Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As European markets navigate a challenging landscape marked by fresh U.S. trade tariffs and fluctuating economic indicators, investors are increasingly on the lookout for resilient opportunities within the region. In this environment, identifying stocks with strong fundamentals and potential for growth can be particularly rewarding, as they may offer stability amid broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative (ENXTPA:CNDF)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative offers a range of banking products and financial services in France, with a market capitalization of approximately €1.01 billion.

Operations: The company generates revenue primarily through its retail banking segment, which contributes €623.64 million.

Crédit Agricole Nord de France stands out with its robust financial health, holding total assets of €38.9B and equity of €5.5B. Its earnings growth at 31.6% over the past year surpasses the industry average of 3.2%, underscoring its competitive edge in a challenging market. The bank's funding is primarily low risk, with customer deposits accounting for 95% of liabilities, and it has a sufficient allowance for bad loans at 102%. Trading at about 30.9% below fair value estimates, it offers potential investment appeal as an undervalued asset in the European banking sector.

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★★★★

Overview: MedCap AB (publ) is a private equity firm that focuses on investments in various stages such as industry consolidation and growth capital, with a market cap of SEK5.41 billion.

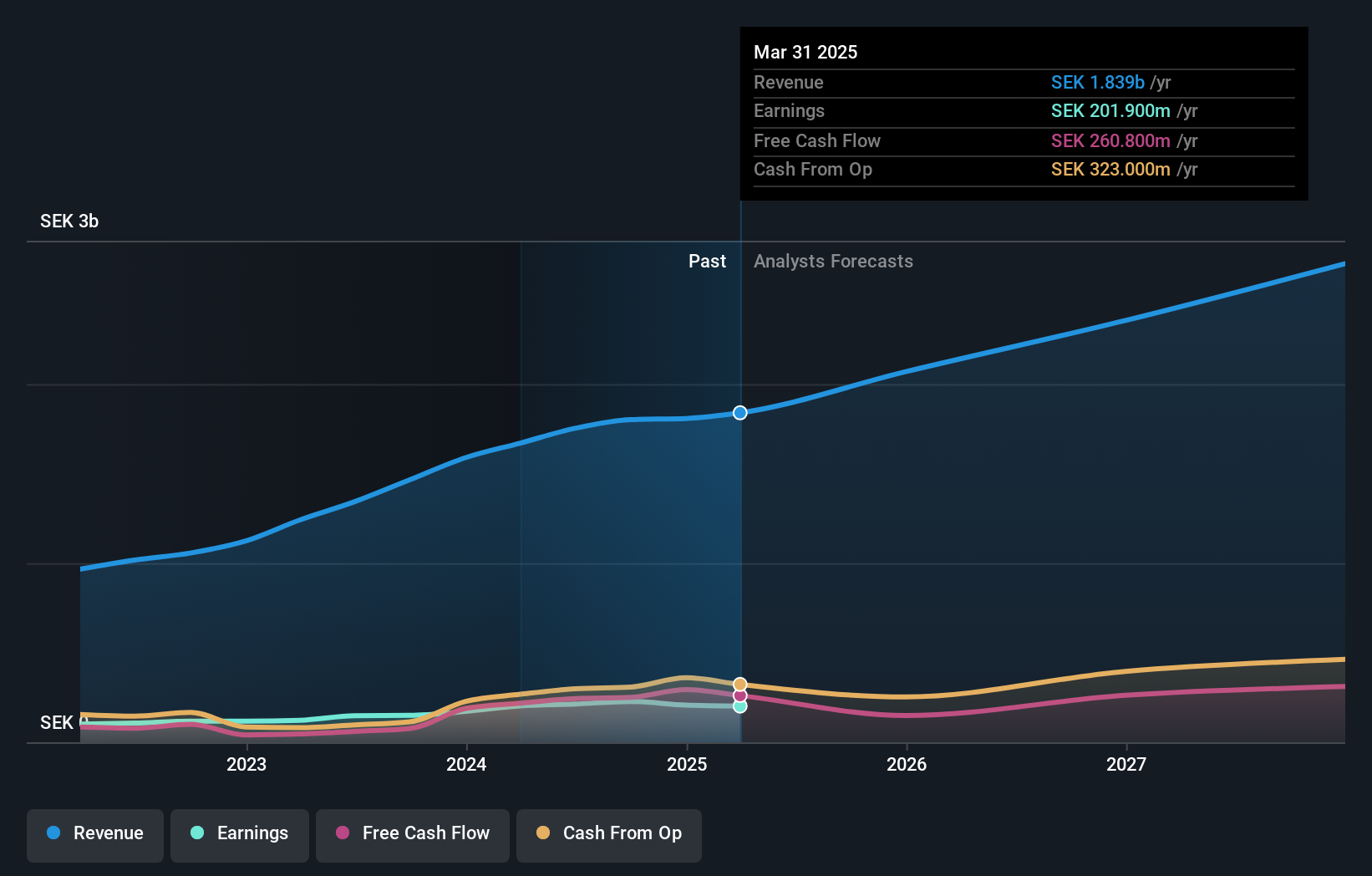

Operations: MedCap generates revenue primarily from its Medtech, Support, and Specialty Pharma segments, with SEK607.70 million from Medtech and SEK767.20 million from Support. The company's financial performance is characterized by a focus on these diversified revenue streams within the healthcare sector.

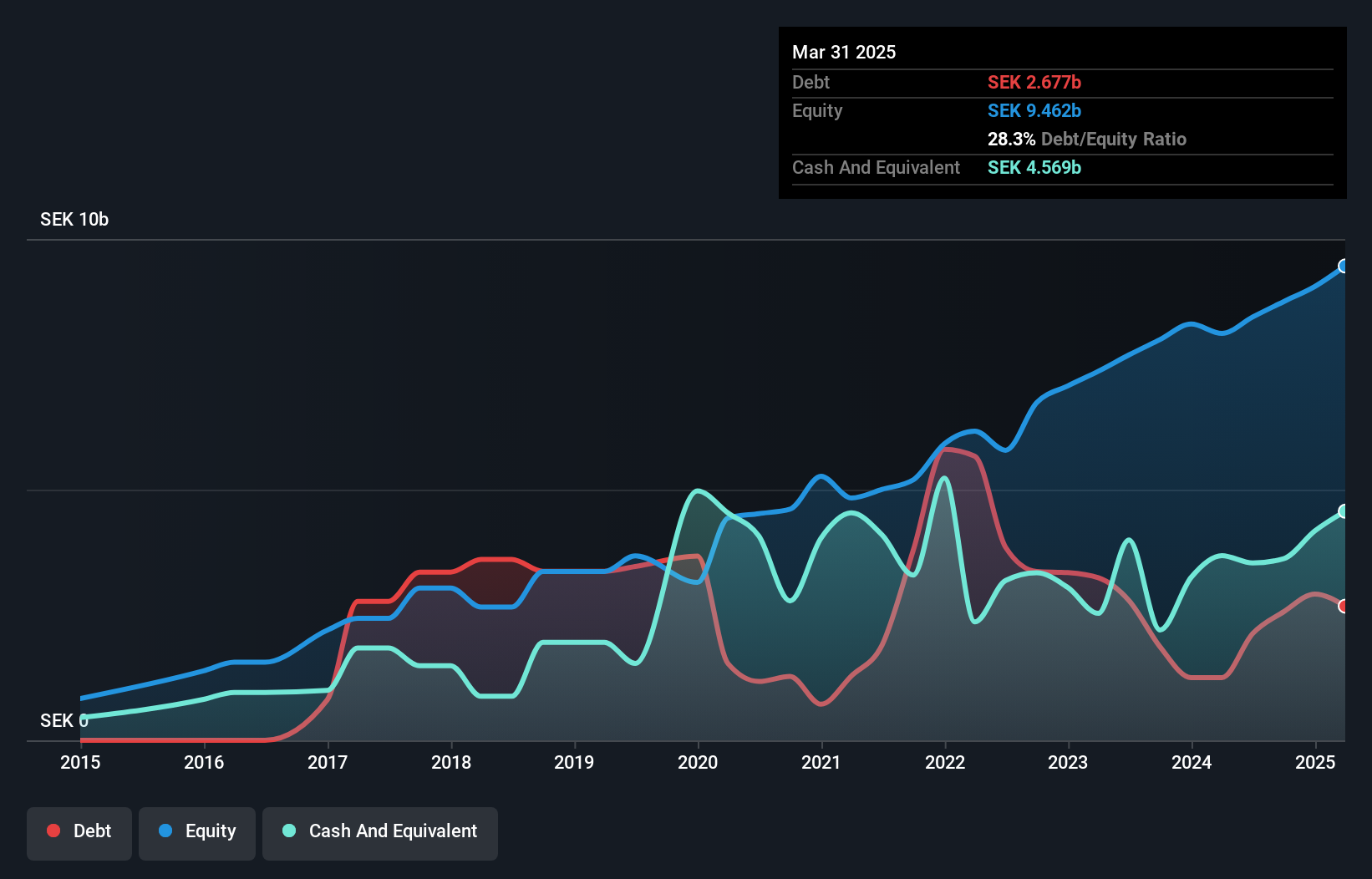

MedCap, a nimble player in the life sciences sector, showcases strong financial health with its debt to equity ratio dropping from 50.4% to 5.7% over five years. The company boasts high-quality earnings and has outpaced industry growth, with earnings rising by 20.4% last year compared to the industry's 15.4%. Trading at a discount of 27.4% below estimated fair value, MedCap's revenue climbed from SEK 1,603.8 million to SEK 1,842 million year-on-year while net income increased from SEK 172.2 million to SEK 207.4 million, reflecting robust performance despite recent share price volatility.

- Get an in-depth perspective on MedCap's performance by reading our health report here.

Assess MedCap's past performance with our detailed historical performance reports.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) offers financial solutions to medium-sized corporates, real estate companies, merchants, and private individuals across several countries including Sweden, Germany, Norway, Denmark, and Finland with a market cap of approximately SEK7.48 billion.

Operations: Norion Bank derives its revenue primarily from the Real Estate segment, contributing SEK1.15 billion, followed by Consumer and Corporate segments at SEK908 million and SEK766 million, respectively. The Payments segment adds another SEK505 million to the revenue stream.

Norion Bank, a smaller player in the European banking scene, offers an intriguing mix of strengths and challenges. With total assets at SEK67.2B and equity of SEK9.1B, it shows a solid foundation supported by SEK53.0B in deposits against SEK50.3B in loans. The bank's earnings grew 1.1% last year, outpacing the industry average of -0.7%, while trading at 79% below its estimated fair value suggests potential undervaluation opportunities for investors seeking bargains. However, with high non-performing loans at 21% and low bad loan allowances (47%), risk management remains a concern despite primarily low-risk funding sources making up 91% of liabilities.

Taking Advantage

- Click this link to deep-dive into the 347 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CNDF

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société cooperative provides banking products and financial services in France.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives