HEXPOL AB (publ)'s (STO:HPOL B) dividend will be increasing from last year's payment of the same period to SEK6.00 on 6th of May. The payment will take the dividend yield to 2.9%, which is in line with the average for the industry.

View our latest analysis for HEXPOL

HEXPOL's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. The last dividend was quite easily covered by HEXPOL's earnings. This means that a large portion of its earnings are being retained to grow the business.

EPS is set to grow by 12.1% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 82%, which is on the higher side, but certainly still feasible.

HEXPOL Has A Solid Track Record

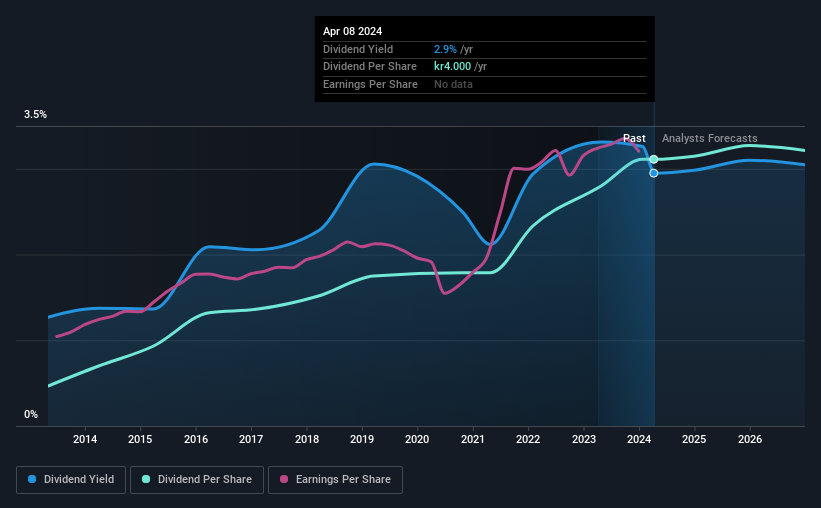

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of SEK0.60 in 2014 to the most recent total annual payment of SEK4.00. This implies that the company grew its distributions at a yearly rate of about 21% over that duration. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

We Could See HEXPOL's Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. HEXPOL has impressed us by growing EPS at 8.9% per year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

We Really Like HEXPOL's Dividend

Overall, a dividend increase is always good, and we think that HEXPOL is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 6 HEXPOL analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Is HEXPOL not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HPOL B

HEXPOL

Engages in development, manufacture, and sale of various polymer compounds and engineered products in Sweden, Europe, the Americas, and Asia.

Undervalued with excellent balance sheet and pays a dividend.