- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Boliden (OM:BOL) Valuation Spotlight After Strategic Shift in Swedish Exploration Partnerships

Reviewed by Simply Wall St

Boliden (OM:BOL) just made a strategic move that is sure to catch the eye of investors watching the Nordic mining sector. The company has decided to pull out of its earn-in and joint venture agreement with District Metals Corp. on the Tomtebo and Stollberg base metal properties in southern Sweden. While Boliden gives up the option to earn a majority stake in Tomtebo, it walks away with 100% control over Stollberg, reshaping both companies’ exploration footprints. The shift hints at a reassessment of priorities in Boliden’s Swedish exploration strategy, which could have implications for its future pipeline and risk profile.

Viewed in the context of recent performance, this decision comes as Boliden’s share price has moved up 14% over the past year, with momentum gathering pace in the past three months. The broader trend has been one of modest gains in recent years, but the stock’s latest moves suggest investors may be rethinking expectations for growth and strategic direction. With annual revenue growth at 6% and net income jumping by 15%, operational execution appears solid even as management adjusts its exploration bets.

After this year’s steady climb, the key question for investors is whether Boliden’s valuation still offers upside, or if the latest share price already reflects the market’s confidence in its future growth.

Most Popular Narrative: 7.4% Overvalued

The most widely followed narrative suggests that Boliden is somewhat overvalued relative to the company’s projected earnings and revenue growth, based on the consensus analyst estimates and a discount rate of 5.9%.

“The Odda green zinc smelter expansion is on track with ramp-up in H2 2025 and full contribution expected in 2026, leveraging stricter environmental standards and demand for low-carbon metals in Europe; this should improve both revenue growth and net margins due to potential premium pricing.”

Curious what’s fueling this hot valuation debate? The underlying assumptions hinge on bold forecasts, including future profits, expanding margins, and industry-defining project timelines. Want to see the vital financial pieces that underpin this pricing puzzle? Unravel the logic and discover the analytical engine driving these expectations.

Result: Fair Value of $310.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent lower grades at key assets or an unexpected drop in metal prices could quickly challenge the current growth outlook for Boliden.

Find out about the key risks to this Boliden narrative.Another View: Discounted Cash Flow Model

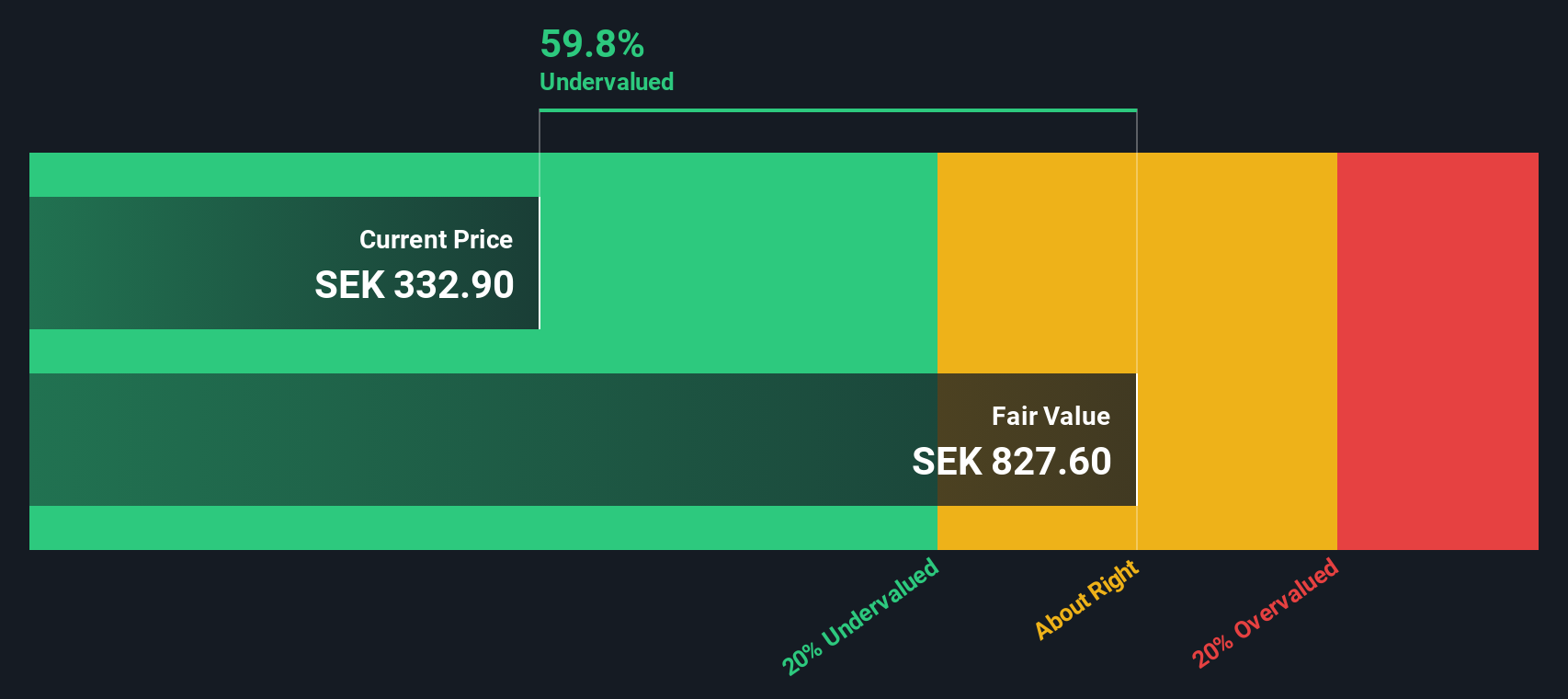

While analysts suggest Boliden could be overvalued based on future earnings, our DCF model paints a very different picture. The model indicates the shares may be trading below what long-term cash flows are worth. Which approach better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boliden Narrative

If you see things differently or would rather rely on your own analysis of the numbers, you can easily craft your own perspective in just minutes. Do it your way

A great starting point for your Boliden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with Boliden? Arm yourself with fresh investing angles that others might overlook by tapping into these unique opportunities right now. Your next outperformer could be a click away.

- Spot tomorrow’s leaders early and seize the chance to back penny stocks with strong financials by checking out penny stocks with strong financials.

- Ride the AI innovation wave as you uncover companies revolutionizing sectors. Get started with our list of AI penny stocks.

- Build real value into your portfolio by zeroing in on undervalued stocks based on their cash flows using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives