- Sweden

- /

- Medical Equipment

- /

- OM:XVIVO

Xvivo Perfusion AB (publ) (STO:XVIVO) Stock Rockets 34% As Investors Are Less Pessimistic Than Expected

The Xvivo Perfusion AB (publ) (STO:XVIVO) share price has done very well over the last month, posting an excellent gain of 34%. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

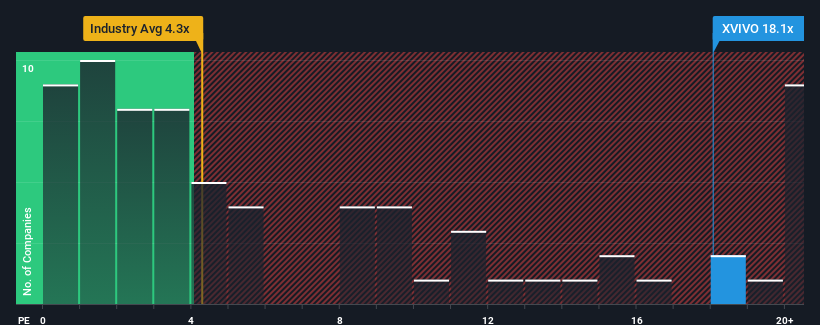

Following the firm bounce in price, Xvivo Perfusion's price-to-sales (or "P/S") ratio of 18.1x might make it look like a strong sell right now compared to other companies in the Medical Equipment industry in Sweden, where around half of the companies have P/S ratios below 4.3x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xvivo Perfusion

What Does Xvivo Perfusion's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Xvivo Perfusion has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xvivo Perfusion.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xvivo Perfusion's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. Pleasingly, revenue has also lifted 235% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 36% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 36% per annum, which is not materially different.

In light of this, it's curious that Xvivo Perfusion's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Xvivo Perfusion's P/S Mean For Investors?

The strong share price surge has lead to Xvivo Perfusion's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Xvivo Perfusion's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Plus, you should also learn about this 1 warning sign we've spotted with Xvivo Perfusion.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:XVIVO

Xvivo Perfusion

A medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives