- Sweden

- /

- Medical Equipment

- /

- OM:INTEG B

We Think Integrum (STO:INTEG B) Can Easily Afford To Drive Business Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Integrum (STO:INTEG B) shareholders have done very well over the last year, with the share price soaring by 146%. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So notwithstanding the buoyant share price, we think it's well worth asking whether Integrum's cash burn is too risky. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Integrum

How Long Is Integrum's Cash Runway?

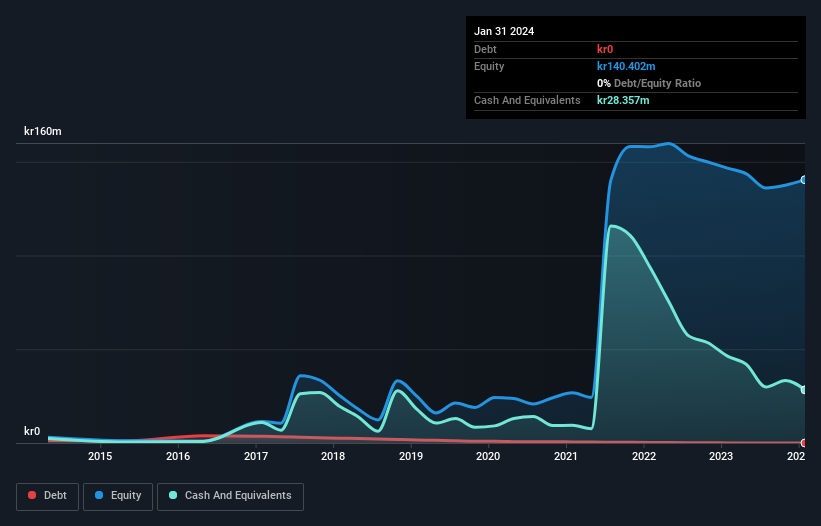

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In January 2024, Integrum had kr28m in cash, and was debt-free. Looking at the last year, the company burnt through kr20m. Therefore, from January 2024 it had roughly 17 months of cash runway. Importantly, analysts think that Integrum will reach cashflow breakeven in around 20 months. So there's a very good chance it won't need more cash, when you consider the burn rate will be reducing in that period. The image below shows how its cash balance has been changing over the last few years.

How Well Is Integrum Growing?

Integrum managed to reduce its cash burn by 58% over the last twelve months, which suggests it's on the right flight path. And revenue is up 27% in that same period; also a good sign. It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Integrum To Raise More Cash For Growth?

While Integrum seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Integrum has a market capitalisation of kr1.1b and burnt through kr20m last year, which is 1.9% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Integrum's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Integrum's cash burn. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. Its weak point is its cash runway, but even that wasn't too bad! There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash. An in-depth examination of risks revealed 2 warning signs for Integrum that readers should think about before committing capital to this stock.

Of course Integrum may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:INTEG B

Integrum

Researches, develops, and sells various systems for bone-anchored prostheses.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026