It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Boliden (STO:BOL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Boliden

Boliden's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Boliden has managed to grow EPS by 23% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

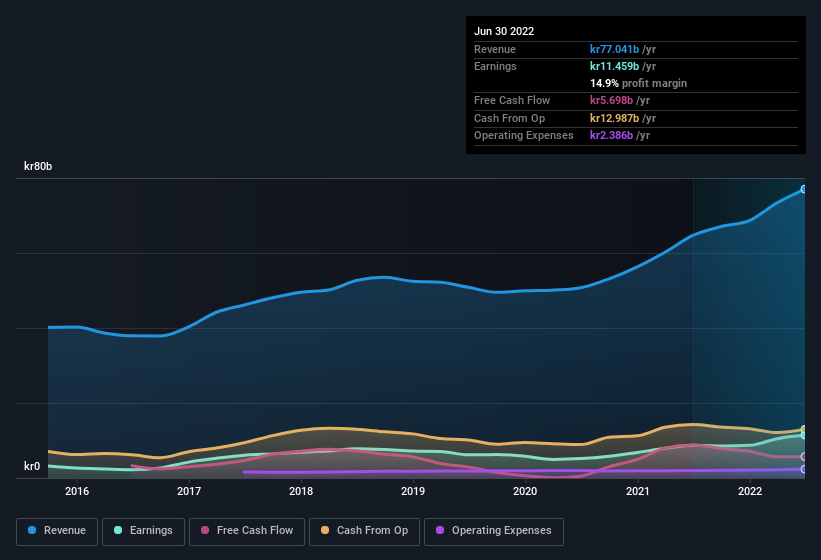

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Boliden achieved similar EBIT margins to last year, revenue grew by a solid 19% to kr77b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Boliden's future EPS 100% free.

Are Boliden Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Boliden were both selling and buying shares; but happily, as a group they spent kr1.6m more on stock, than they netted from selling it. Shareholders who may have questioned insiders selling will find some reassurance in this fact. We also note that it was the President & CEO, Mikael Staffas, who made the biggest single acquisition, paying kr794k for shares at about kr397 each.

It's reassuring that Boliden insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Boliden, with market caps between kr42b and kr127b, is around kr23m.

Boliden offered total compensation worth kr16m to its CEO in the year to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Boliden Worth Keeping An Eye On?

For growth investors, Boliden's raw rate of earnings growth is a beacon in the night. To add to the positives, Boliden has recorded instances of insider buying and a modest executive pay to boot. On balance the message seems to be that this stock is worth looking at, at least for a while. Still, you should learn about the 2 warning signs we've spotted with Boliden (including 1 which can't be ignored).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Boliden, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives