- Sweden

- /

- Medical Equipment

- /

- OM:SUS

Is Now The Time To Put Surgical Science Sweden (STO:SUS) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Surgical Science Sweden (STO:SUS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out the opportunities and risks within the SE Medical Equipment industry.

How Fast Is Surgical Science Sweden Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Surgical Science Sweden to have grown EPS from kr0.78 to kr2.72 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

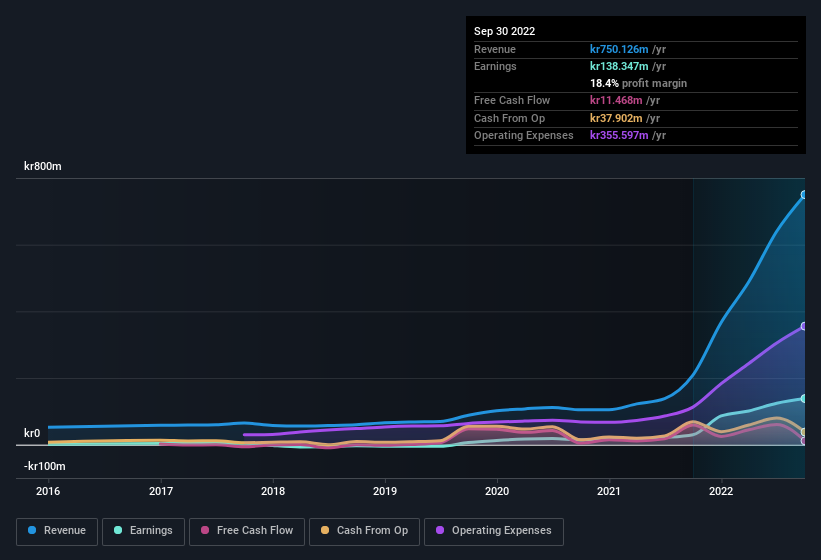

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, Surgical Science Sweden has done well over the past year, growing revenue by 259% to kr750m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Surgical Science Sweden's forecast profits?

Are Surgical Science Sweden Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Surgical Science Sweden insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at kr2.8b. This totals to 34% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Surgical Science Sweden To Your Watchlist?

Surgical Science Sweden's earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Surgical Science Sweden for a spot on your watchlist. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Surgical Science Sweden shapes up to industry peers, when it comes to ROE.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SUS

Surgical Science Sweden

Develops and markets virtual reality simulators for evidence-based medical training in Europe, North and South America, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)