The European stock markets have shown positive momentum, with the pan-European STOXX Europe 600 Index closing 2.35% higher and major single-country indexes also experiencing gains. Amidst this backdrop of market optimism and relatively subdued inflation, growth companies with high insider ownership can be appealing to investors as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 52.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market capitalization of approximately SEK4.18 billion.

Operations: The company's revenue primarily comes from selling and implementing CRM systems, amounting to SEK731.63 million.

Insider Ownership: 10.4%

Lime Technologies is poised for significant growth, with earnings expected to increase by 22.2% annually, outpacing the Swedish market's 13.5%. Trading at 31.3% below its estimated fair value and with a high forecasted return on equity of 33.9%, it presents a compelling investment case despite revenue growth being slower than 20% annually. The recent appointment of Tommas Davoust as CEO reflects strategic continuity, supporting Lime's long-term planning amidst solid financial performance in recent quarters.

- Delve into the full analysis future growth report here for a deeper understanding of Lime Technologies.

- Upon reviewing our latest valuation report, Lime Technologies' share price might be too pessimistic.

Circus (XTRA:CA1)

Simply Wall St Growth Rating: ★★★★★★

Overview: Circus SE is a technology company that develops and delivers autonomous solutions for the food service market, with a market cap of €310.44 million.

Operations: Circus SE generates revenue of €0.98 million from its Industrial Automation & Controls segment.

Insider Ownership: 24.1%

Circus SE is on a growth trajectory with earnings forecasted to grow 65.83% annually, outpacing the German market's average. Despite its current lack of meaningful revenue (€979K), Circus is expected to see substantial revenue growth, driven by strategic expansions into defense and retail sectors. The recent appointment of Frank Holtey as CCO underscores a focus on international expansion and brand positioning, while partnerships with entities like Meta enhance its AI capabilities in defense applications.

- Click to explore a detailed breakdown of our findings in Circus' earnings growth report.

- The valuation report we've compiled suggests that Circus' current price could be inflated.

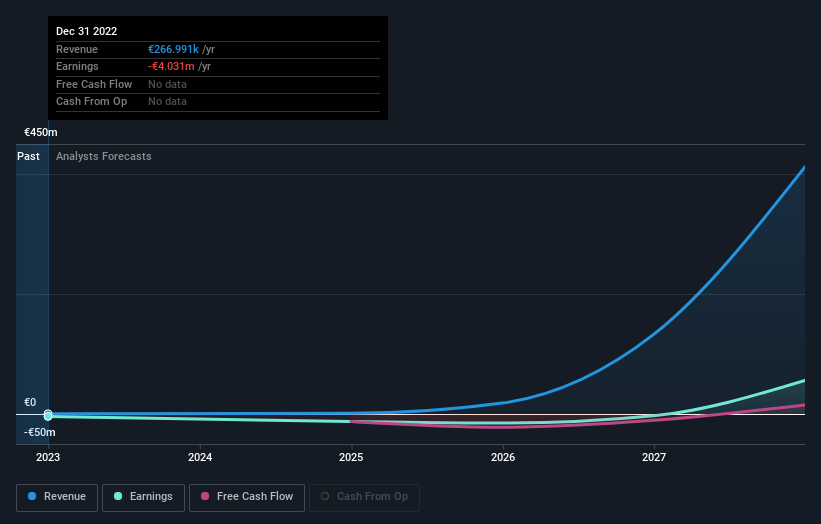

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market capitalization of €336.99 million.

Operations: The company's revenue is derived from Demand Side Platforms (DSP) at €131.03 million and Supply Side Platforms (SSP) at €427.48 million.

Insider Ownership: 24.5%

Verve Group SE is experiencing significant growth with earnings expected to rise 78.45% annually, surpassing the German market's average. Despite recent financial challenges, including a net loss of €3.58 million in Q3 2025, the company projects strong revenue growth, forecasting over €560 million for 2025 due to strategic acquisitions and platform unification. Insider ownership remains substantial, indicating confidence in its long-term strategy despite short-term volatility and lower profit margins compared to previous years.

- Navigate through the intricacies of Verve Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Verve Group is priced lower than what may be justified by its financials.

Taking Advantage

- Explore the 205 names from our Fast Growing European Companies With High Insider Ownership screener here.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M8G

Verve Group

A digital media company, engages in the provision of ad-software solutions in North America and Europe.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026