Rusta (STO:RUSTA) Is Paying Out A Larger Dividend Than Last Year

The board of Rusta AB (publ) (STO:RUSTA) has announced that it will be paying its dividend of SEK1.45 on the 26th of September, an increased payment from last year's comparable dividend. This takes the annual payment to 2.0% of the current stock price, which is about average for the industry.

Rusta's Future Dividend Projections Appear Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. The last dividend was quite easily covered by Rusta's earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

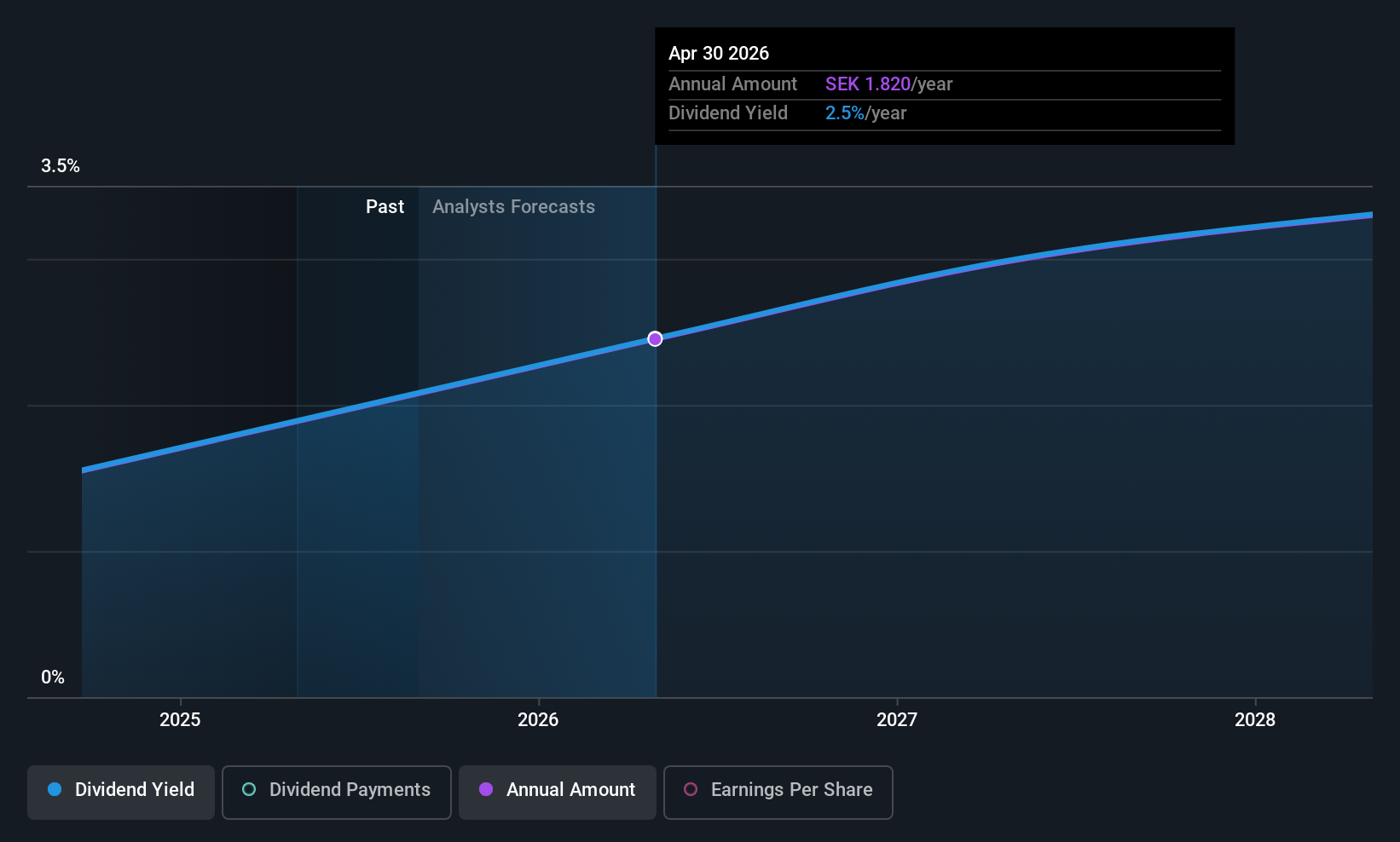

Over the next year, EPS is forecast to expand by 66.0%. If the dividend continues along recent trends, we estimate the payout ratio will be 28%, which is in the range that makes us comfortable with the sustainability of the dividend.

View our latest analysis for Rusta

Rusta Doesn't Have A Long Payment History

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings per share has been crawling upwards at 3.1% per year. Growth of 3.1% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Now, if you want to look closer, it would be worth checking out our free research on Rusta management tenure, salary, and performance. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RUSTA

Rusta

Engages in the retail of products in home decoration, consumables, seasonal products, leisure, and Do It Yourself (DIY) categories in Sweden, Norway, Finland, and Germany.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion