- Sweden

- /

- Metals and Mining

- /

- OM:GRNG

Gränges (OM:GRNG) Margin Decline Challenges Bullish Growth Narrative Despite Strong Earnings Track Record

Reviewed by Simply Wall St

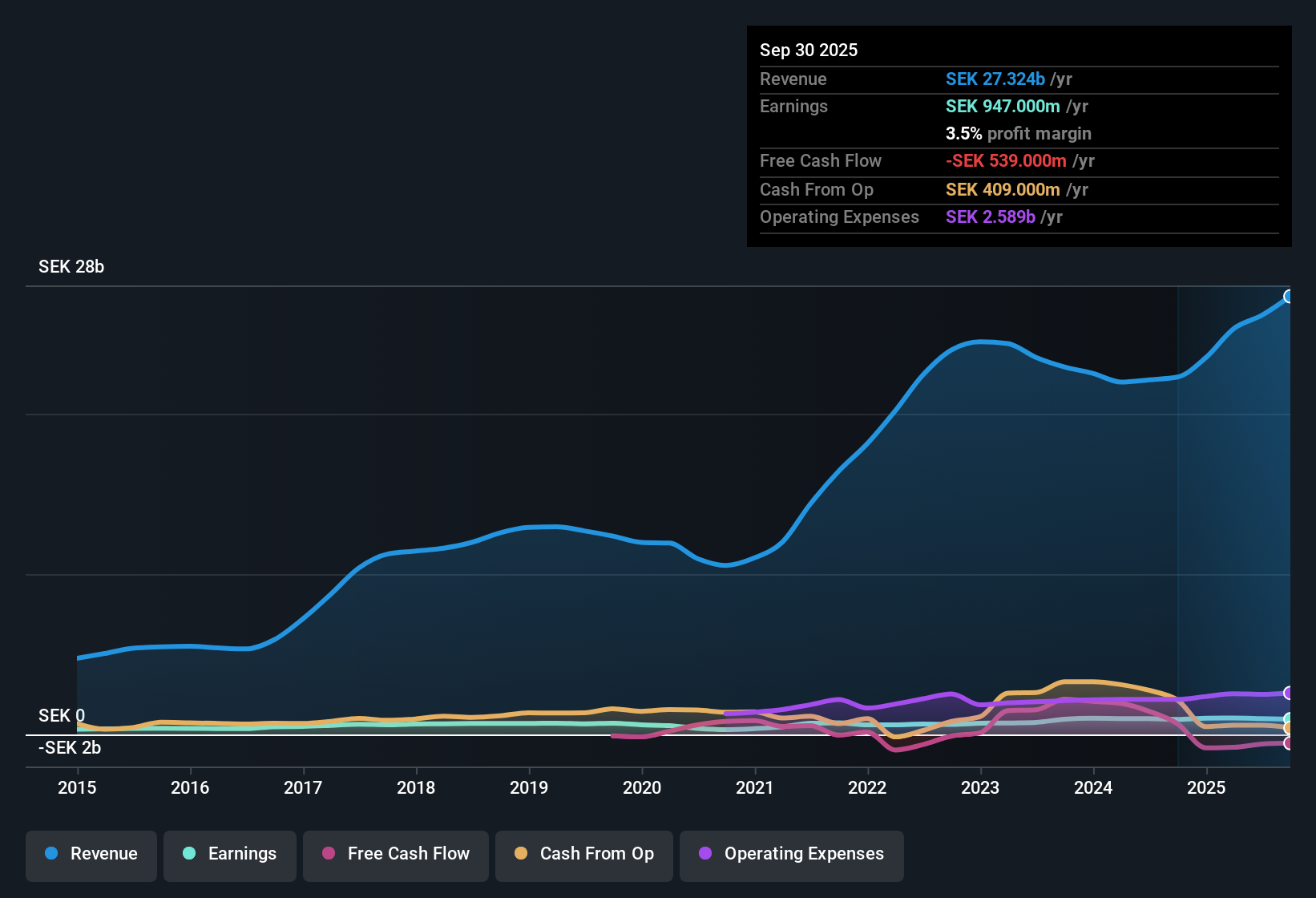

Gränges (OM:GRNG) has posted a strong set of numbers, with earnings growing at 18.7% per year over the last five years, and analysts forecasting a continued pace of 18.4% annual earnings growth. This is well ahead of the broader Swedish market’s 12.3% outlook. Revenue is expected to rise by 6.4% per year, outstripping the Swedish average of 3.6%. Net profit margins currently sit at 3.8%, a dip from last year’s 4.5%, giving investors something to watch even as both growth and value narratives look favorable.

See our full analysis for Gränges.Next up, we’re putting the latest figures side by side with the community’s most widely held narratives to see where the story remains consistent and where it might get challenged.

See what the community is saying about Gränges

DCF Fair Value at Nearly Triple the Share Price

- With a DCF fair value of SEK 338.86 and Gränges trading at SEK 133.00, the stock is at a significant discount. This raises the question of whether the market is overlooking its future earnings potential.

- The analysts' consensus view highlights high-quality earnings growth, profitability trends, and an undervalued price relative to expectations:

- Forecasted earnings growth of 18.4% per year surpasses the Swedish market's 12.3% projection and places Gränges well above industry averages in terms of growth potential.

- Strong sales expansion in Asia supports future revenue. However, the recent margin dip to 3.8% prompts investors to consider whether improving market share will translate into persistent profit growth.

Margin Pressure Despite Regional Expansion

- Net profit margin stands at 3.8%, down from 4.5% last year, as Gränges manages production costs amid rapid growth in new markets such as Asia.

- According to the analysts' consensus view, Gränges' swift ramp-up of the Shandong facility and regional production moves are expected to eventually lift margins. However, the current lower level suggests that improvements in product mix and cost discipline are not yet fully reflected:

- The breakeven point at Shandong shows the new capacity is operational, but it is not yet a significant margin driver.

- Ongoing expansion may enhance profitability if Gränges succeeds in increasing recycled aluminum use and implementing sustainability initiatives.

Dividend Sustainability Raises Questions

- Dividend sustainability remains the primary risk identified, with the only material concern highlighted by analysts centering on whether cash flows can keep pace with current payouts as Gränges manages heavy capital spending and thinner margins.

- The analysts' consensus narrative points out this risk, particularly as revenue and earnings grow but capital expenditures remain elevated:

- Continued high investment in new facilities means near-term cash flows must be carefully monitored to ensure dividends remain reliable.

- Consensus expects margin improvement over the next three years to support dividend commitments. However, investors may need to track progress closely as profitability trends develop.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gränges on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different take on the data? Put your view together in just a few minutes and shape your own story. Do it your way

A great starting point for your Gränges research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Gränges is forecast to grow, shrinking margins and questions over dividend sustainability create some uncertainty about its ability to turn expansion into dependable returns.

If reliable income matters most to you, discover companies with a proven track record of sustained dividends and yield by checking out these 1979 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GRNG

Gränges

Engages in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications in Asia Pacific, Europe, and North and South Americas.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)