As global markets experience heightened volatility and economic uncertainties, the Swedish market has shown resilience, attracting attention for its stable growth prospects. In this climate, identifying companies with strong insider ownership can be a key indicator of confidence and long-term potential.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| Biovica International (OM:BIOVIC B) | 18.8% | 73.1% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's take a closer look at a couple of our picks from the screened companies.

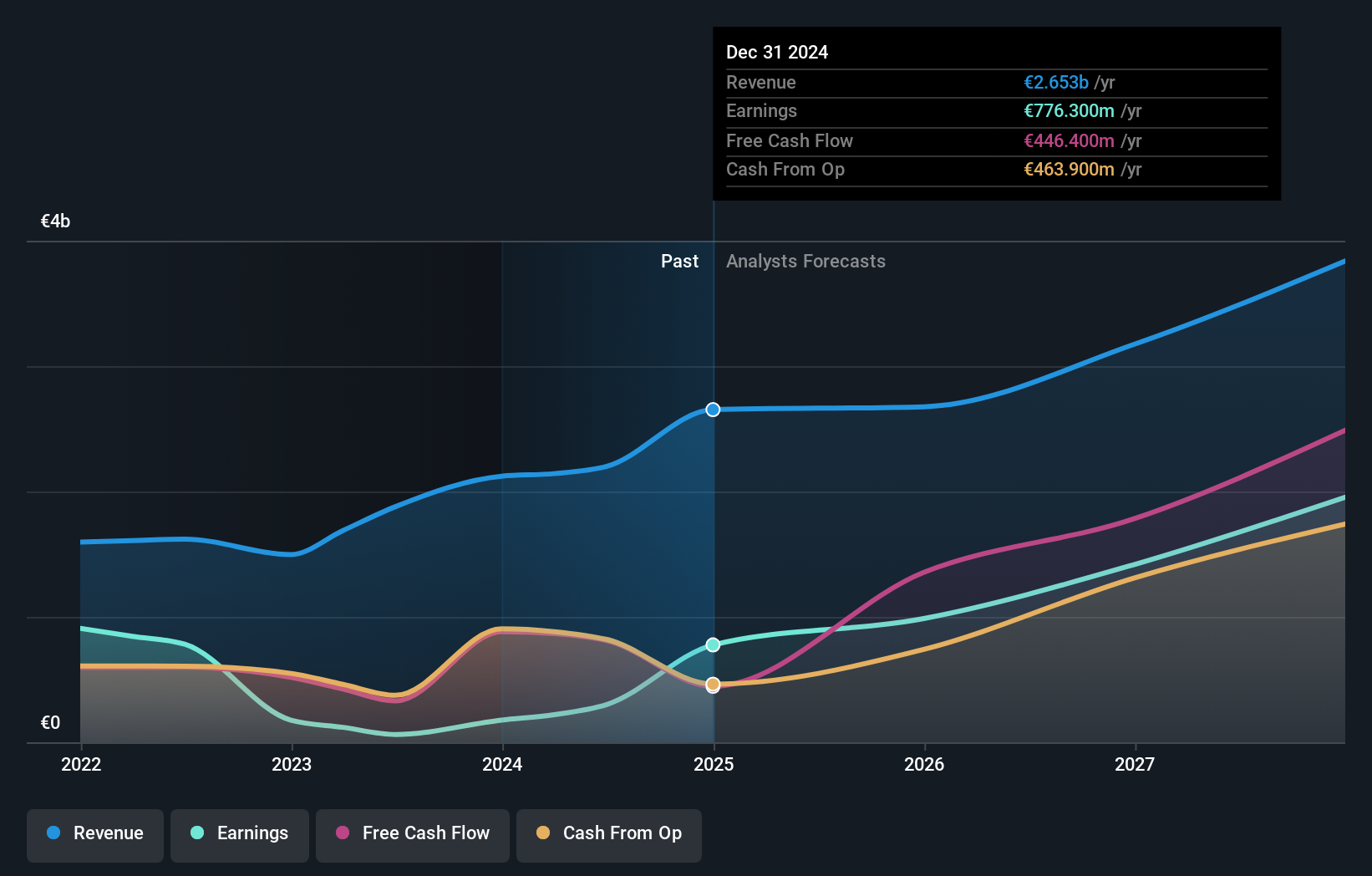

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments with a market cap of SEK399.29 billion.

Operations: The company's revenue segments include Central (€37.20 million), Real Assets (€878.70 million), and Private Capital (€1.28 billion).

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.9% p.a.

EQT AB (publ) is a prominent growth company in Sweden with significant insider ownership. The firm has been active in M&A, recently emerging as a contender for multiple acquisitions including Singapore Post's Australian business and GeBBS Healthcare Solutions. Despite some insider selling, EQT's earnings are forecast to grow at 35.9% annually, outpacing the Swedish market. Recent half-year results showed revenue of €1.23 billion and net income of €282 million, reflecting substantial profit growth from the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of EQT.

- Insights from our recent valuation report point to the potential overvaluation of EQT shares in the market.

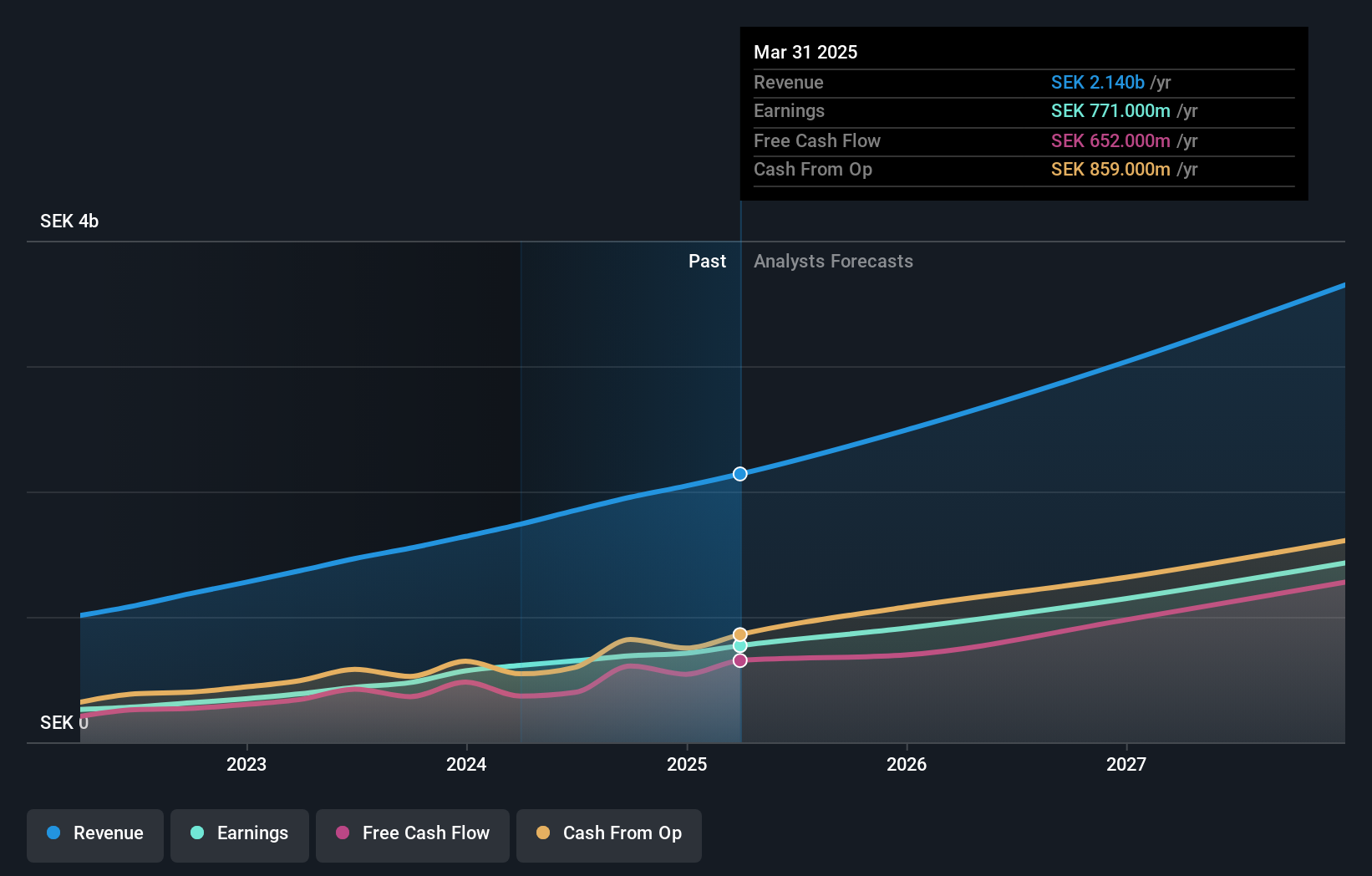

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK37.27 billion.

Operations: The company's revenue segments include Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

Insider Ownership: 21.1%

Earnings Growth Forecast: 22.6% p.a.

Fortnox AB is a key growth company in Sweden with substantial insider ownership. Earnings are forecast to grow 22.6% annually, significantly outpacing the Swedish market's 15.3%. Recent results showed strong performance, with Q2 revenue at SEK 521 million and net income at SEK 164 million, up from SEK 413 million and SEK 127 million respectively the previous year. Insiders have been buying more shares recently, indicating confidence in future growth prospects.

- Unlock comprehensive insights into our analysis of Fortnox stock in this growth report.

- In light of our recent valuation report, it seems possible that Fortnox is trading behind its estimated value.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK50.79 billion.

Operations: Sectra's revenue segments include Imaging IT Solutions at SEK2.67 billion, Secure Communications at SEK388.55 million, and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 21.2% p.a.

Sectra AB stands out among Swedish growth companies with high insider ownership. The company reported strong Q1 earnings, with sales reaching SEK 736.75 million and net income at SEK 80.4 million, both showing significant year-over-year increases. Revenue is forecast to grow at 14.2% annually, outpacing the broader market's 1%. Additionally, recent successful implementation of Sectra One Cloud in Belgian hospitals highlights its innovative capabilities and potential for streamlined operations across healthcare facilities.

- Delve into the full analysis future growth report here for a deeper understanding of Sectra.

- Our valuation report here indicates Sectra may be overvalued.

Taking Advantage

- Get an in-depth perspective on all 93 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Outstanding track record with flawless balance sheet.