- Sweden

- /

- Specialty Stores

- /

- OM:HM B

H & M Hennes & Mauritz AB (publ) (STO:HM B) Not Flying Under The Radar

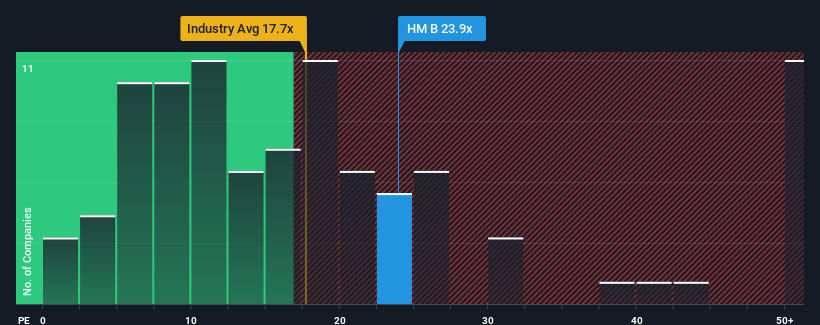

It's not a stretch to say that H & M Hennes & Mauritz AB (publ)'s (STO:HM B) price-to-earnings (or "P/E") ratio of 23.9x right now seems quite "middle-of-the-road" compared to the market in Sweden, where the median P/E ratio is around 23x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

H & M Hennes & Mauritz certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for H & M Hennes & Mauritz

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like H & M Hennes & Mauritz's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 62%. The latest three year period has also seen a 18% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 20% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 21% per annum, which is not materially different.

In light of this, it's understandable that H & M Hennes & Mauritz's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From H & M Hennes & Mauritz's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that H & M Hennes & Mauritz maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for H & M Hennes & Mauritz that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives