- Finland

- /

- Medical Equipment

- /

- HLSE:REG1V

3 Promising Stocks Estimated To Be Up To 47.2% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and strong earnings reports, major U.S. stock indexes have rebounded, particularly favoring value stocks over growth shares. In this environment, identifying undervalued stocks becomes crucial as they may offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩18390.00 | ₩36679.19 | 49.9% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.89 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.39 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩129300.00 | ₩257307.05 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.19 | NZ$6.18 | 48.4% |

Let's uncover some gems from our specialized screener.

Revenio Group Oyj (HLSE:REG1V)

Overview: Revenio Group Oyj specializes in ophthalmological devices and software for diagnosing glaucoma, macular degeneration, and diabetic retinopathy across Finland, Europe, North America, and internationally with a market cap of €769.69 million.

Operations: The company's revenue is primarily generated from its Health Tech segment, which amounted to €102.49 million.

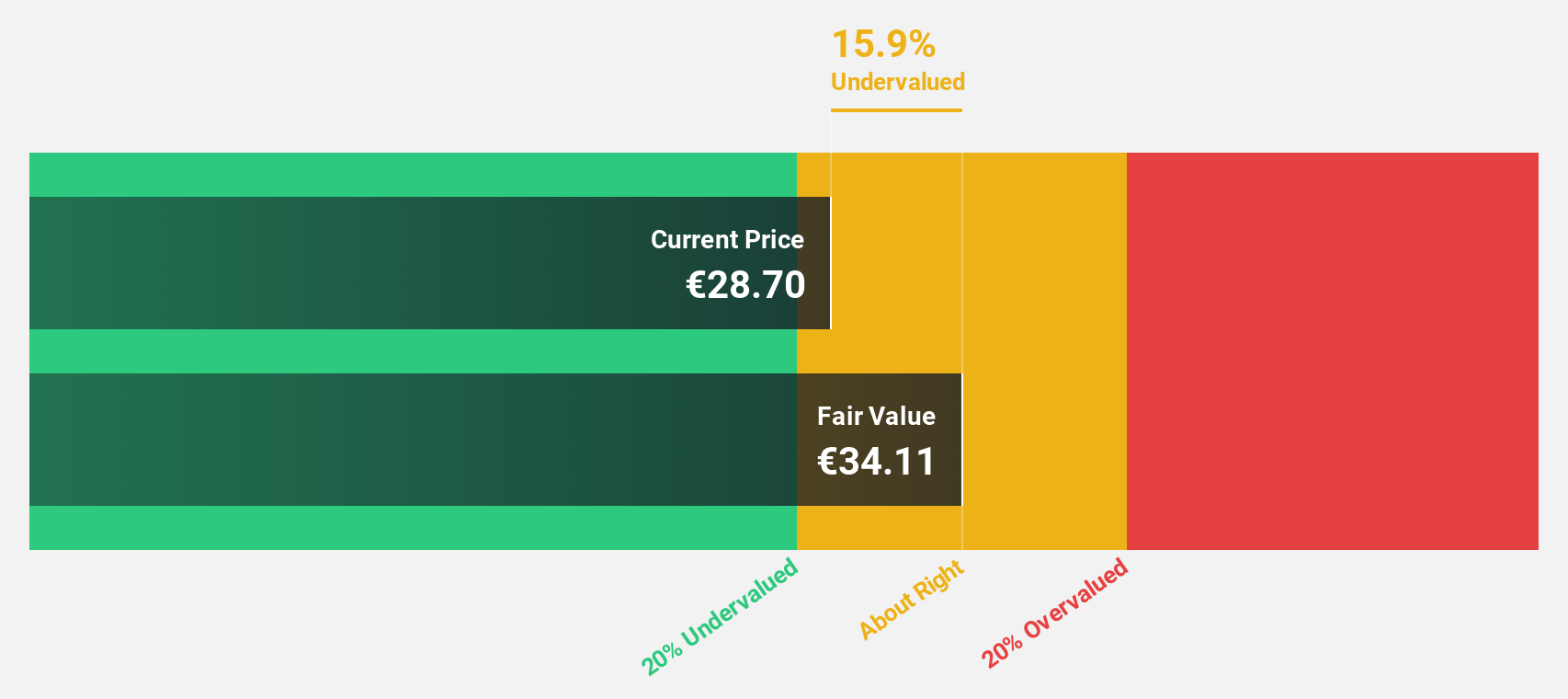

Estimated Discount To Fair Value: 36.5%

Revenio Group Oyj is trading at €28.94, significantly below its estimated fair value of €45.56, suggesting it may be undervalued based on discounted cash flow analysis. With earnings forecast to grow 18.8% annually—outpacing the Finnish market—and revenue expected to rise by 12.1% per year, the company shows strong growth potential despite recent stable net income figures and modest sales increases reported in Q3 2024 results (€23.9 million).

- Upon reviewing our latest growth report, Revenio Group Oyj's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Revenio Group Oyj's balance sheet by reading our health report here.

Surgical Science Sweden (OM:SUS)

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of SEK8.93 billion.

Operations: The company generates revenue from Industry/OEM at SEK419.66 million and Educational Products at SEK440.17 million.

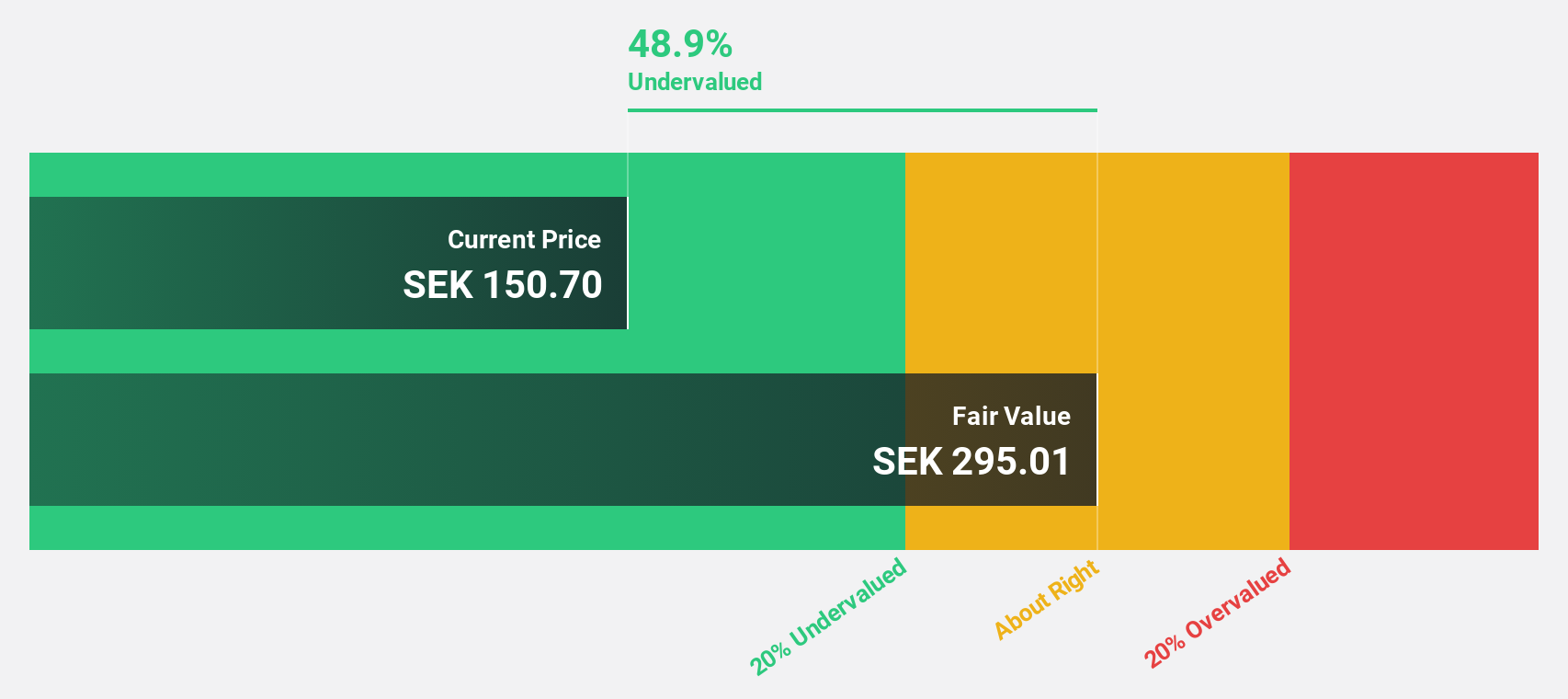

Estimated Discount To Fair Value: 47.2%

Surgical Science Sweden, trading at SEK175, is significantly undervalued with a fair value estimate of SEK331.54 based on discounted cash flow analysis. The company's earnings are projected to grow 36.1% annually, surpassing the Swedish market's growth rate. Recent developments include a strengthened collaboration with Intuitive for its da Vinci 5 systems and an acquisition agreement with Intelligent Ultrasound Group plc, indicating strategic expansion efforts despite recent dips in quarterly net income and sales figures.

- Insights from our recent growth report point to a promising forecast for Surgical Science Sweden's business outlook.

- Take a closer look at Surgical Science Sweden's balance sheet health here in our report.

NagaCorp (SEHK:3918)

Overview: NagaCorp Ltd. is an investment holding company that manages and operates a hotel and casino complex in Cambodia, with a market cap of HK$13 billion.

Operations: The company's revenue primarily comes from casino operations, generating $545.61 million, complemented by hotel and entertainment operations contributing $23.22 million.

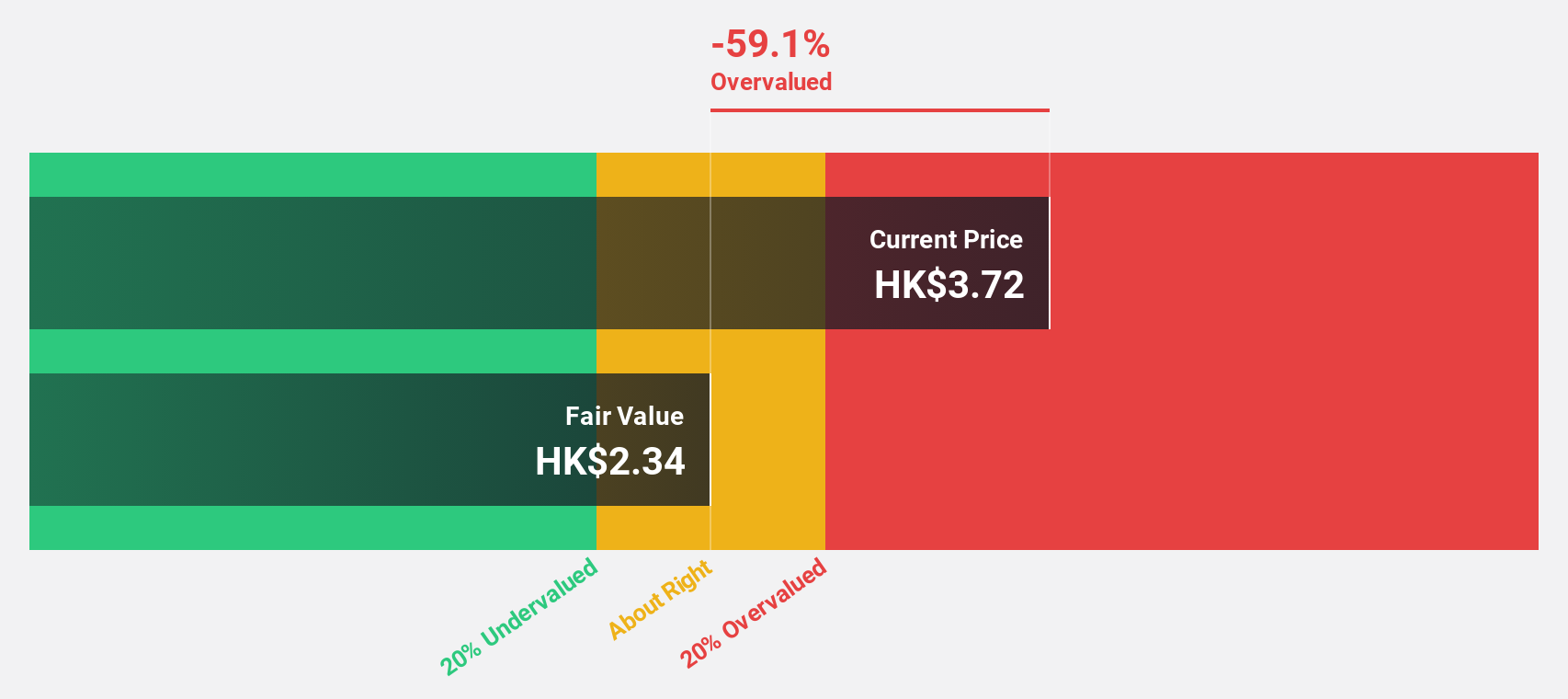

Estimated Discount To Fair Value: 17.3%

NagaCorp, trading at HK$2.94, is undervalued with a fair value estimate of HK$3.56 based on discounted cash flow analysis. Earnings are forecast to grow significantly at 42.5% annually, outpacing the Hong Kong market's growth rate of 11.2%. Despite lower profit margins compared to last year and large one-off items impacting results, revenue growth exceeds the market average. Recent board changes include Ms. Monica Lam's transition from company secretary to non-executive director.

- Our expertly prepared growth report on NagaCorp implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in NagaCorp's balance sheet health report.

Turning Ideas Into Actions

- Discover the full array of 875 Undervalued Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:REG1V

Revenio Group Oyj

Provides ophthalmological devices and software solutions for the diagnosis of glaucoma, macular degeneration, and diabetic retinopathy in Finland, rest of Europe, North America, and internationally.

Flawless balance sheet with reasonable growth potential.