European Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of U.S.-China trade tensions, major indices like Germany's DAX and France's CAC 40 are seeing notable gains. In this environment, growth companies with significant insider ownership can be particularly appealing, as insider stakes often signal confidence in a company's long-term prospects amidst evolving market dynamics.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.6% | 30.4% |

| Vow (OB:VOW) | 13.1% | 81% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 107.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 57.1% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

We'll examine a selection from our screener results.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

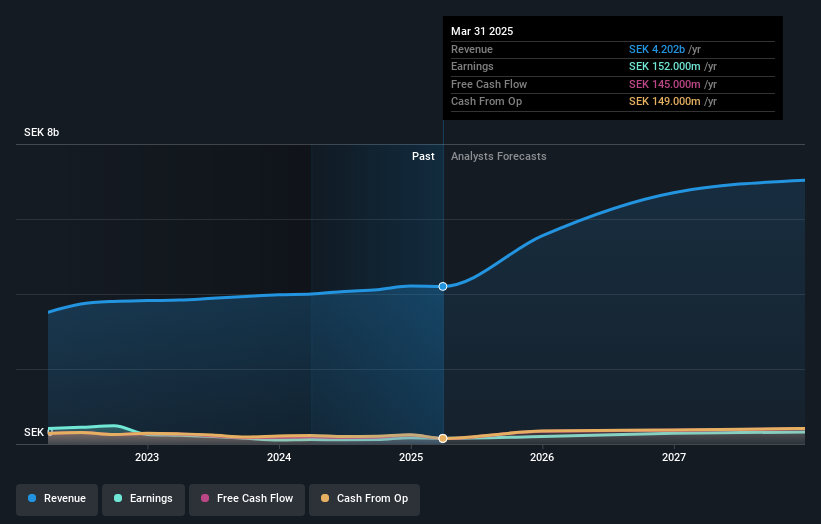

Overview: Humble Group AB (publ) is engaged in the development, refinement, and distribution of fast-moving consumer products both in Sweden and internationally, with a market cap of SEK3.55 billion.

Operations: The company's revenue segments include Future Snacking at SEK1.02 billion, Sustainable Care at SEK2.43 billion, Quality Nutrition at SEK1.51 billion, and Nordic Distribution at SEK2.82 billion.

Insider Ownership: 14.8%

Earnings Growth Forecast: 45% p.a.

Humble Group demonstrates strong growth potential as its earnings are expected to grow significantly, outpacing the Swedish market. Despite recent lower net income of SEK 11 million for Q1 2025, insider buying has been substantial over the past three months, indicating confidence from within. The company trades at a significant discount to its estimated fair value. Recent changes in share structure aim to enhance long-term incentives, potentially aligning management's interests with shareholders'.

- Dive into the specifics of Humble Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Humble Group's current price could be quite moderate.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

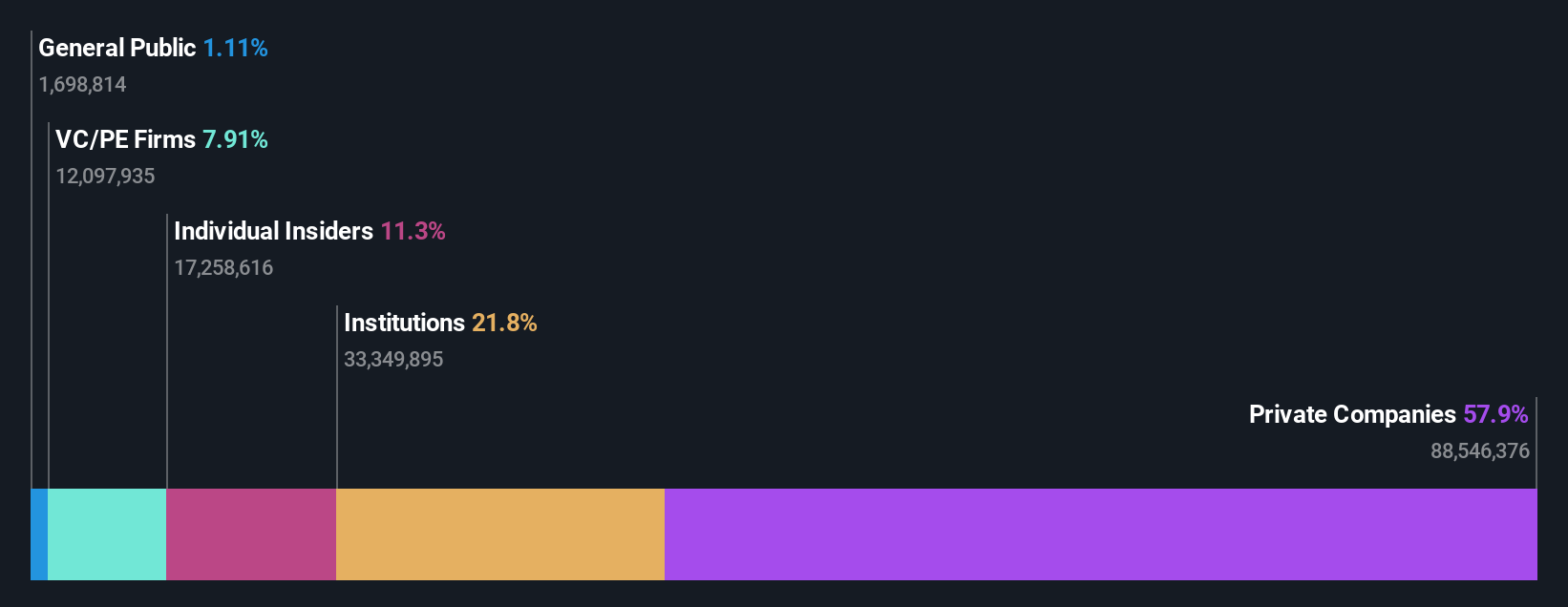

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK12.24 billion.

Operations: The company's revenue is segmented into Sweden with SEK6.68 billion, Norway with SEK2.47 billion, and other markets generating SEK2.39 billion.

Insider Ownership: 11.3%

Earnings Growth Forecast: 24.4% p.a.

Rusta's growth trajectory is underscored by its ambitious expansion plans, with recent store openings bolstering its presence in Europe. The company reported a rise in sales and net income for the third quarter of 2025, reflecting solid financial performance. Trading significantly below estimated fair value, Rusta's earnings are forecast to grow substantially faster than the Swedish market. Despite no recent insider trading activity, high insider ownership aligns management interests with shareholders'.

- Click to explore a detailed breakdown of our findings in Rusta's earnings growth report.

- Our expertly prepared valuation report Rusta implies its share price may be lower than expected.

Viva Wine Group (OM:VIVA)

Simply Wall St Growth Rating: ★★★★☆☆

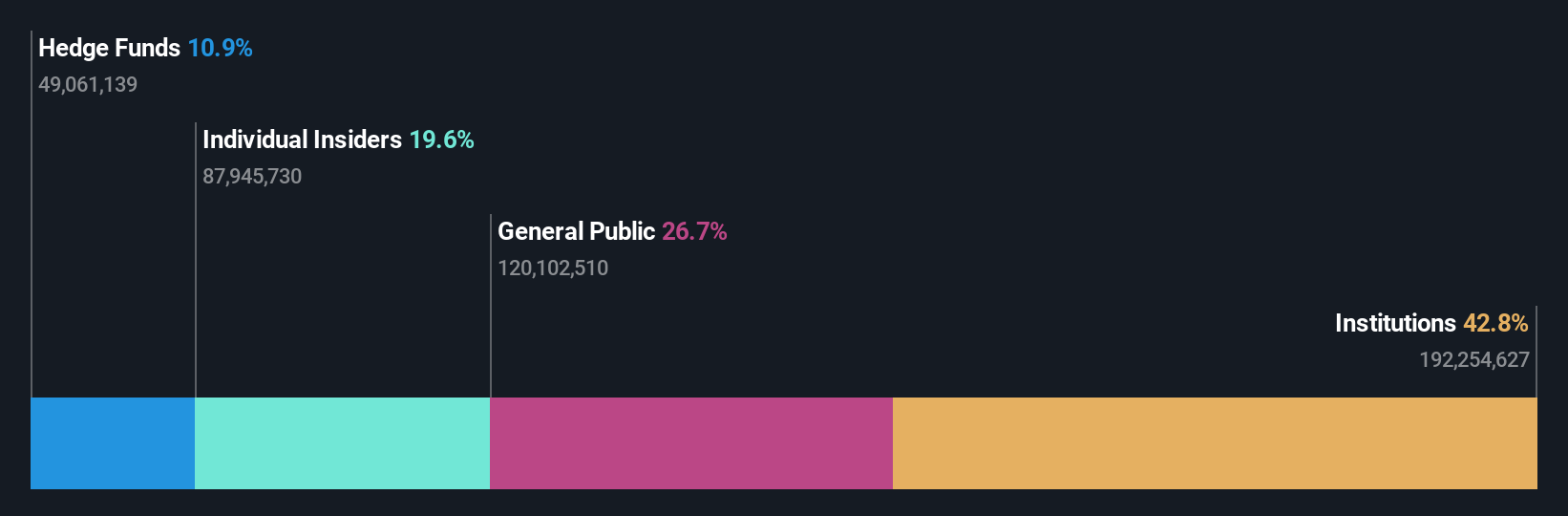

Overview: Viva Wine Group AB develops, markets, imports, and sells wines, with a market cap of SEK3.71 billion.

Operations: Viva Wine Group AB generates revenue through its activities in developing, marketing, importing, and selling wines.

Insider Ownership: 22%

Earnings Growth Forecast: 21.5% p.a.

Viva Wine Group's growth is driven by strategic acquisitions, such as Delta Wines, enhancing its European market position. Despite a recent dip in Q1 2025 earnings to SEK 21 million from SEK 39 million the previous year, the company is trading well below its estimated fair value. Earnings are forecast to grow faster than the Swedish market at 21.47% annually. The decentralized model fosters agility and local insights, though dividends are not fully covered by earnings or free cash flows.

- Take a closer look at Viva Wine Group's potential here in our earnings growth report.

- Our expertly prepared valuation report Viva Wine Group implies its share price may be too high.

Where To Now?

- Click through to start exploring the rest of the 213 Fast Growing European Companies With High Insider Ownership now.

- Contemplating Other Strategies? AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIVA

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives