Who Has Been Selling Formpipe Software AB (publ) (STO:FPIP) Shares?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in Formpipe Software AB (publ) (STO:FPIP).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But it is perfectly logical to keep tabs on what insiders are doing. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

See our latest analysis for Formpipe Software

The Last 12 Months Of Insider Transactions At Formpipe Software

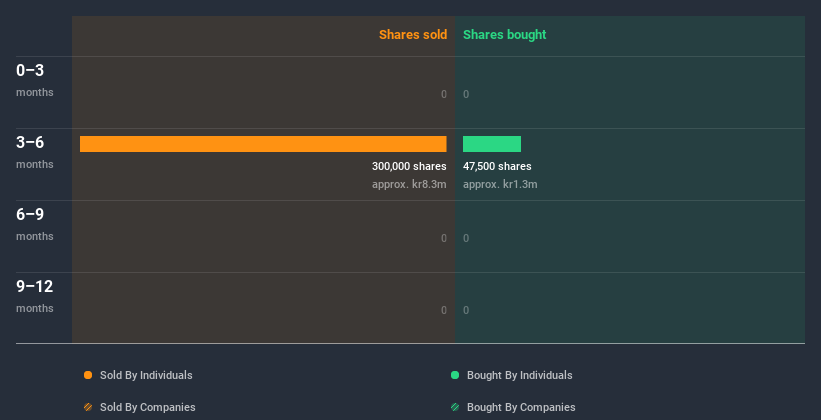

The CEO & President, Christian Sundin, made the biggest insider sale in the last 12 months. That single transaction was for kr8.3m worth of shares at a price of kr27.78 each. That means that an insider was selling shares at slightly below the current price (kr30.30). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 24% of Christian Sundin's holding. The only individual insider seller over the last year was Christian Sundin.

In the last twelve months insiders purchased 47.50k shares for kr1.3m. On the other hand they divested 300.00k shares, for kr8.3m. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Formpipe Software

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that Formpipe Software insiders own 15% of the company, worth about kr240m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Formpipe Software Tell Us?

It doesn't really mean much that no insider has traded Formpipe Software shares in the last quarter. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Formpipe Software insiders selling. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. You'd be interested to know, that we found 1 warning sign for Formpipe Software and we suggest you have a look.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Formpipe Software, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:FPIP

Formpipe Software

Provides software and consulting services for capturing, managing, and distributing information in Sweden, Denmark, rest of Nordic countries, the United Kingdom, Germany, rest of Europe, North America, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)