- Japan

- /

- Personal Products

- /

- TSE:4922

3 Growth Companies With High Insider Ownership And 55% Earnings Growth

Reviewed by Simply Wall St

Amid a backdrop of diverging performances in global markets, growth stocks have continued to capture investor attention, with major U.S. indexes like the S&P 500 and Nasdaq Composite reaching record highs. This trend highlights the importance of identifying growth companies with strong fundamentals, such as high insider ownership and significant earnings potential, which can be appealing characteristics in today's competitive market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

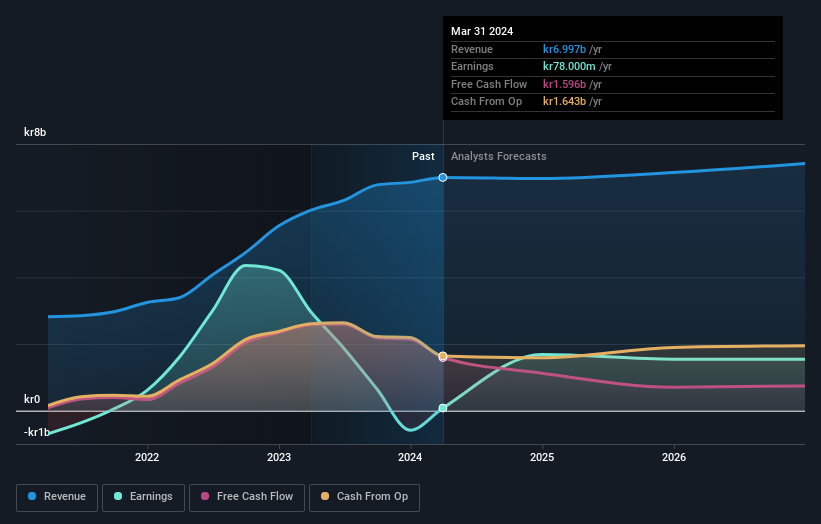

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a hotel property company that owns, develops, and leases hotel properties globally, with a market cap of SEK37.83 billion.

Operations: The company's revenue segments consist of Leases generating SEK3.85 billion and Own operation contributing SEK3.23 billion.

Insider Ownership: 11.1%

Earnings Growth Forecast: 55.2% p.a.

Pandox AB has seen more insider buying than selling recently, suggesting confidence in its future. Despite a recent SEK 2 billion equity offering leading to shareholder dilution, the company is forecast to achieve above-market profit growth over the next three years. Revenue growth of 6.7% annually also surpasses the Swedish market average. However, Pandox faces challenges with interest coverage and a low return on equity forecast of 6.6%.

- Click here and access our complete growth analysis report to understand the dynamics of Pandox.

- The analysis detailed in our Pandox valuation report hints at an deflated share price compared to its estimated value.

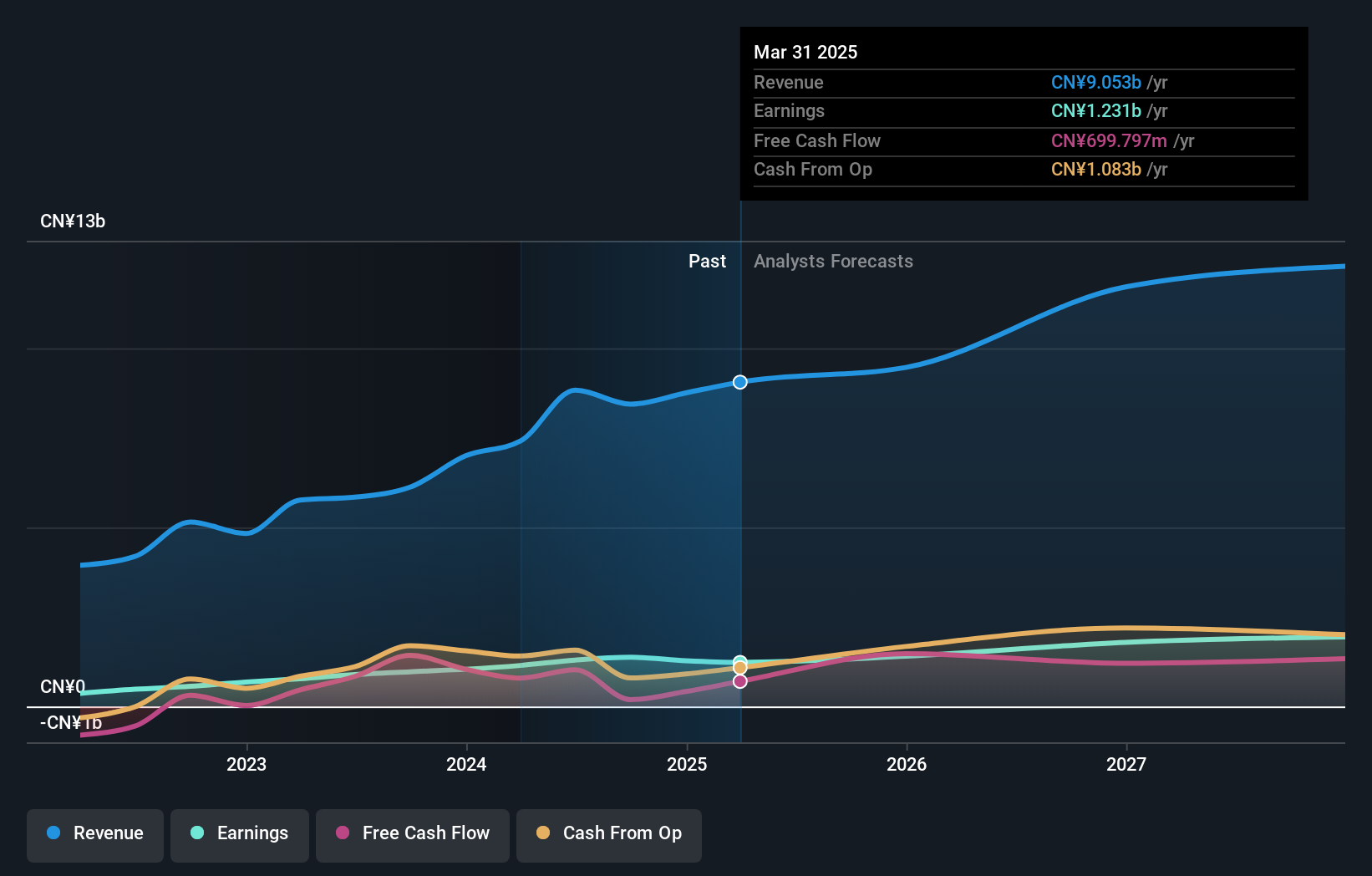

Jiayou International LogisticsLtd (SHSE:603871)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jiayou International Logistics Co., Ltd, with a market cap of CN¥20.23 billion, operates in domestic and international multimodal transportation, logistics infrastructure investment and operation, and supply chain trade through its subsidiaries.

Operations: Jiayou International Logistics Co., Ltd generates revenue through its operations in multimodal transportation, logistics infrastructure investment and operation, and supply chain trade.

Insider Ownership: 19.3%

Earnings Growth Forecast: 27.3% p.a.

Jiayou International Logistics Ltd. has demonstrated robust growth, with recent earnings showing a significant increase in sales and net income compared to the previous year. The company's earnings are forecasted to grow faster than the broader Chinese market, supported by a favorable price-to-earnings ratio of 14.6x. Despite high non-cash earnings impacting dividend sustainability, analysts expect the stock price to rise by 25%, reflecting confidence in its growth trajectory and insider stability.

- Delve into the full analysis future growth report here for a deeper understanding of Jiayou International LogisticsLtd.

- Upon reviewing our latest valuation report, Jiayou International LogisticsLtd's share price might be too pessimistic.

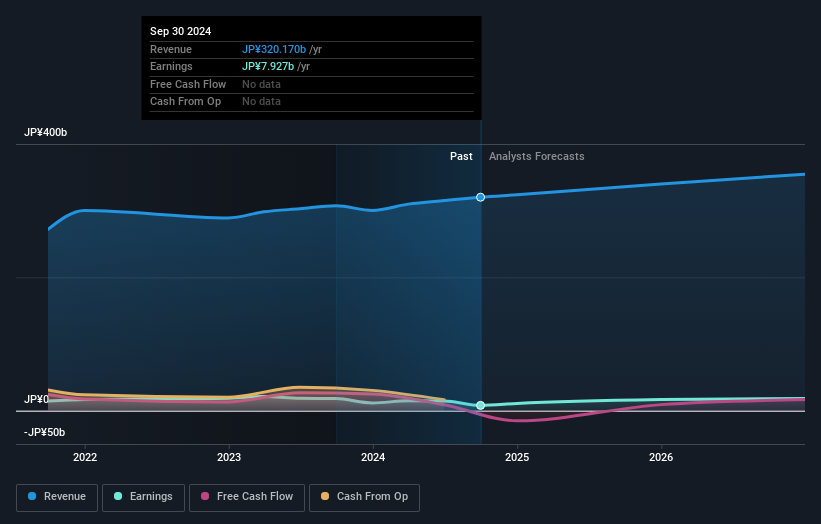

KOSÉ (TSE:4922)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KOSÉ Corporation is a company that manufactures and sells cosmetics and cosmetology products both in Japan and internationally, with a market cap of ¥384.90 billion.

Operations: The company's revenue segments include ¥253.43 billion from the Cosmetics Business and ¥64.22 billion from Cosmetaries.

Insider Ownership: 32.9%

Earnings Growth Forecast: 23% p.a.

KOSÉ Corporation is poised for significant earnings growth, forecasted at 23% annually, outpacing the Japanese market. Despite volatile share prices and a recent revision in earnings guidance, the company trades at 29% below its estimated fair value. Organizational restructuring aims to enhance operations in Europe and America while consolidating domestic channels. However, profit margins have declined from last year, and dividends remain inadequately covered by earnings or cash flows.

- Dive into the specifics of KOSÉ here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of KOSÉ shares in the market.

Make It Happen

- Reveal the 1501 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if KOSÉ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4922

KOSÉ

Manufactures and sells cosmetics and cosmetology products primarily in Japan and internationally.

Flawless balance sheet with reasonable growth potential.