High Growth Tech And 2 Other Promising Stocks For Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable upswing, driven by easing core U.S. inflation and robust bank earnings that have propelled major U.S. stock indexes higher. This positive momentum has been reflected in the performance of key indices such as the S&P 500 and Russell 2000, highlighting a broader market sentiment that favors value stocks over growth shares amid fluctuating economic indicators. In this context, identifying promising stocks involves looking for companies with strong fundamentals and innovative potential that can capitalize on current economic trends while navigating potential challenges in the tech sector and beyond.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★☆☆

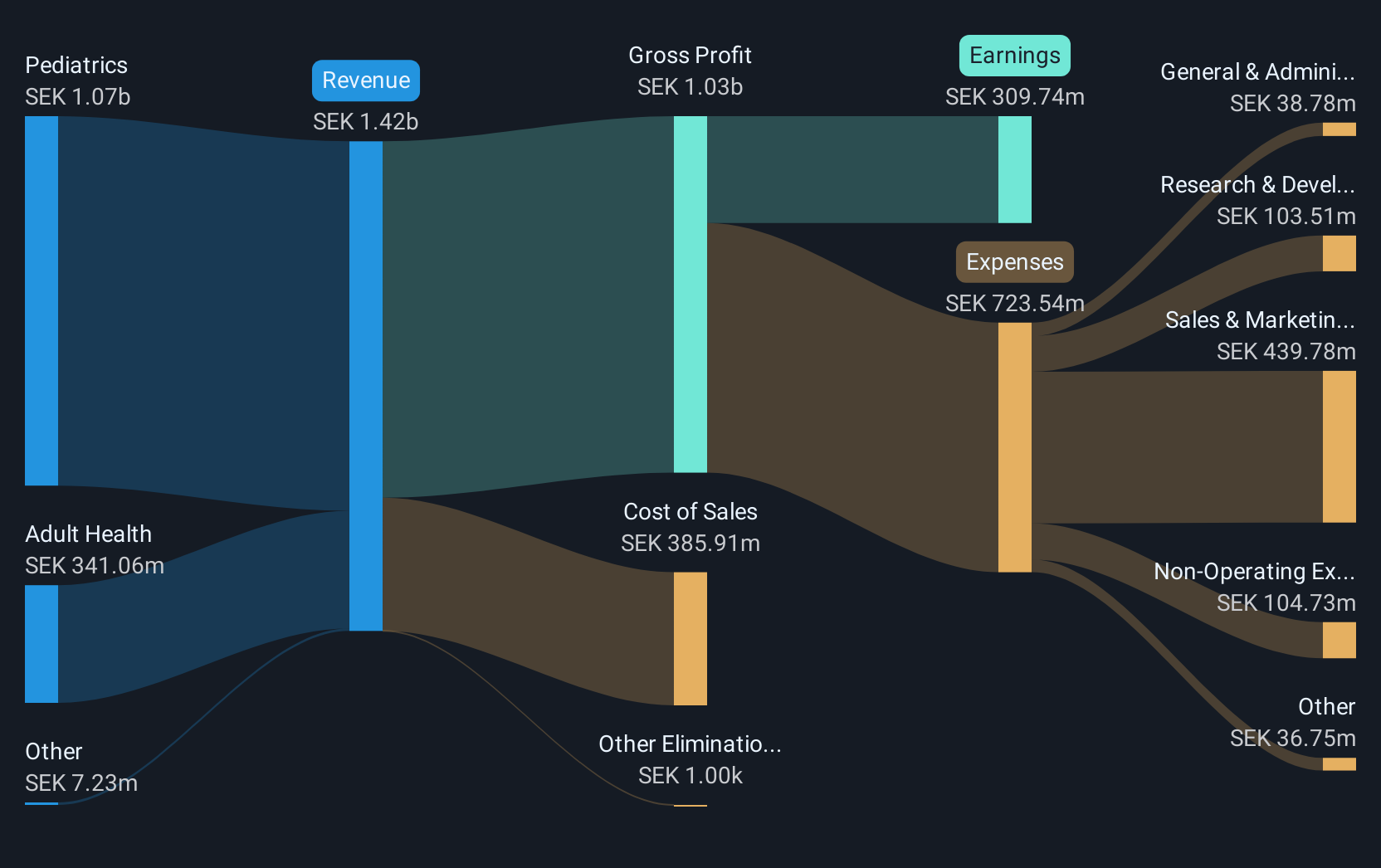

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market capitalization of approximately SEK11.52 billion.

Operations: The company's primary revenue streams are from its Pediatrics segment, generating SEK 1.04 billion, and Adult Health segment, contributing SEK 306.08 million.

Despite a challenging year with a 23% decline in earnings, BioGaia remains resilient, showcasing its agility within the biotech sector. The company's focus on innovation is evident from its recent launch of BioGaia® Gastrus® PURE ACTION, targeting sensitive stomachs with scientifically backed probiotics. This product expansion aligns with their R&D commitment—reflected in their substantial investment ratio of R&D to revenue at 15%. Looking ahead, BioGaia's strategic initiatives could enhance its market position even as it navigates industry volatility marked by rapid technological advancements and shifting consumer health trends.

- Dive into the specifics of BioGaia here with our thorough health report.

Gain insights into BioGaia's past trends and performance with our Past report.

NCAB Group (OM:NCAB)

Simply Wall St Growth Rating: ★★★★★☆

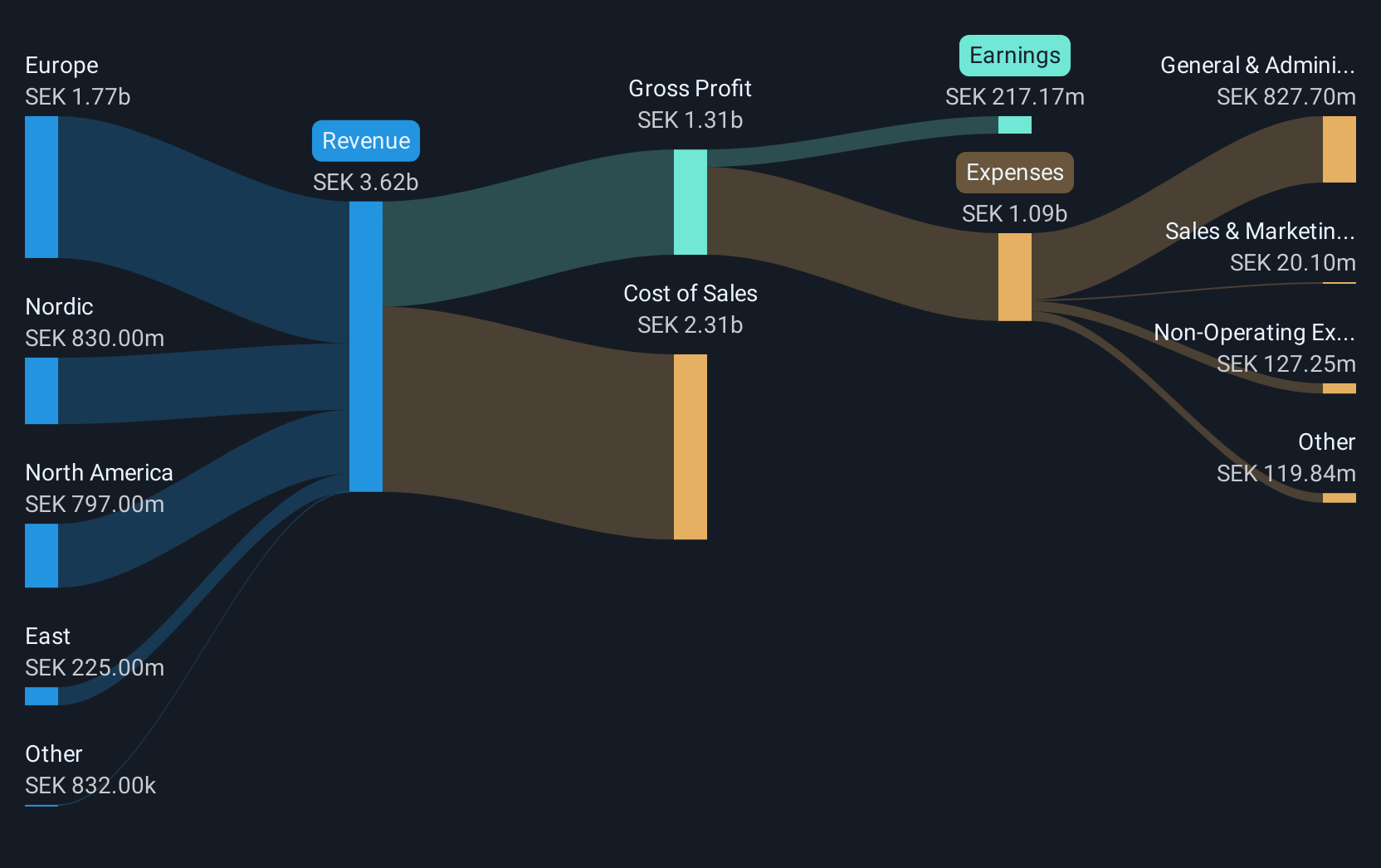

Overview: NCAB Group AB (publ) is a company that specializes in the manufacturing and sale of printed circuit boards (PCBs) across Sweden, the Nordic region, Europe, North America, and Asia, with a market capitalization of approximately SEK12.19 billion.

Operations: NCAB Group generates revenue primarily from the sale of printed circuit boards (PCBs) with significant contributions from Europe at SEK1.91 billion and North America at SEK786.70 million.

NCAB Group, amid a challenging fiscal year with revenue dipping to SEK 2.79 billion from SEK 3.24 billion, still projects robust future growth, with expected annual revenue increases of 11.4% outpacing the Swedish market's 1.1%. This resilience is mirrored in its earnings forecast, anticipated to surge by an impressive 24.3% annually. Contributing to this optimistic outlook is a strong focus on R&D and strategic market positioning that aligns well with evolving industry demands and client needs, ensuring NCAB remains competitive despite recent setbacks in net income which fell to SEK 213.4 million from SEK 336.5 million year-over-year.

- Take a closer look at NCAB Group's potential here in our health report.

Evaluate NCAB Group's historical performance by accessing our past performance report.

TianJin 712 Communication & Broadcasting (SHSE:603712)

Simply Wall St Growth Rating: ★★★★★☆

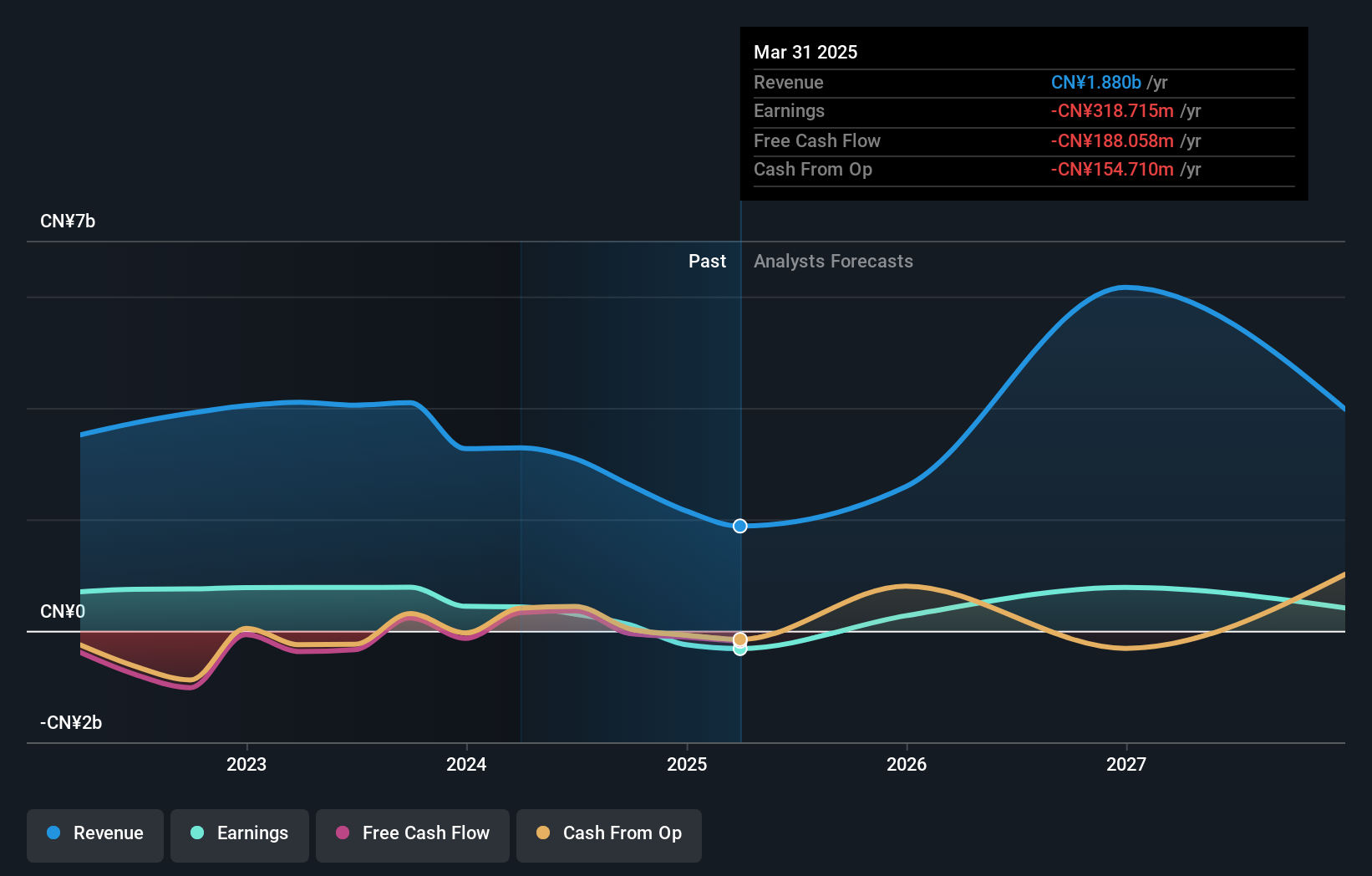

Overview: TianJin 712 Communication & Broadcasting Co., Ltd. operates in the communication and broadcasting industry with a market capitalization of CN¥12.52 billion.

Operations: The company generates revenue primarily from its communication and broadcasting operations. It focuses on delivering products and services tailored to the needs of these sectors, with a notable emphasis on technological advancements. The firm's financial performance is characterized by its strategic allocation of resources towards innovation and market expansion, which influences its cost structure.

Despite a challenging year with significant revenue decline to CNY 1.61 billion from CNY 2.27 billion, TianJin 712 Communication & Broadcasting is poised for recovery, forecasting an impressive annual earnings growth of 53.8%. This optimistic outlook is bolstered by its strategic focus on R&D and adapting to market demands, which could reposition it favorably within the tech sector. The company's recent extraordinary shareholders meeting suggests proactive governance amidst these financial adjustments, aiming to stabilize and eventually escalate its market standing.

- Delve into the full analysis health report here for a deeper understanding of TianJin 712 Communication & Broadcasting.

Understand TianJin 712 Communication & Broadcasting's track record by examining our Past report.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1224 more companies for you to explore.Click here to unveil our expertly curated list of 1227 High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

Flawless balance sheet with reasonable growth potential and pays a dividend.