- Sweden

- /

- Paper and Forestry Products

- /

- OM:RROS

Is Now The Time To Put Rottneros (STO:RROS) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Rottneros (STO:RROS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Rottneros

Rottneros' Improving Profits

In the last three years Rottneros' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. In previous twelve months, Rottneros' EPS has risen from kr2.65 to kr2.82. That's a fair increase of 6.4%.

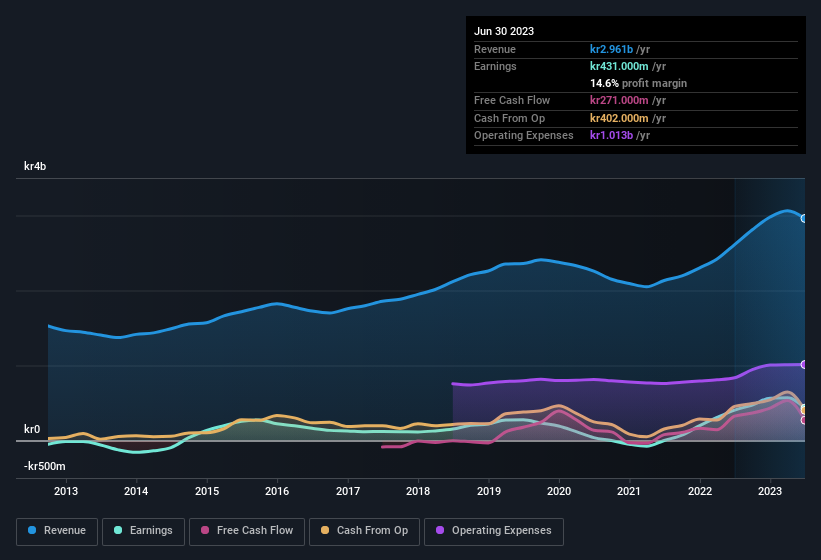

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Rottneros did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Rottneros' forecast profits?

Are Rottneros Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Rottneros shares, in the last year. With that in mind, it's heartening that Kasper Skuthalla, the Marketing & Business Development Director of the company, paid kr367k for shares at around kr13.36 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Should You Add Rottneros To Your Watchlist?

As previously touched on, Rottneros is a growing business, which is encouraging. It's not easy for business to grow EPS, but Rottneros has shown the strengths to do just that. Despite there being a solitary insider adding to their holdings, it's enough to consider adding this to the watchlist. Before you take the next step you should know about the 2 warning signs for Rottneros (1 shouldn't be ignored!) that we have uncovered.

The good news is that Rottneros is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RROS

Rottneros

Develops and produces chemical and mechanical market pulp worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives