As European markets navigate the turbulence of escalating trade tensions and economic uncertainties, investors are increasingly focused on stability and income generation. In this environment, dividend stocks can offer a reliable stream of income, making them an attractive consideration for those looking to mitigate risk while potentially benefiting from steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.39% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.89% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.67% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.17% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.56% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.54% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CaixaBank (BME:CABK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CaixaBank, S.A. is a financial institution offering a range of banking products and services in Spain and internationally, with a market cap of approximately €47.59 billion.

Operations: CaixaBank's revenue is primarily derived from its Banking segment, which includes non-core real estate, generating €11.21 billion, followed by contributions from Insurance at €1.82 billion and the Portuguese Investment Bank (BPI) at €1.23 billion, with a smaller portion coming from the Corporate Center at €167 million.

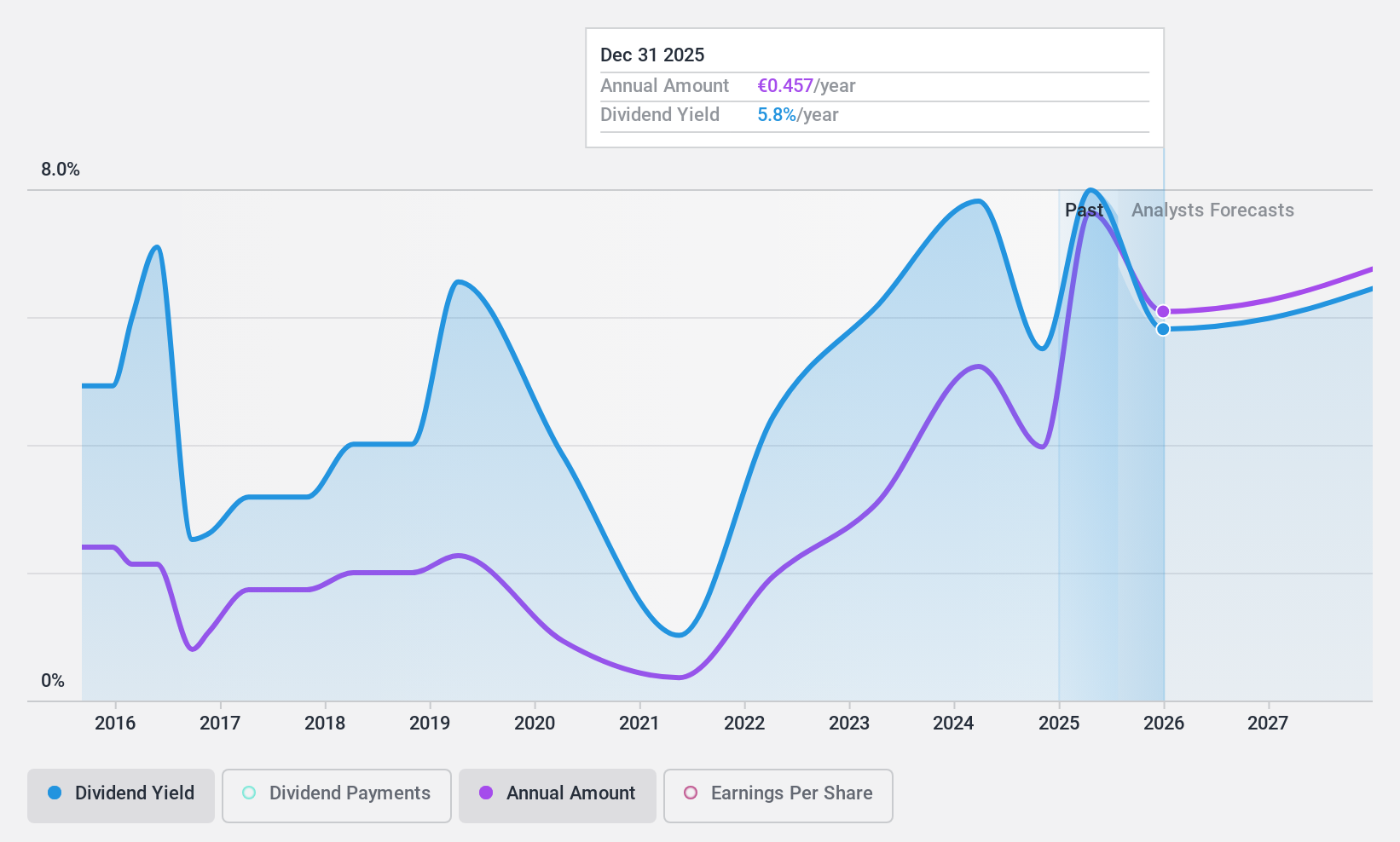

Dividend Yield: 8.6%

CaixaBank's dividend yield is among the top 25% in Spain, supported by a reasonable payout ratio of 57.3%, indicating coverage by earnings. Despite this, its dividend history has been volatile and unreliable over the past decade, with periods of growth but also significant drops. Recent earnings growth and a €998.8 million fixed-income offering could support future payouts; however, the high level of bad loans at 2.6% poses a risk to sustainability.

- Unlock comprehensive insights into our analysis of CaixaBank stock in this dividend report.

- Our valuation report here indicates CaixaBank may be undervalued.

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avanza Bank Holding AB (publ) operates in Sweden, providing savings, pension, and mortgage products through its subsidiaries, with a market capitalization of approximately SEK48.84 billion.

Operations: Avanza Bank Holding AB (publ) generates revenue primarily from its commercial operations, totaling SEK4.29 billion.

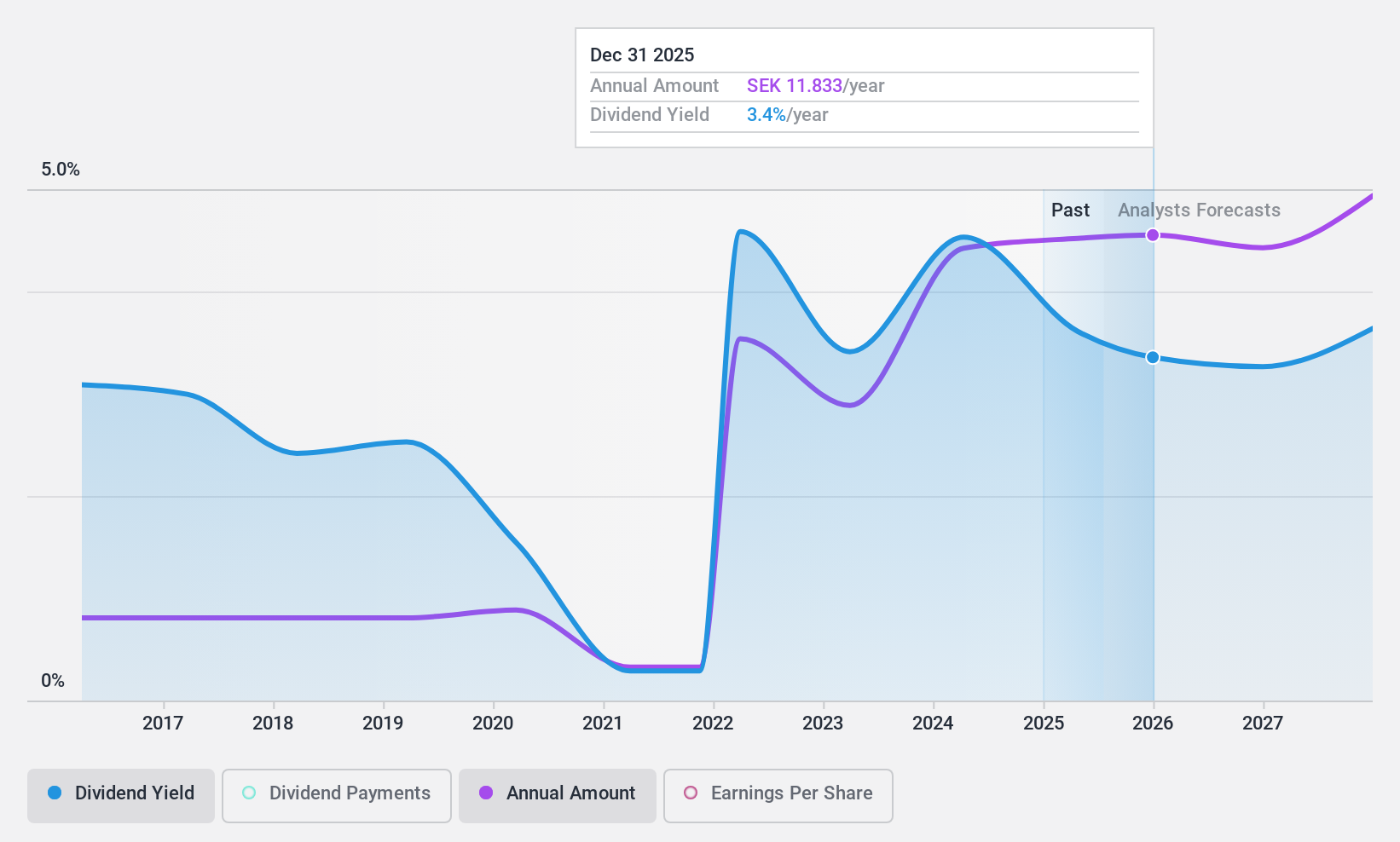

Dividend Yield: 3.8%

Avanza Bank Holding's dividend yield of 3.78% is below the top 25% in Sweden, yet its payout ratio of 82% indicates coverage by earnings, and a cash payout ratio of 46.8% suggests strong cash flow support. Despite past volatility in dividends, recent earnings growth—net income rose to SEK 707 million in Q1 2025—could stabilize future payouts. However, executive changes may influence strategic directions impacting dividend reliability.

- Click here to discover the nuances of Avanza Bank Holding with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Avanza Bank Holding's share price might be too optimistic.

SSAB (OM:SSAB A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SSAB AB (publ) is a company involved in the production and sale of steel products across Sweden, Finland, the United States, Europe, and internationally with a market capitalization of approximately SEK58.35 billion.

Operations: SSAB AB (publ) generates revenue from several segments, including SSAB Europe with SEK41.79 billion, SSAB Americas at SEK22.71 billion, SSAB Special Steels contributing SEK28.79 billion, Tibnor at SEK12.07 billion, and Ruukki Construction with SEK5.51 billion in revenue.

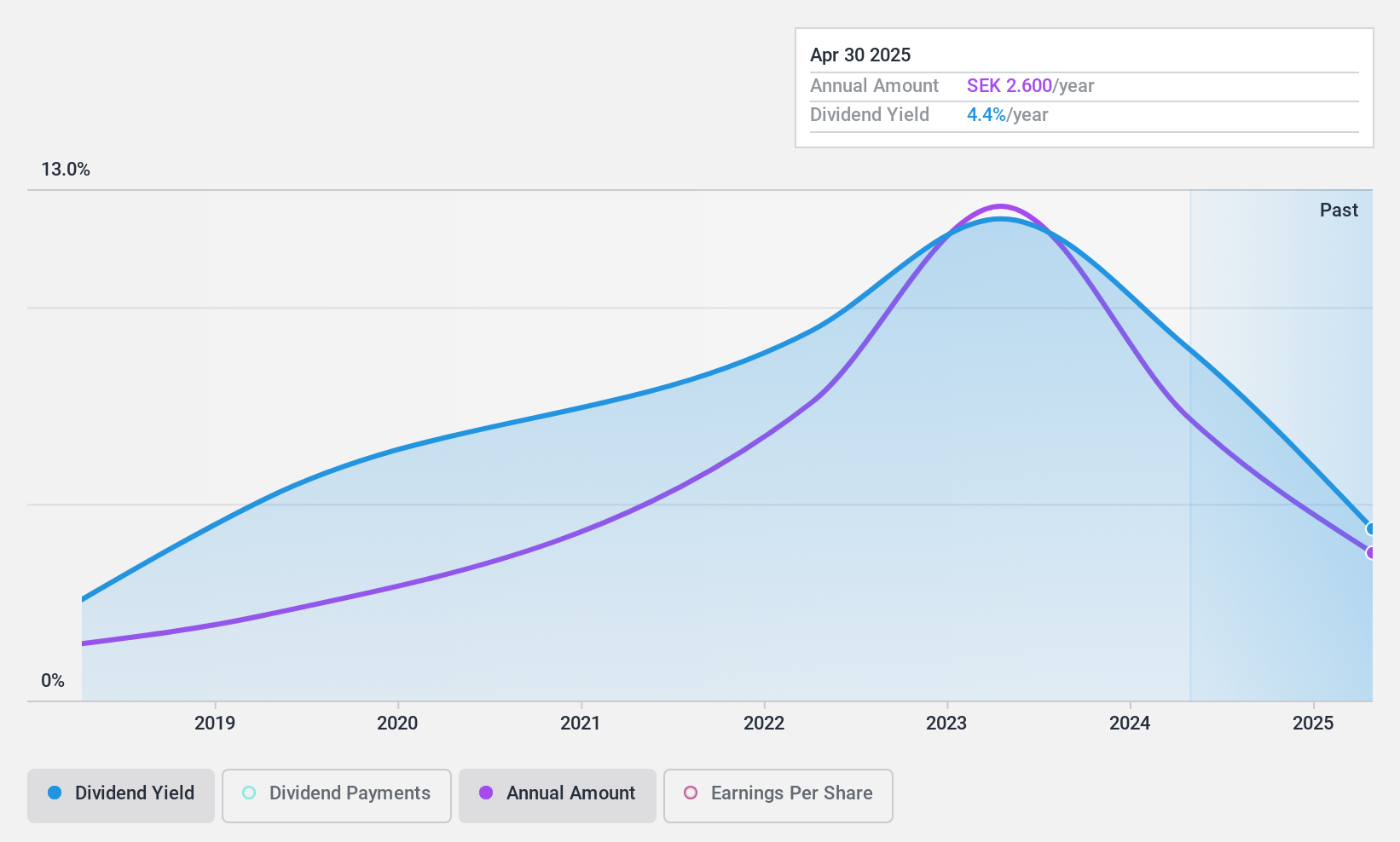

Dividend Yield: 4.4%

SSAB's dividend yield of 4.41% is among the top 25% in Sweden, with a payout ratio of 39.8% ensuring coverage by earnings, and cash flow support at a cash payout ratio of 70.4%. Despite recent reductions in dividends to SEK 2.60 per share due to lower net income, strategic partnerships like the one with Toyota for SSAB Zero™ steel indicate potential future growth avenues. Recent executive changes may impact strategic focus and dividend stability moving forward.

- Click to explore a detailed breakdown of our findings in SSAB's dividend report.

- The analysis detailed in our SSAB valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Explore the 237 names from our Top European Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CABK

CaixaBank

Provides various banking products and financial services in Spain and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives