- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Boliden's (OM:BOL) Withdrawal from Swedish JV Raises Questions About Its Exploration Strategy

Reviewed by Simply Wall St

- In August 2025, District Metals Corp. announced that Boliden Mineral AB decided to terminate its earn-in and joint venture agreement on the Tomtebo and Stollberg base metal properties in Sweden, originally signed in October 2023. This development means Boliden steps back from exploration exposure in the Bergslagen Mining District, potentially shifting how its Scandinavian resource pipeline is viewed.

- We'll examine what Boliden's withdrawal from these Swedish properties could mean for the company's project pipeline and long-term growth outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Boliden Investment Narrative Recap

To invest in Boliden, you need to believe in the company's ability to successfully grow its integrated mining and smelting operations, capitalize on demand for low-carbon metals, and manage cost inflation, operational risks, and environmental compliance. Boliden's exit from the Tomtebo and Stollberg joint venture is a minor event relative to the near-term catalysts guiding the company's outlook, namely the integration of recent acquisitions and completion of smelter expansions; the impact on short-term growth drivers is not material. Of recent announcements, the EU’s regulatory approval for Boliden’s acquisitions of Neves-Corvo and Zinkgruvan in April 2025 is most relevant to project pipeline discussion. These assets, which immediately lift production volumes, support the company's major growth catalyst and may offset any perceived loss of exploration opportunity from the terminated Swedish agreements. But, contrasting with the positive integration theme, investors should also be aware of ongoing risks tied to the company’s increased debt and...

Read the full narrative on Boliden (it's free!)

Boliden's outlook anticipates SEK108.9 billion in revenue and SEK10.8 billion in earnings by 2028. This scenario assumes a 6.0% annual revenue growth rate and a SEK2.8 billion increase in earnings from the current SEK8.0 billion.

Uncover how Boliden's forecasts yield a SEK310.07 fair value, a 7% downside to its current price.

Exploring Other Perspectives

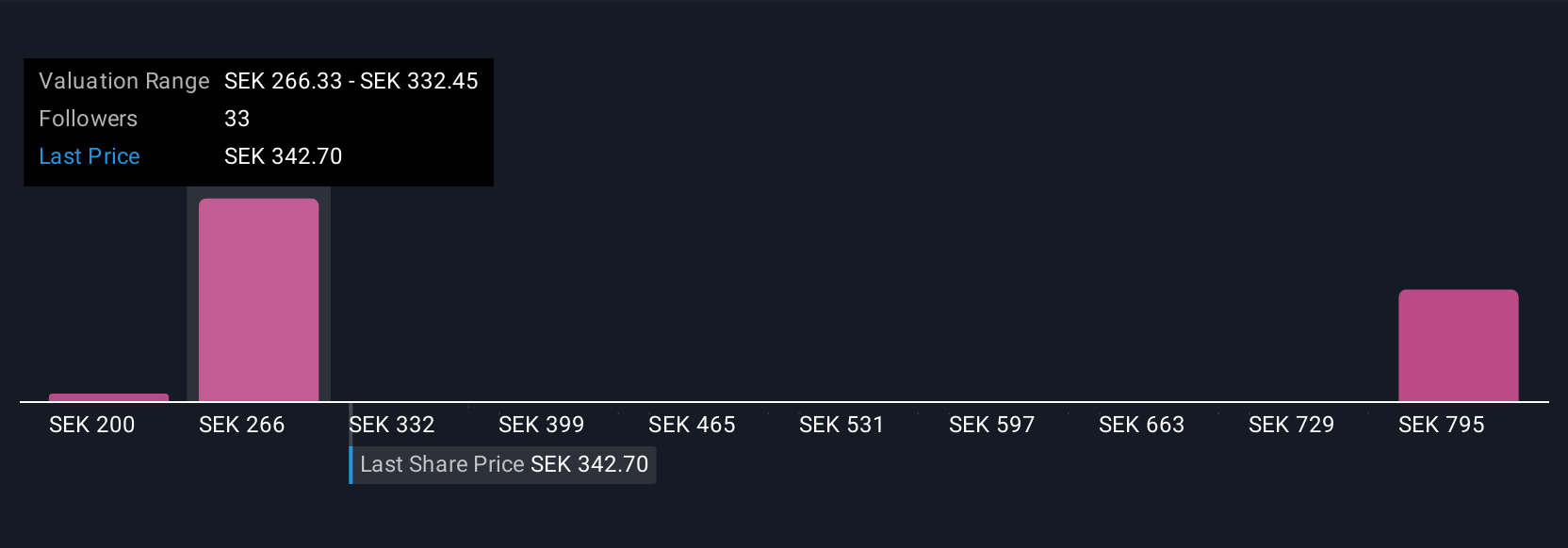

Six Simply Wall St Community members submitted fair value estimates for Boliden, ranging widely from SEK 200.20 to SEK 730.70. With such diverging forecasts, remember the company faces increased debt following expansions, which could affect its ability to invest or weather downturns, so be sure to compare how different market participants weigh these challenges.

Explore 6 other fair value estimates on Boliden - why the stock might be worth over 2x more than the current price!

Build Your Own Boliden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boliden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boliden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boliden's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives