- Sweden

- /

- Industrials

- /

- OM:VOLO

European Growth Companies With High Insider Ownership July 2025

Reviewed by Simply Wall St

As the European market navigates a complex landscape of trade negotiations and economic policies, recent optimism surrounding a potential EU-U.S. trade deal has buoyed investor sentiment, with indices like the STOXX Europe 600 showing modest gains. In this environment, growth companies with high insider ownership stand out as potentially strong performers due to their alignment of interests between management and shareholders, which can be particularly advantageous amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 43.3% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's dive into some prime choices out of the screener.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK11.96 billion.

Operations: The company's revenue segments are comprised of Sweden with SEK6.86 billion, Norway with SEK2.53 billion, and Other Markets generating SEK2.44 billion.

Insider Ownership: 11%

Rusta AB's recent performance highlights its robust growth trajectory, with full-year sales reaching SEK 11.83 billion, up from SEK 11.12 billion the previous year, and net income increasing to SEK 476 million. The company is enhancing operational efficiency by establishing a bonded warehouse in Sweden, expected to save approximately SEK 30 million annually from 2026/2027. Despite moderate insider ownership changes recently, Rusta's earnings and revenue are forecasted to outpace the Swedish market growth rates.

- Get an in-depth perspective on Rusta's performance by reading our analyst estimates report here.

- Our valuation report here indicates Rusta may be overvalued.

Volati (OM:VOLO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Volati AB (publ) is a private equity firm that focuses on growth capital, buyouts, and add-on acquisitions in mature and middle-market companies, with a market cap of SEK8.66 billion.

Operations: The company's revenue is derived from the Salix Group with SEK3.89 billion, the Ettiketto Group contributing SEK1.09 billion, and the Industry segment excluding Ettiketto generating SEK3.27 billion.

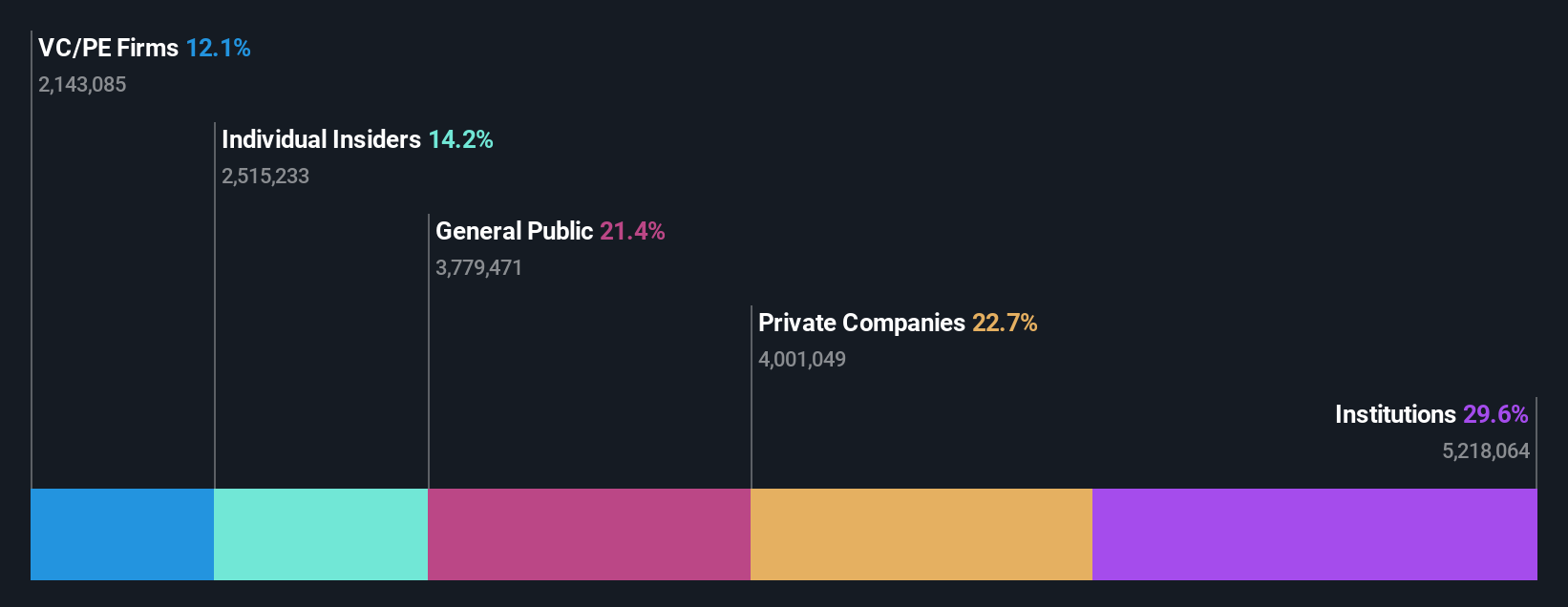

Insider Ownership: 28.9%

Volati demonstrates strong growth potential with earnings forecasted to rise significantly at 34.1% annually, outpacing the Swedish market's 16.9%. Despite high debt levels, it trades at a substantial discount to its estimated fair value and is expected to see a stock price increase of 33%. Recent results show steady sales growth, with Q2 sales reaching SEK 2.32 billion compared to SEK 2.20 billion last year, reflecting consistent performance amidst executive changes.

- Delve into the full analysis future growth report here for a deeper understanding of Volati.

- The valuation report we've compiled suggests that Volati's current price could be quite moderate.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market cap of €535.00 million.

Operations: The company's revenue is primarily derived from its Drug Delivery Systems segment, which generated €69.67 million.

Insider Ownership: 14.2%

Formycon shows promising growth potential, with expected annual revenue growth of 18.8%, surpassing the German market average. Despite a low forecasted Return on Equity of 5% in three years, Formycon's strategic partnerships and product launches, including the commercialization of biosimilars like FYB202/Otulfi™ in Canada and Germany, bolster its market position. The recent completion of patient enrollment for the Dahlia study further accelerates development timelines while reducing investment needs significantly.

- Click here to discover the nuances of Formycon with our detailed analytical future growth report.

- According our valuation report, there's an indication that Formycon's share price might be on the cheaper side.

Summing It All Up

- Reveal the 216 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLO

Volati

A private equity firm specializing in growth capital, buyouts, add on acquisitions in mature and middle market companies.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives