As global markets navigate choppy waters marked by inflation concerns and political uncertainties, investors are closely watching economic indicators and policy shifts that could influence future growth trajectories. In this environment, stocks with high insider ownership can offer a unique perspective on potential growth opportunities, as insiders often have a deep understanding of their company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 25.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany, with a market cap of SEK11.40 billion.

Operations: The company's revenue segments are comprised of SEK6.49 billion from Sweden, SEK2.43 billion from Norway, and SEK2.39 billion from other markets.

Insider Ownership: 11.4%

Earnings Growth Forecast: 22.1% p.a.

Rusta demonstrates potential as a growth company with high insider ownership, evidenced by recent insider buying and no substantial selling. Despite slower revenue growth at 9.9% annually compared to the desired 20%, earnings are expected to grow significantly at 22.1% per year, outpacing the Swedish market's 14.3%. The stock trades well below its estimated fair value, while recent board changes may influence strategic direction positively.

- Get an in-depth perspective on Rusta's performance by reading our analyst estimates report here.

- Our valuation report here indicates Rusta may be undervalued.

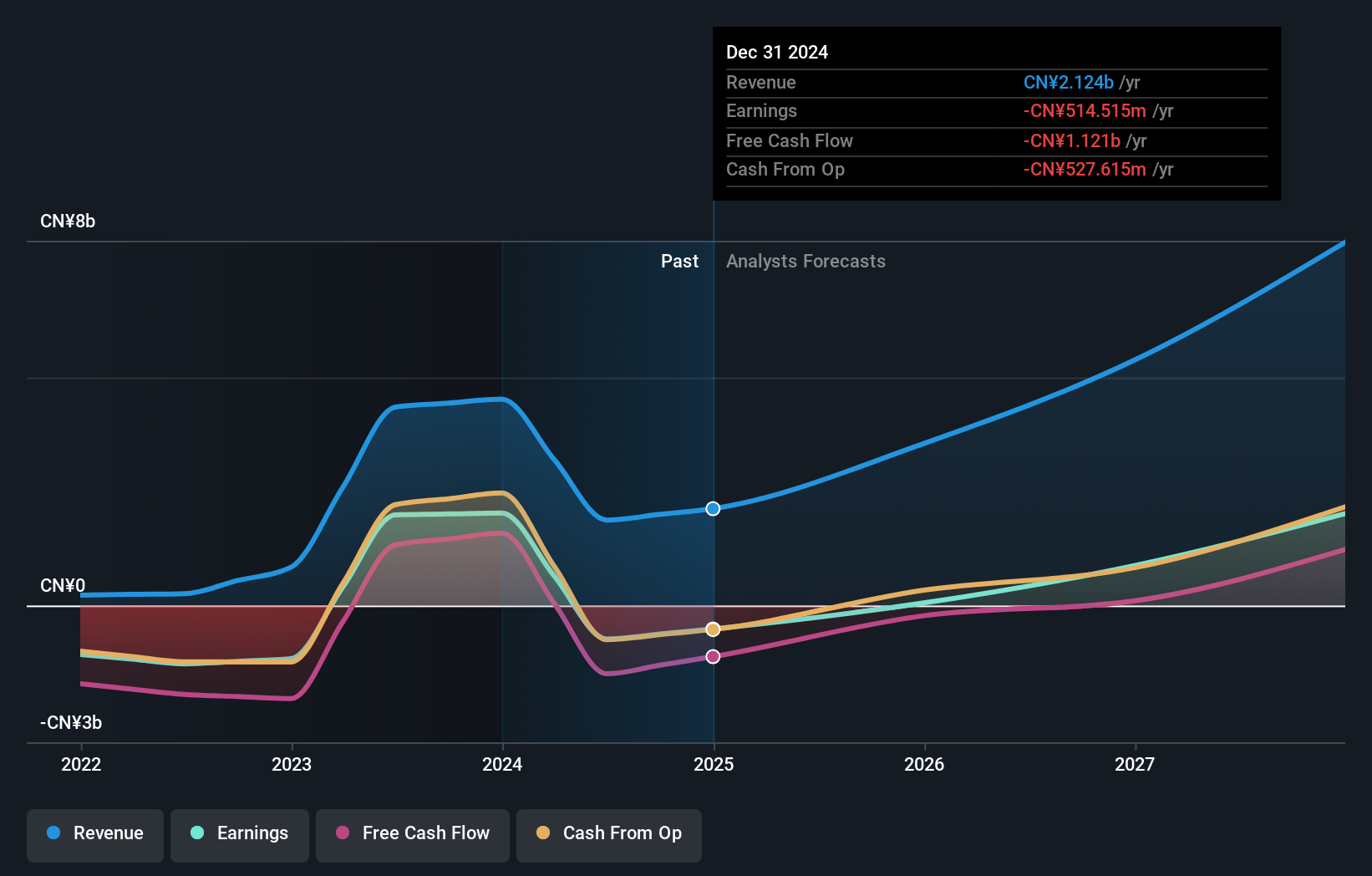

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on researching, developing, manufacturing, and commercializing antibody drugs with a market cap of HK$51.12 billion.

Operations: The company generates revenue of CN¥1.87 billion from its activities in the research, development, production, and sale of biopharmaceutical products.

Insider Ownership: 19%

Earnings Growth Forecast: 43.8% p.a.

Akeso showcases strong growth potential, with revenue forecasted to increase by 30.1% annually, surpassing the Hong Kong market average. Despite significant insider selling recently, the company remains undervalued at 59.8% below fair value estimates. Akeso's innovative bispecific antibody drugs like cadonilimab and ivonescimab have gained inclusion in China's National Reimbursement Drug List, enhancing their market presence and clinical relevance across multiple cancer indications, which supports its long-term growth trajectory.

- Click here to discover the nuances of Akeso with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Akeso shares in the market.

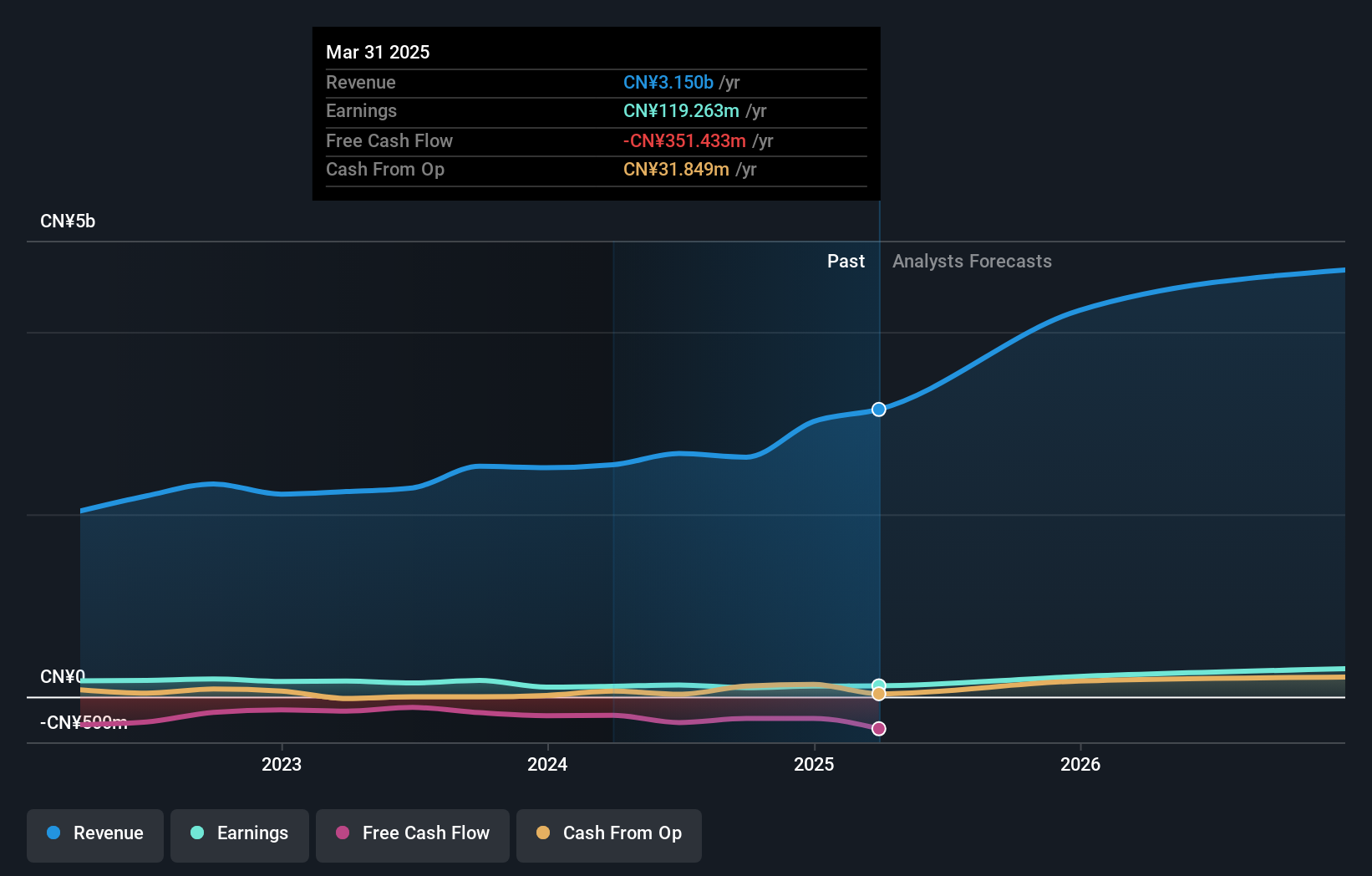

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd. operates in the environmental systems industry and has a market cap of CN¥11.02 billion.

Operations: Guangdong Shenling Environmental Systems Co., Ltd. operates in the environmental systems industry with a market cap of CN¥11.02 billion. Revenue segments (in millions of CN¥): [Insert revenue segment details here].

Insider Ownership: 38.7%

Earnings Growth Forecast: 39.6% p.a.

Guangdong Shenling Environmental Systems is poised for substantial growth, with earnings projected to rise significantly by 39.64% annually, outpacing the Chinese market average. Despite recent volatility in share price and a decline in profit margins from 7.1% to 3.8%, insider ownership remains robust, as evidenced by Zhang Yu's acquisition of a 5% stake for CNY 320 million. Revenue growth is expected to exceed market rates at 20.6% annually, indicating strong future potential.

- Navigate through the intricacies of Guangdong Shenling Environmental Systems with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Guangdong Shenling Environmental Systems is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1452 more companies for you to explore.Click here to unveil our expertly curated list of 1455 Fast Growing Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301018

Guangdong Shenling Environmental Systems

Guangdong Shenling Environmental Systems Co., Ltd.

High growth potential with excellent balance sheet.