- Sweden

- /

- Household Products

- /

- OM:ESSITY B

Essity AB (publ)'s (STO:ESSITY B) Share Price Matching Investor Opinion

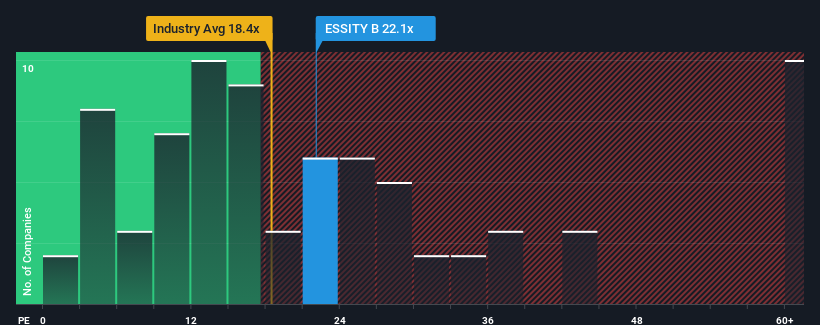

It's not a stretch to say that Essity AB (publ)'s (STO:ESSITY B) price-to-earnings (or "P/E") ratio of 22.1x right now seems quite "middle-of-the-road" compared to the market in Sweden, where the median P/E ratio is around 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Essity has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Essity

How Is Essity's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Essity's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. Still, incredibly EPS has fallen 1.0% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 20% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is not materially different.

With this information, we can see why Essity is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Essity's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Essity you should be aware of.

If these risks are making you reconsider your opinion on Essity, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Essity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ESSITY B

Essity

Develops, produces, and sells hygiene and health products and services in Europe, North and Latin America, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives