- Sweden

- /

- Healthcare Services

- /

- OM:AMBEA

Shareholders Would Not Be Objecting To Ambea AB (publ)'s (STO:AMBEA) CEO Compensation And Here's Why

Key Insights

- Ambea to hold its Annual General Meeting on 14th of May

- Total pay for CEO Mark Jensen includes kr6.62m salary

- Total compensation is similar to the industry average

- Ambea's EPS grew by 40% over the past three years while total shareholder return over the past three years was 140%

The performance at Ambea AB (publ) (STO:AMBEA) has been quite strong recently and CEO Mark Jensen has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 14th of May. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for Ambea

Comparing Ambea AB (publ)'s CEO Compensation With The Industry

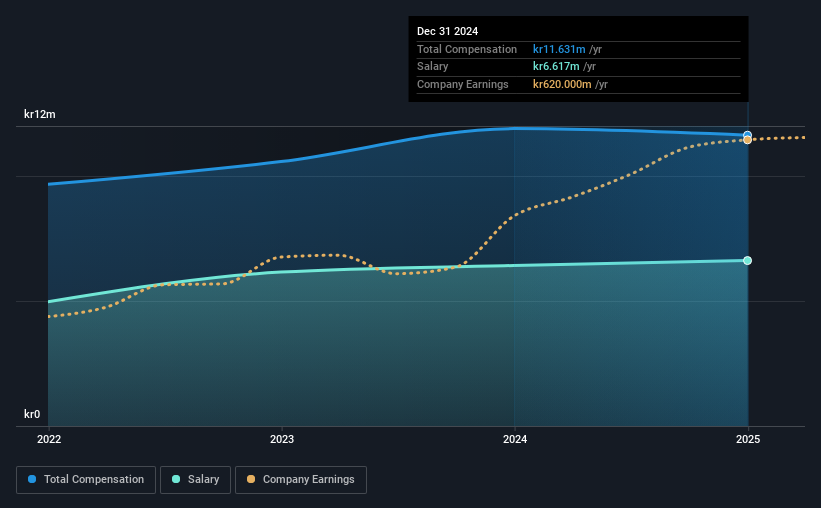

According to our data, Ambea AB (publ) has a market capitalization of kr9.1b, and paid its CEO total annual compensation worth kr12m over the year to December 2024. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is kr6.62m, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the Swedish Healthcare industry with market capitalizations ranging from kr3.9b to kr16b, the reported median CEO total compensation was kr13m. So it looks like Ambea compensates Mark Jensen in line with the median for the industry. What's more, Mark Jensen holds kr16m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr6.6m | kr6.4m | 57% |

| Other | kr5.0m | kr5.5m | 43% |

| Total Compensation | kr12m | kr12m | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. Ambea is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Ambea AB (publ)'s Growth Numbers

Ambea AB (publ) has seen its earnings per share (EPS) increase by 40% a year over the past three years. Its revenue is up 6.7% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ambea AB (publ) Been A Good Investment?

We think that the total shareholder return of 140%, over three years, would leave most Ambea AB (publ) shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Ambea you should be aware of, and 1 of them doesn't sit too well with us.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AMBEA

Ambea

Provides elderly care, disability care, and psychosocial support for the elderly and people with disabilities in Sweden, Norway, and Denmark.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)