- South Korea

- /

- Machinery

- /

- KOSE:A009540

3 Stocks That May Be Trading At Estimated Discounts Of Up To 49.8%

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation and strong earnings from the financial sector, investors are increasingly focused on identifying opportunities within value stocks. In this environment, finding stocks that may be trading at significant discounts can offer potential for growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267) | CN¥35.51 | CN¥70.87 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.10 | ₹2219.85 | 49.8% |

| Solum (KOSE:A248070) | ₩18700.00 | ₩37393.72 | 50% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.07 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.10 | A$6.19 | 50% |

| Zhejiang Juhua (SHSE:600160) | CN¥25.37 | CN¥50.53 | 49.8% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5870.00 | ¥11700.97 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. is a leading company in the shipbuilding and offshore engineering industry with a market cap of ₩17.22 trillion.

Operations: The company's revenue segments include Shipbuilding at ₩22.95 billion, Engine at ₩4.38 billion, Marine Plant at ₩732.83 million, and Green Energy at ₩480.22 million.

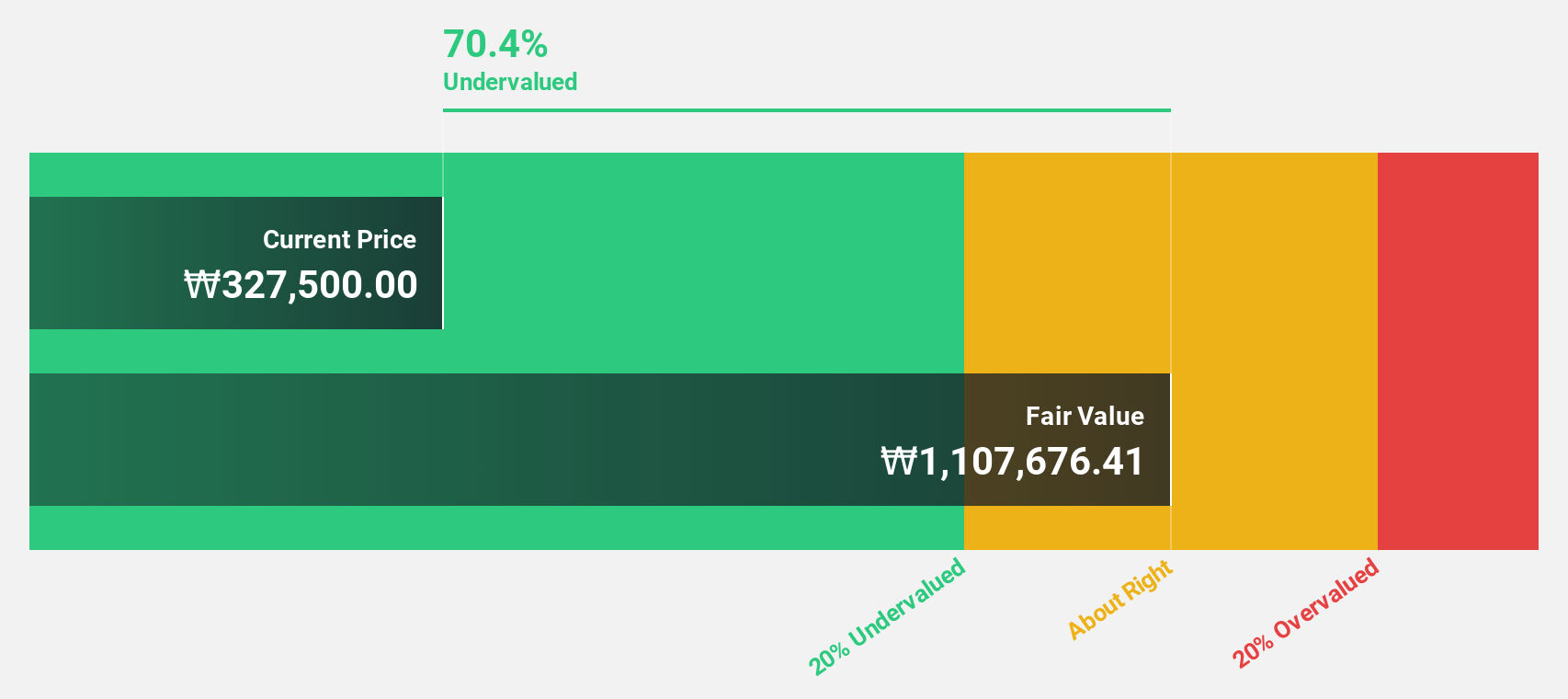

Estimated Discount To Fair Value: 38.3%

HD Korea Shipbuilding & Offshore Engineering is trading at a significant discount to its estimated fair value of ₩394,878.38, with shares currently priced at ₩243,500. Despite a decline in third-quarter net income year-over-year, the company reported substantial sales growth and an impressive nine-month earnings increase. Future projections indicate robust annual earnings growth of 51.9%, outpacing the broader Korean market's expectations and highlighting potential undervaluation based on cash flows.

- Our earnings growth report unveils the potential for significant increases in HD Korea Shipbuilding & Offshore Engineering's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of HD Korea Shipbuilding & Offshore Engineering.

Vitrolife (OM:VITR)

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market cap of SEK28.16 billion.

Operations: The company's revenue is derived from three segments: Genetics (SEK1.23 billion), Consumables (SEK1.61 billion), and Technologies (SEK721 million).

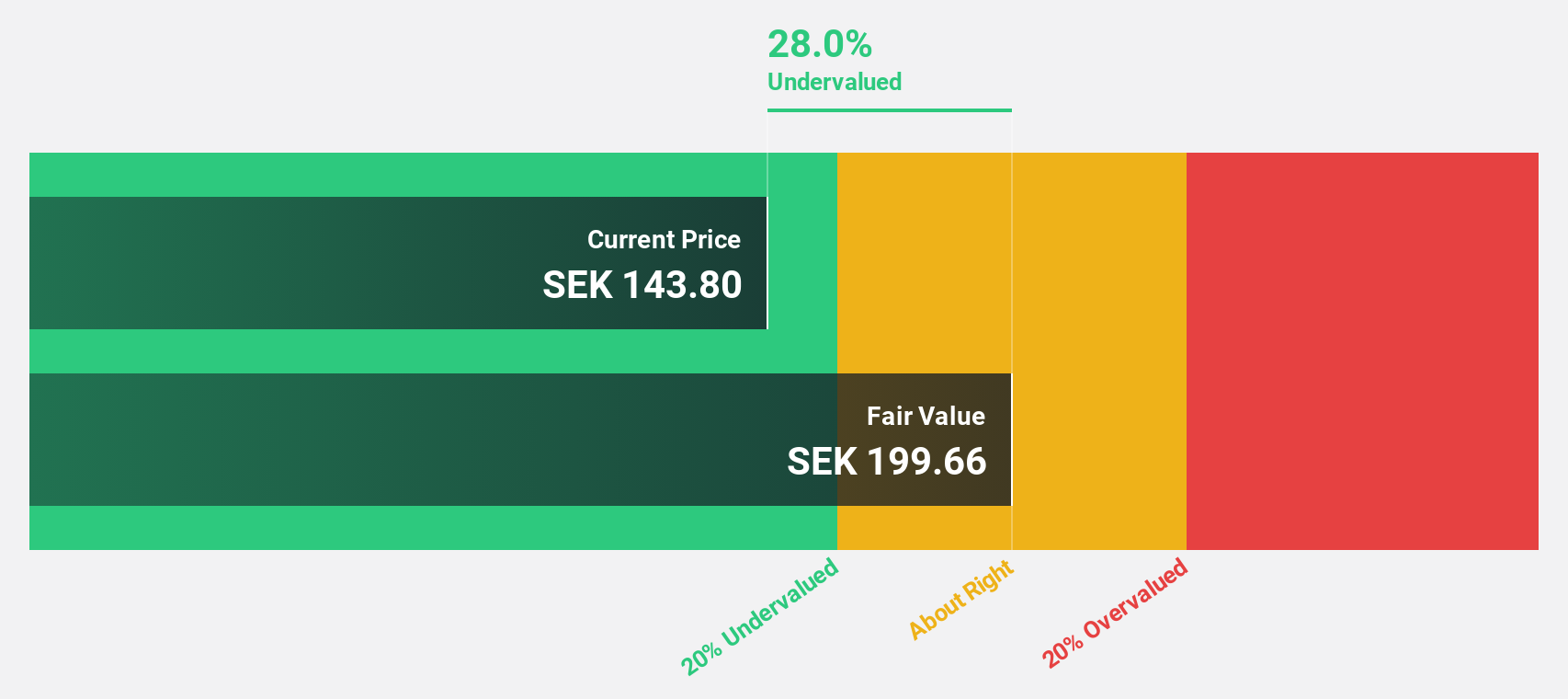

Estimated Discount To Fair Value: 17.4%

Vitrolife is trading at SEK208, below its estimated fair value of SEK251.72, suggesting potential undervaluation. Despite a slight decline in third-quarter net income to SEK116 million from SEK122 million the previous year, nine-month earnings improved to SEK374 million. Revenue growth is expected to outpace the Swedish market at 8.3% annually. The company anticipates becoming profitable within three years, although its return on equity is forecasted to remain low at 5.9%.

- Upon reviewing our latest growth report, Vitrolife's projected financial performance appears quite optimistic.

- Dive into the specifics of Vitrolife here with our thorough financial health report.

Zhejiang Juhua (SHSE:600160)

Overview: Zhejiang Juhua Co., Ltd. is engaged in the research, development, production, and sale of chemical raw materials, chemical products, and food additives in China with a market cap of CN¥68.49 billion.

Operations: The company's revenue is primarily derived from the Chemical Industry segment, which generated CN¥22.55 billion.

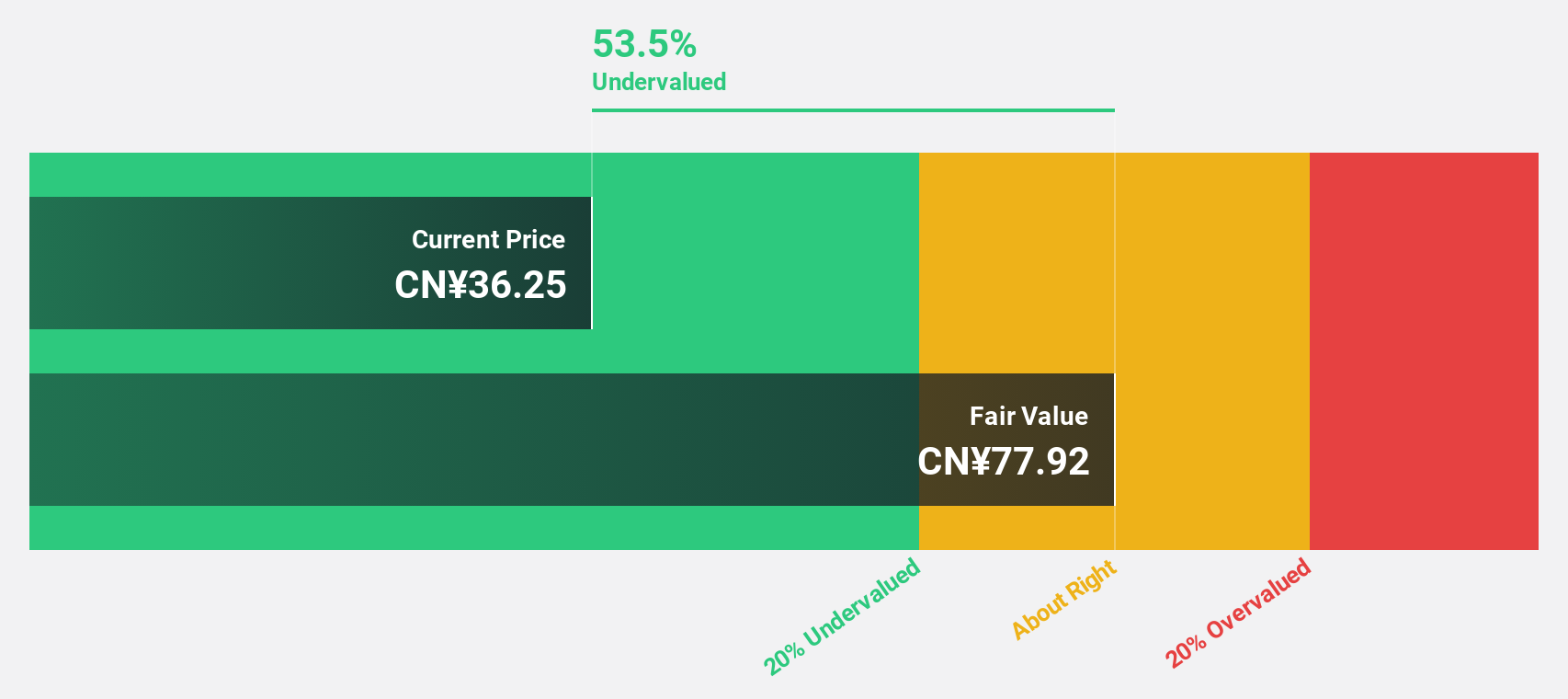

Estimated Discount To Fair Value: 49.8%

Zhejiang Juhua is trading at CNY 25.37, significantly below its estimated fair value of CNY 50.53, indicating potential undervaluation. For the first nine months of 2024, net income rose to CNY 1.26 billion from CNY 746.78 million a year earlier, with earnings per share also increasing. Revenue growth is forecasted at a moderate pace of 13.4% annually, while earnings are expected to grow substantially by over 39% per year for the next three years.

- Our expertly prepared growth report on Zhejiang Juhua implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Zhejiang Juhua with our detailed financial health report.

Key Takeaways

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 874 more companies for you to explore.Click here to unveil our expertly curated list of 877 Undervalued Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Korea Shipbuilding & Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009540

HD Korea Shipbuilding & Offshore Engineering

HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Flawless balance sheet with high growth potential.