Market Might Still Lack Some Conviction On Online Brands Nordic AB (publ) (STO:OBAB) Even After 28% Share Price Boost

Despite an already strong run, Online Brands Nordic AB (publ) (STO:OBAB) shares have been powering on, with a gain of 28% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 3.4% isn't as impressive.

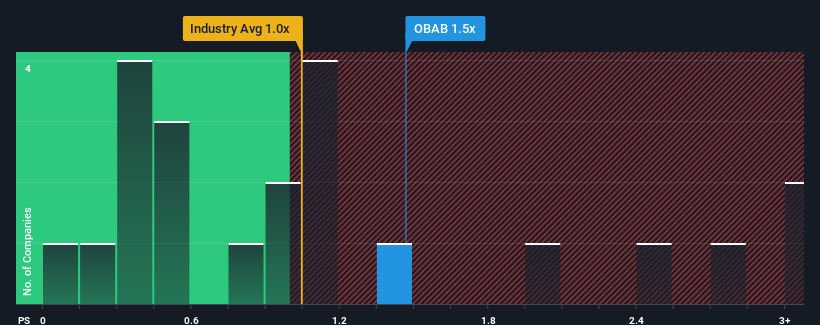

In spite of the firm bounce in price, there still wouldn't be many who think Online Brands Nordic's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in Sweden's Multiline Retail industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Online Brands Nordic

How Online Brands Nordic Has Been Performing

Online Brands Nordic has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. Those who are bullish on Online Brands Nordic will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Online Brands Nordic's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Online Brands Nordic's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.7%. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 1.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Online Brands Nordic's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Online Brands Nordic's P/S?

Online Brands Nordic's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To our surprise, Online Brands Nordic revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for Online Brands Nordic you should be aware of, and 1 of them is significant.

If these risks are making you reconsider your opinion on Online Brands Nordic, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OBAB

Online Brands Nordic

Engages in the online sale of carpets under Trendcarpet brand in Sweden and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives