- Sweden

- /

- Entertainment

- /

- OM:FLEXM

The Flexion Mobile (STO:FLEXM) Share Price Is Up 159% And Shareholders Are Boasting About It

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Flexion Mobile Plc (STO:FLEXM) share price has soared 159% in the last year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 18% over the last quarter. We'll need to follow Flexion Mobile for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Flexion Mobile

Given that Flexion Mobile didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Flexion Mobile grew its revenue by 113% last year. That's stonking growth even when compared to other loss-making stocks. And the share price has responded, gaining 159% as we previously mentioned. It's great to see strong revenue growth, but the question is whether it can be sustained. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

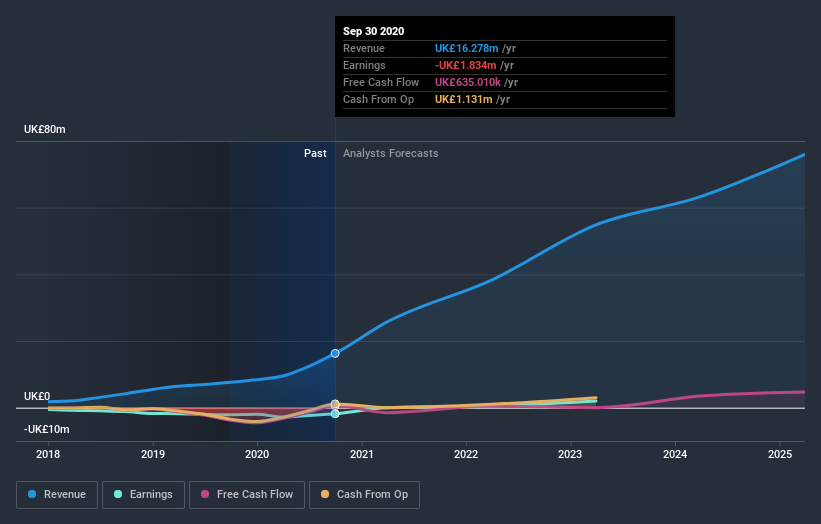

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Flexion Mobile's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Flexion Mobile boasts a total shareholder return of 159% for the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 18%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Flexion Mobile you should be aware of.

But note: Flexion Mobile may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Flexion Mobile, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:FLEXM

Flexion Mobile

Operates game distribution platform for game developers worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026