- Sweden

- /

- Entertainment

- /

- OM:SF

Stillfront Group (STO:SF investor three-year losses grow to 84% as the stock sheds kr554m this past week

It is doubtless a positive to see that the Stillfront Group AB (publ) (STO:SF) share price has gained some 31% in the last three months. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 86% in that time. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 8.1% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Stillfront Group

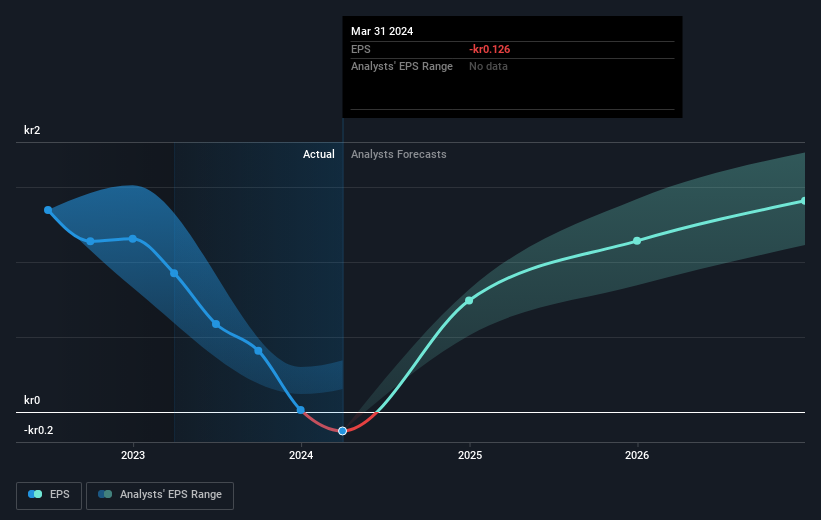

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Stillfront Group saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Stillfront Group shareholders are down 38% for the year, but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Stillfront Group better, we need to consider many other factors. Take risks, for example - Stillfront Group has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

If you're looking to trade Stillfront Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SF

Stillfront Group

Designs, develops, markets, publishes, and sells digital games in Europe, North America, the United Kingdom, and the Middle East and North Africa region.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives