It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like C-Rad (STO:CRAD B). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for C-Rad

C-Rad's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years C-Rad grew its EPS by 16% per year. That's a good rate of growth, if it can be sustained.

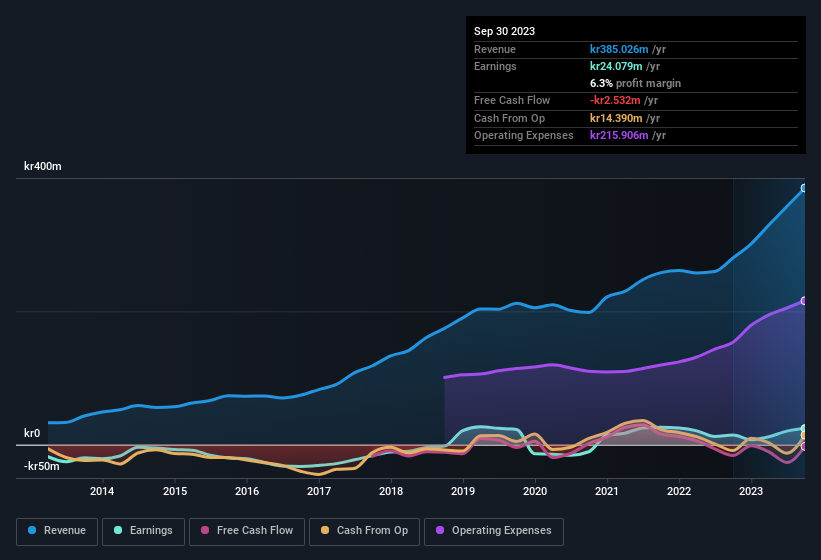

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. C-Rad shareholders can take confidence from the fact that EBIT margins are up from 9.0% to 11%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since C-Rad is no giant, with a market capitalisation of kr1.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are C-Rad Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for C-Rad shareholders is that no insiders reported selling shares in the last year. Add in the fact that Jenny Rosberg, the Independent Director of the company, paid kr256k for shares at around kr32.00 each. It seems that at least one insider is prepared to show the market there is potential within C-Rad.

Along with the insider buying, another encouraging sign for C-Rad is that insiders, as a group, have a considerable shareholding. Indeed, they hold kr285m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 17% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Cecilia De Leeuw is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between kr1.0b and kr4.2b, like C-Rad, the median CEO pay is around kr4.4m.

The C-Rad CEO received total compensation of just kr839k in the year to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add C-Rad To Your Watchlist?

One positive for C-Rad is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. Of course, profit growth is one thing but it's even better if C-Rad is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of C-Rad, you'll probably love this curated collection of companies in SE that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CRAD B

C-Rad

Develops, manufactures, and sells products and systems with applications in radiotherapy for the treatment of cancer in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives