- Sweden

- /

- Medical Equipment

- /

- OM:CEVI

3 Swedish Stocks Estimated To Be Trading At Discounts Of Up To 40.9%

Reviewed by Simply Wall St

As global markets navigate shifting economic landscapes, the Swedish market has been influenced by recent monetary policy adjustments from the European Central Bank, which have sparked optimism for further easing. In this context of potential economic support, identifying undervalued stocks can be a strategic move for investors seeking opportunities in Sweden's evolving financial environment.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK43.80 | SEK79.13 | 44.7% |

| Svedbergs Group (OM:SVED B) | SEK42.75 | SEK77.72 | 45% |

| Getinge (OM:GETI B) | SEK200.90 | SEK399.01 | 49.7% |

| Truecaller (OM:TRUE B) | SEK46.60 | SEK90.01 | 48.2% |

| Nolato (OM:NOLA B) | SEK52.45 | SEK103.31 | 49.2% |

| Wall to Wall Group (OM:WTW A) | SEK52.20 | SEK104.16 | 49.9% |

| TF Bank (OM:TFBANK) | SEK326.00 | SEK612.50 | 46.8% |

| Mentice (OM:MNTC) | SEK28.40 | SEK51.27 | 44.6% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| Bactiguard Holding (OM:BACTI B) | SEK45.00 | SEK85.45 | 47.3% |

Underneath we present a selection of stocks filtered out by our screen.

Betsson (OM:BETS B)

Overview: Betsson AB (publ) operates and manages online gaming businesses across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK38.45 billion.

Operations: The company's revenue segments include Casino at €605.50 million, Sportsbook at €402.30 million, and Other Products at €28.20 million.

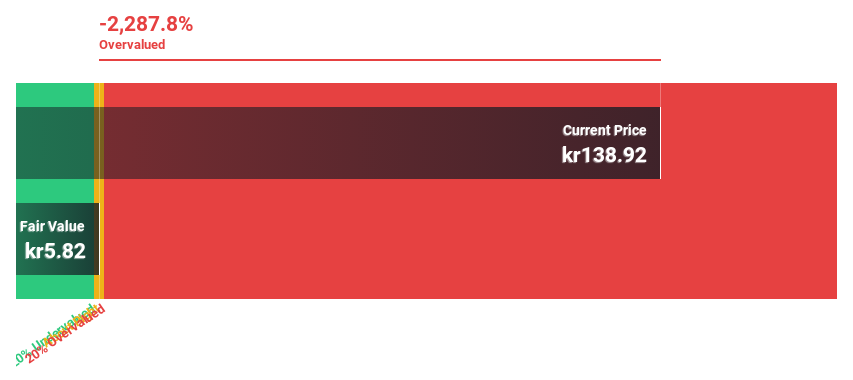

Estimated Discount To Fair Value: 40.9%

Betsson AB is trading at SEK 138.94, significantly below its estimated fair value of SEK 235.23, indicating potential undervaluation based on cash flows. Despite a dividend yield of 5.31% not being well covered by free cash flows and recent shareholder dilution, the company shows promising growth prospects with earnings forecasted to grow faster than the Swedish market at 16.85% annually. Recent earnings reports show increased sales but slightly lower net income compared to last year.

- The growth report we've compiled suggests that Betsson's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Betsson's balance sheet health report.

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of approximately SEK6.67 billion.

Operations: The company generates revenue of SEK726.40 million from its automated microscopy systems and reagents in the field of hematology.

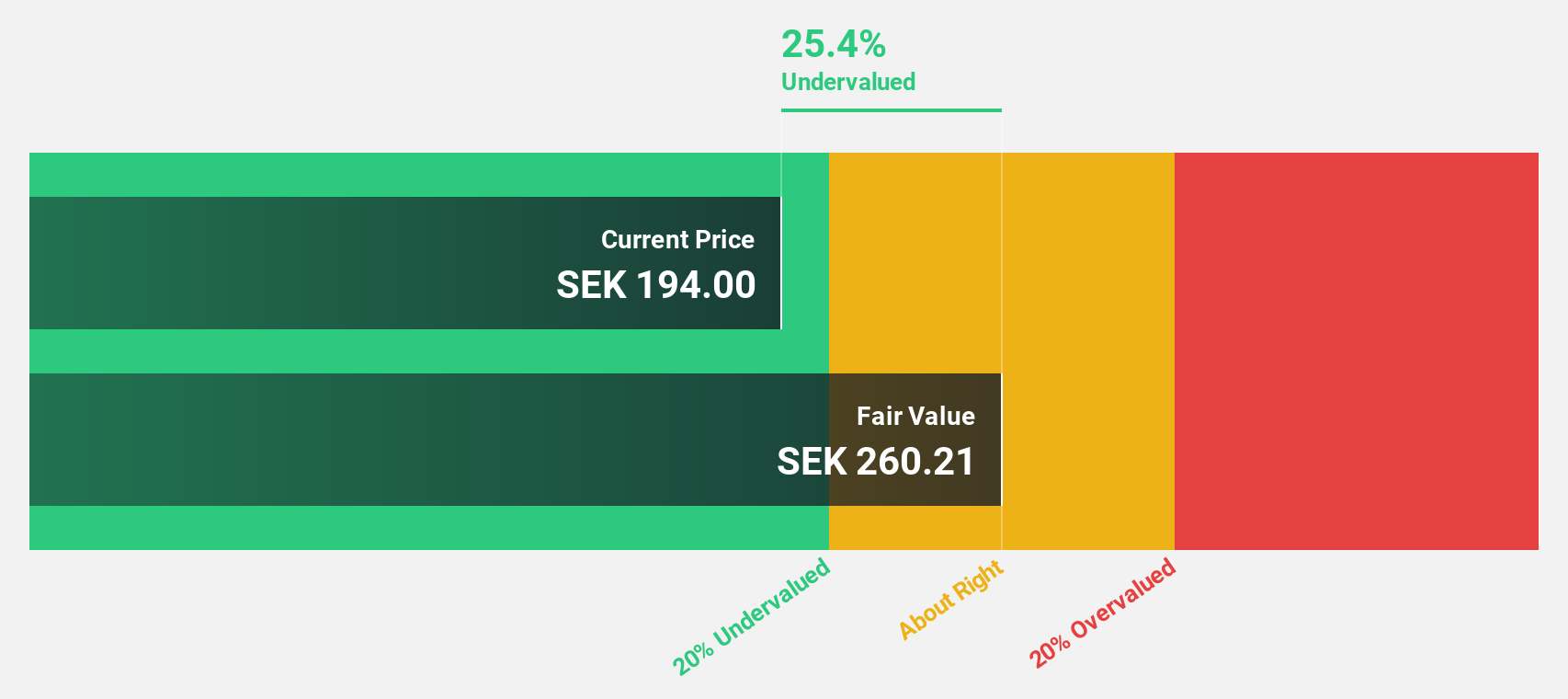

Estimated Discount To Fair Value: 12.4%

CellaVision is trading at SEK 279.5, slightly below its fair value of SEK 319.18, suggesting it may be undervalued based on cash flows. The company reported third-quarter sales of SEK 178.66 million and net income of SEK 31.11 million, both up from the previous year. Earnings are forecasted to grow significantly at 22.8% annually over the next three years, outpacing the Swedish market's growth rate, despite recent insider selling activity.

- Our expertly prepared growth report on CellaVision implies its future financial outlook may be stronger than recent results.

- Take a closer look at CellaVision's balance sheet health here in our report.

Ratos (OM:RATO B)

Overview: Ratos AB (publ) is a private equity firm that focuses on buyouts, turnarounds, add-on acquisitions, and middle market transactions, with a market cap of SEK11.10 billion.

Operations: Ratos generates revenue through its specialized activities in buyouts, turnarounds, add-on acquisitions, and middle market transactions.

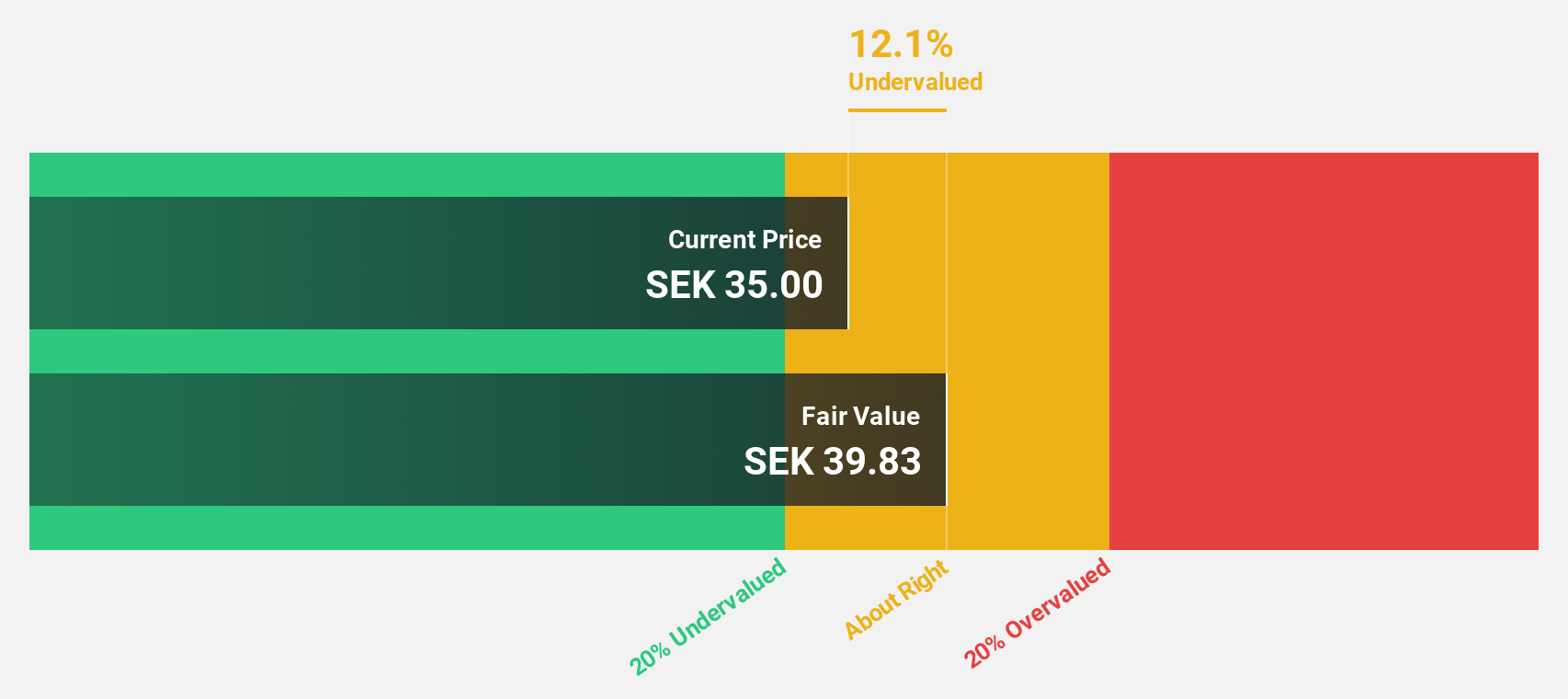

Estimated Discount To Fair Value: 31.2%

Ratos, trading at SEK 33.38, is undervalued relative to its fair value estimate of SEK 48.55, and is priced attractively compared to industry peers. Despite a recent net loss of SEK 146 million for Q3, earnings are projected to grow significantly at 23.9% annually over the next three years, outpacing Swedish market growth rates. However, its return on equity is anticipated to remain low at 10.5%, and dividend stability remains uncertain due to an inconsistent track record.

- Our growth report here indicates Ratos may be poised for an improving outlook.

- Dive into the specifics of Ratos here with our thorough financial health report.

Where To Now?

- Navigate through the entire inventory of 49 Undervalued Swedish Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CEVI

CellaVision

Develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives