Exploring High Growth Tech Stocks Including Lime Technologies And Two Others

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising U.S. inflation and volatile Treasury yields, the tech sector remains a focal point for investors seeking growth opportunities. With small-cap stocks lagging behind larger indices like the S&P 500, identifying high-growth tech companies such as Lime Technologies becomes crucial for those looking to capitalize on potential market shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 1210 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

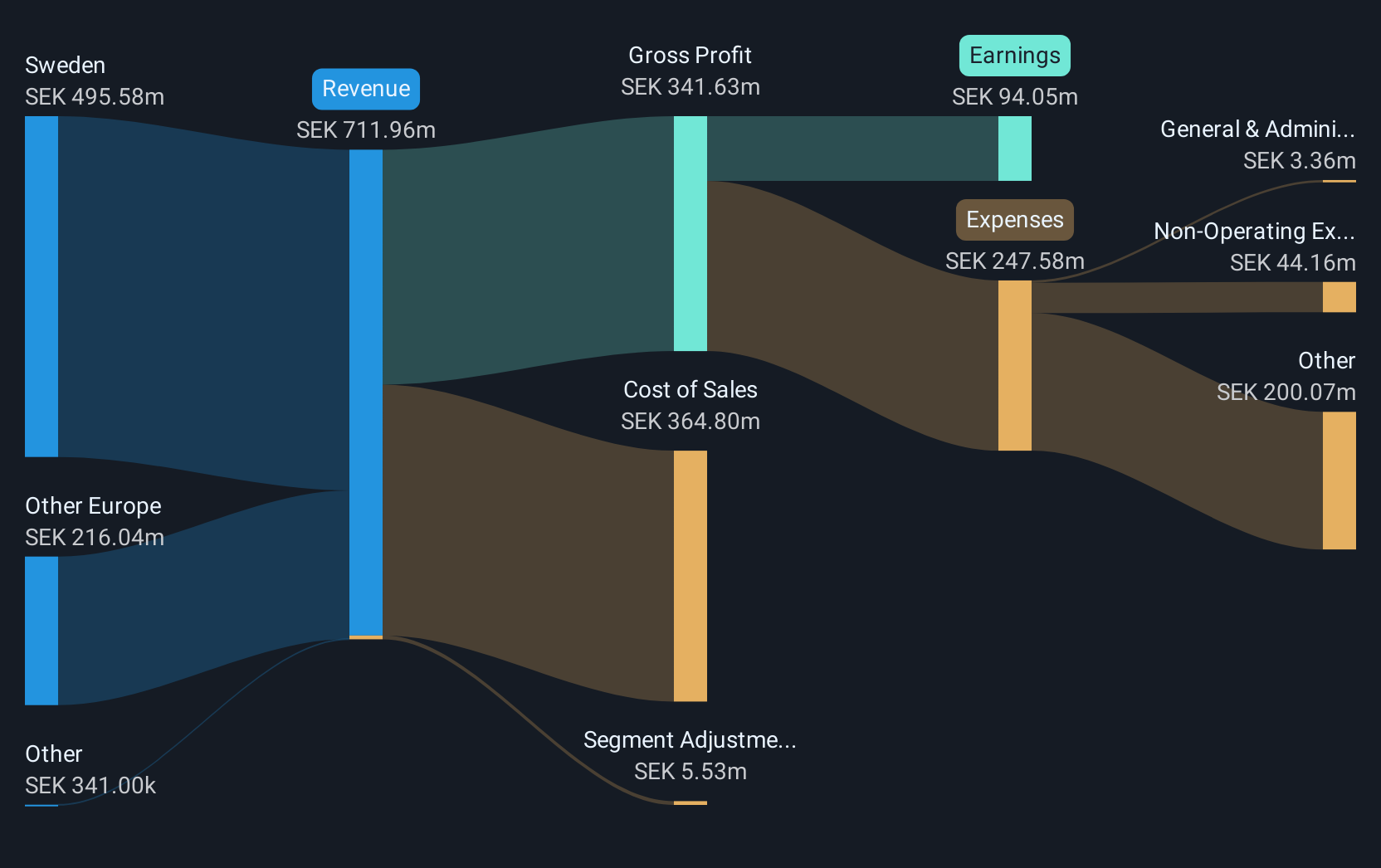

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region, with a market capitalization of SEK4.89 billion.

Operations: The company generates revenue primarily from selling and implementing software, specifically CRM systems, amounting to SEK685.75 million.

Lime Technologies has demonstrated robust financial health with a notable 23.5% forecast in annual earnings growth and a consistent revenue increase at 13.2% annually, outpacing the Swedish market's growth. The firm's commitment to innovation is evident from its R&D expenditure trends, ensuring it remains competitive in the software industry despite not leading in high-growth metrics compared to some peers. Recent corporate guidance confirms their strategic focus, projecting an EBITA margin of 25%, aligning with medium-term financial targets. Furthermore, Lime Technologies' recent dividend increase to SEK 4.00 per share underscores its strong profitability and shareholder value approach, reflecting confidence in sustained fiscal performance and future prospects.

- Unlock comprehensive insights into our analysis of Lime Technologies stock in this health report.

Understand Lime Technologies' track record by examining our Past report.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

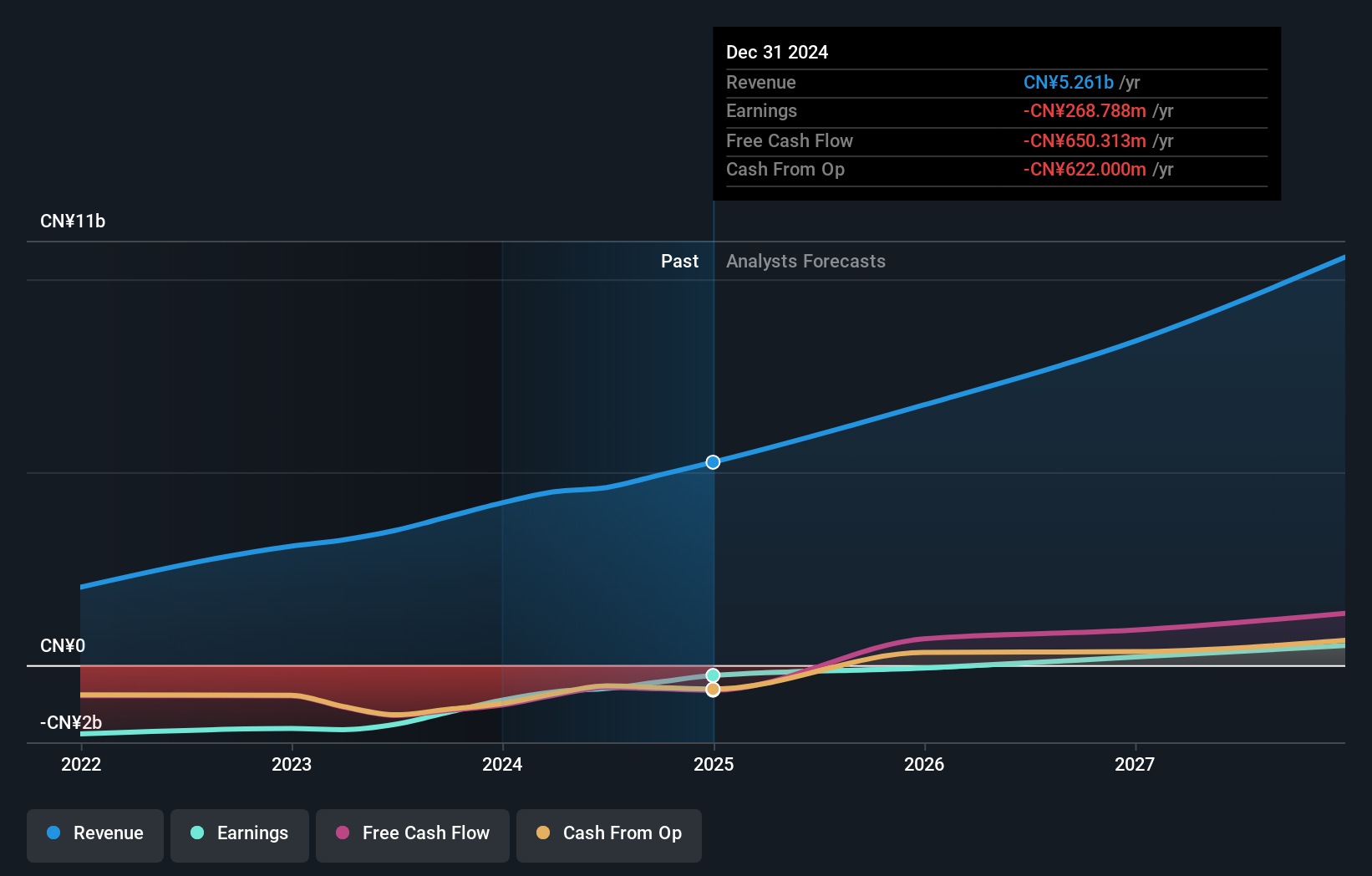

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of HK$26.97 billion.

Operations: Fourth Paradigm focuses on platform-centric AI solutions, generating revenue primarily from its Sage AI Platform (CN¥3 billion), followed by Shift Intelligent Solutions (CN¥1.15 billion) and Sagegpt Aigs Services (CN¥448.10 million).

Beijing Fourth Paradigm Technology, navigating through a volatile market, showcases promising growth with an expected 19.3% annual revenue increase and a striking forecast of 113.12% in earnings growth per year. This trajectory is supported by significant R&D investment, aligning with industry trends towards enhanced technological capabilities. Recent strategic shifts include executive changes and relocation of their business hub to Hong Kong's Lee Garden One, positioning them closer to core markets and signaling agility in corporate governance. These moves could potentially bolster their market presence and operational efficiency in the competitive tech landscape.

Infomart (TSE:2492)

Simply Wall St Growth Rating: ★★★★★☆

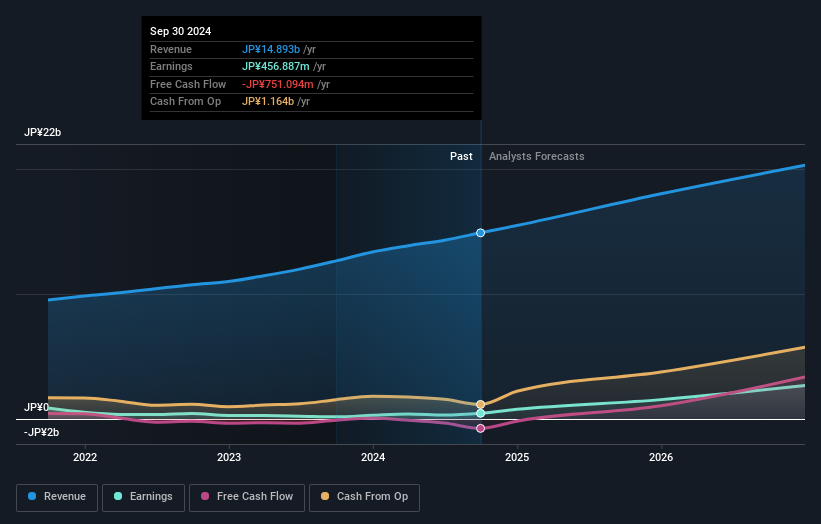

Overview: Infomart Corporation operates an online business-to-business electronic commerce platform in Japan with a market cap of ¥86.22 billion.

Operations: The company generates revenue through its online BtoB electronic commerce platform in Japan, focusing on facilitating transactions between businesses. With a market cap of ¥86.22 billion, Infomart leverages its digital infrastructure to streamline business operations and enhance connectivity within the corporate sector.

Infomart, amidst its recent earnings call, highlighted a robust trajectory with an annual revenue growth of 9% and a remarkable earnings surge of 119.8% over the past year, outpacing the Professional Services industry's growth of 11.1%. This performance is underpinned by substantial R&D investments which have significantly shaped their market offerings and competitive stance. Despite a highly volatile share price in recent months and challenges such as a one-off loss of ¥255M affecting financials, Infomart's strategic focus on innovation and market expansion is poised to harness future growth opportunities, especially given their forecasted earnings growth rate of 30.2% annually.

- Click to explore a detailed breakdown of our findings in Infomart's health report.

Examine Infomart's past performance report to understand how it has performed in the past.

Summing It All Up

- Investigate our full lineup of 1210 High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives