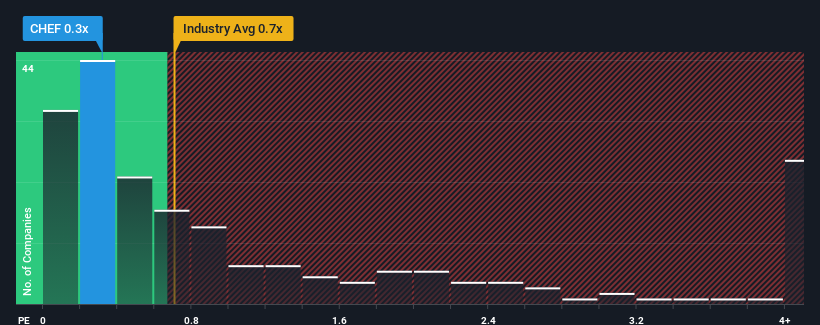

There wouldn't be many who think Cheffelo AB (publ)'s (STO:CHEF) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Food industry in Sweden is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Cheffelo

How Cheffelo Has Been Performing

With only a limited decrease in revenue compared to most other companies of late, Cheffelo has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Cheffelo's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cheffelo's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Cheffelo's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.0% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 0.4%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Cheffelo's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Cheffelo's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Cheffelo that you need to be mindful of.

If these risks are making you reconsider your opinion on Cheffelo, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CHEF

Cheffelo

Engages in the supply and delivery of meal kits to the customer's front door in Sweden, Norway, and Denmark.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives