- Poland

- /

- Entertainment

- /

- WSE:CDR

European Insider Favorites For High Growth In April 2025

Reviewed by Simply Wall St

As European markets grapple with the steepest declines in five years, sparked by unexpected U.S. tariff hikes, investors are increasingly focused on navigating the heightened economic uncertainty. In such a volatile environment, stocks with high insider ownership can be appealing as they often indicate confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elicera Therapeutics (OM:ELIC) | 28.3% | 97.2% |

| Lokotech Group (OB:LOKO) | 13.9% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

We're going to check out a few of the best picks from our screener tool.

Intercos (BIT:ICOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intercos S.p.A. and its subsidiaries engage in the creation, production, and marketing of cosmetics and skincare products globally, with a market cap of approximately €1.22 billion.

Operations: The company's revenue is primarily derived from its Make up Line at €619.84 million, Skin Care Line at €167.09 million, and Hair & Body Line at €277.98 million.

Insider Ownership: 32.2%

Earnings Growth Forecast: 20.5% p.a.

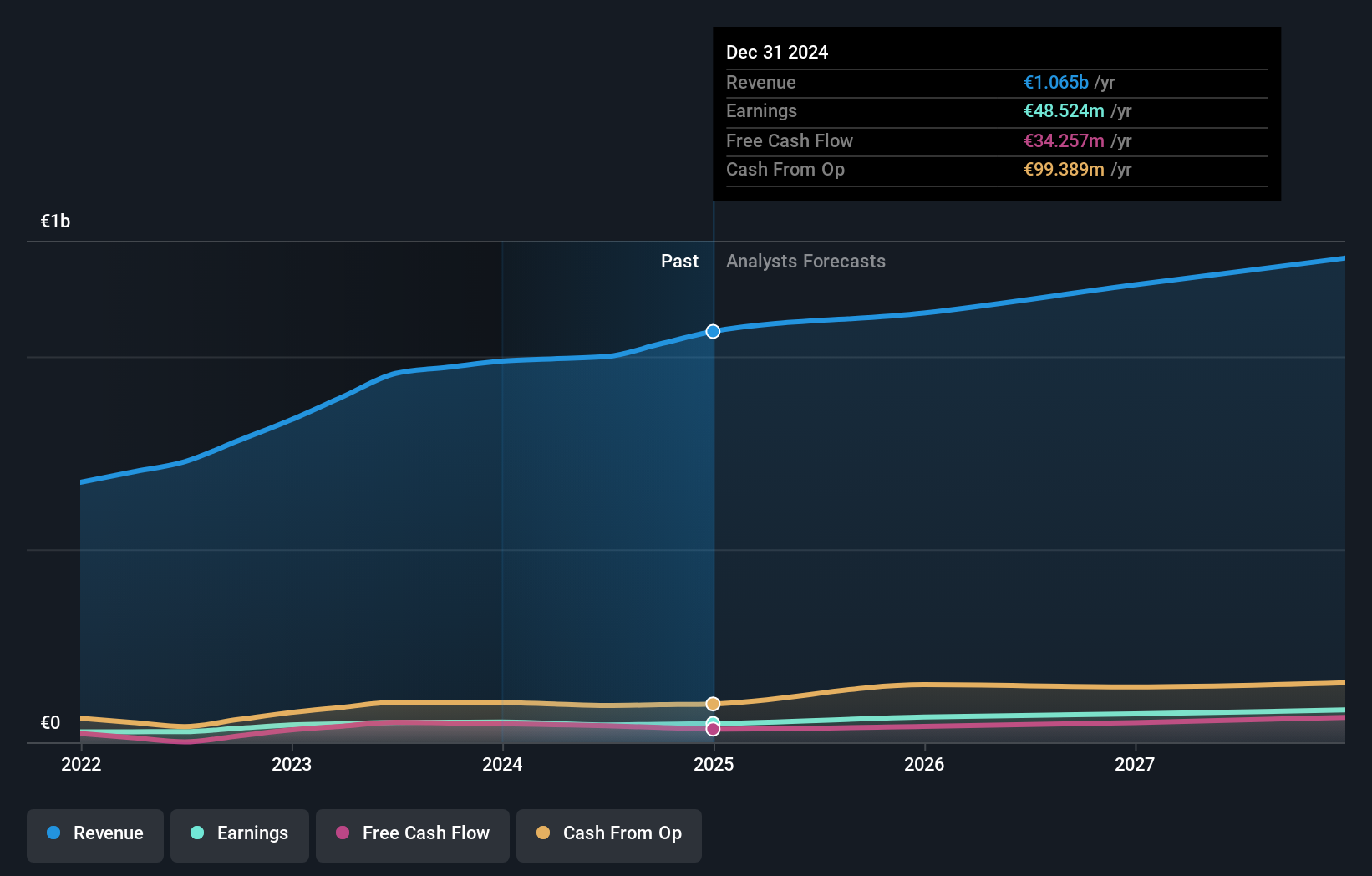

Intercos is poised for robust growth, with earnings projected to increase by 20.5% annually, outpacing the Italian market's 7.6%. Revenue growth at 6.4% also exceeds the market average of 4.1%. Despite no recent insider trading activity, analysts expect a significant stock price rise of 40.6%. Recent financials show sales reaching €1.06 billion with a net income dip to €48.8 million from €52.4 million, alongside an announced dividend of €0.1972 per share.

- Navigate through the intricacies of Intercos with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Intercos shares in the market.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers smart technical products, services, and integrations for financial and administrative applications targeting small and medium-sized businesses, accounting firms, and organizations in Sweden, with a market cap of SEK52.46 billion.

Operations: Fortnox generates revenue primarily from its business segment, amounting to SEK2.09 billion.

Insider Ownership: 39.8%

Earnings Growth Forecast: 21.3% p.a.

Fortnox exhibits strong growth potential, with earnings forecasted to rise significantly at 21.3% annually, surpassing the Swedish market's 9.3%. Revenue is expected to grow at 17.7%, faster than the market average of 0.7%. Recent insider activities show more purchases than sales, though not in large volumes. A proposed acquisition by First Kraft and EQT offers a premium of 38% over recent share prices, reflecting confidence in Fortnox's future prospects despite high share price volatility recently observed.

- Delve into the full analysis future growth report here for a deeper understanding of Fortnox.

- Our valuation report unveils the possibility Fortnox's shares may be trading at a premium.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market cap of PLN21.40 billion.

Operations: The company's revenue is primarily derived from CD PROJEKT RED, contributing PLN801.64 million, and GOG.Com, which adds PLN199.34 million.

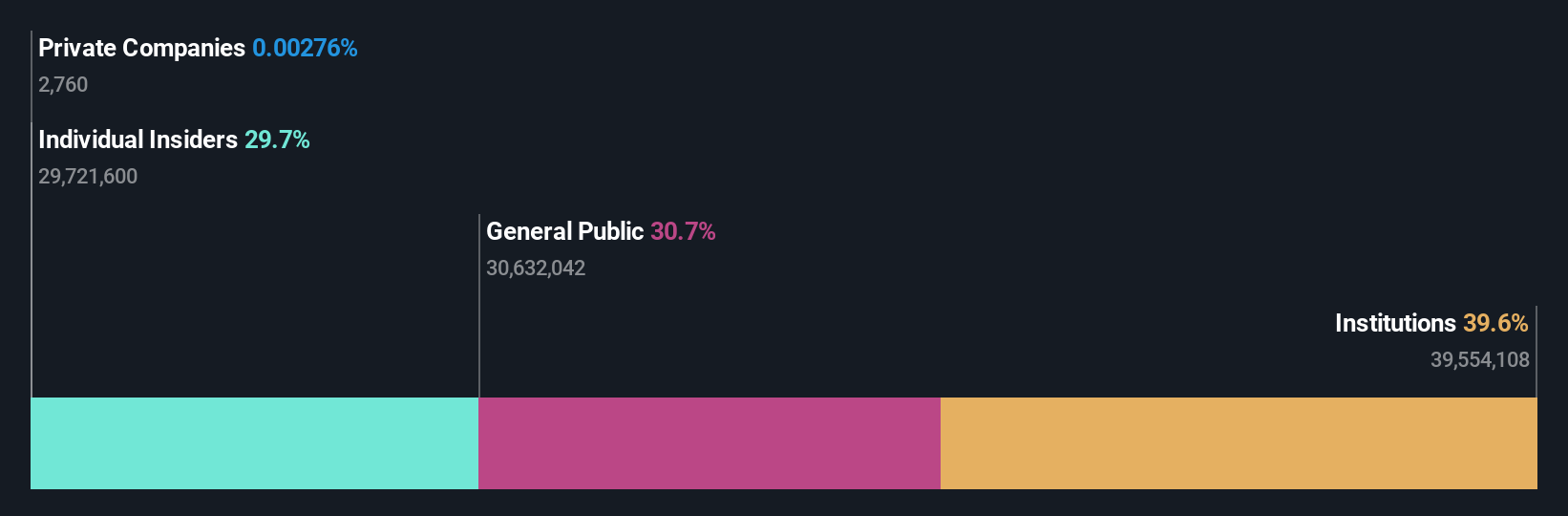

Insider Ownership: 29.7%

Earnings Growth Forecast: 37.4% p.a.

CD Projekt demonstrates significant growth potential, with earnings expected to rise 37.4% annually, outpacing the Polish market's 12.8%. Revenue is also forecasted to grow robustly at 33.8%, exceeding both the market average and a high growth benchmark of 20%. Despite recent revenue decline to PLN 985.03 million in 2024 from PLN 1,230.2 million in the previous year, its valuation remains attractive at a substantial discount compared to its fair value estimate.

- Dive into the specifics of CD Projekt here with our thorough growth forecast report.

- The analysis detailed in our CD Projekt valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 228 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade CD Projekt, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives