Investors are selling off Cint Group (STO:CINT), lack of profits no doubt contribute to shareholders one-year loss

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a Cint Group AB (publ) (STO:CINT) shareholder over the last year, since the stock price plummeted 88% in that time. A loss like this is a stark reminder that portfolio diversification is important. We wouldn't rush to judgement on Cint Group because we don't have a long term history to look at. Furthermore, it's down 49% in about a quarter. That's not much fun for holders. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Cint Group

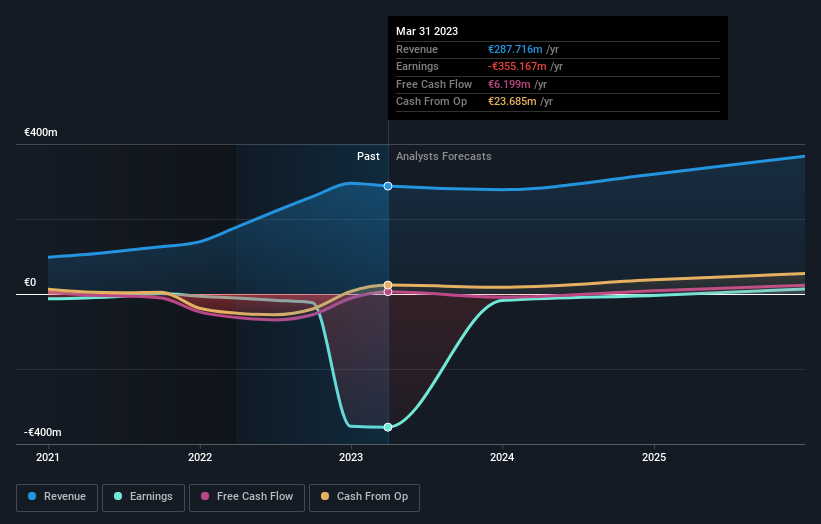

Because Cint Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Cint Group increased its revenue by 62%. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 88% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Cint Group shareholders are down 88% for the year, the market itself is up 0.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 49%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Cint Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Cint Group , and understanding them should be part of your investment process.

We will like Cint Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CINT

Cint Group

Provides software solutions for digital insights and research technology worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives