disruptions at home.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Micro Systemation on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from a fresh angle? Share your take and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Micro Systemation research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Micro Systemation’s earnings expansion is promising, the market’s near-term growth is largely priced in and the company still trades at a premium. This leaves less room for error.

If you’re seeking better value opportunities and want to target stocks with more attractive price points based on forward fundamentals, consider these 854 undervalued stocks based on cash flows that could strengthen your portfolio’s upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MSAB B

Micro Systemation

Provides forensic technology for mobile device examination and analysis in Sweden and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)