- Sweden

- /

- Specialty Stores

- /

- OM:CLAS B

Undiscovered Gems In Sweden Featuring Clas Ohlson And 2 Other Small Cap Treasures

Reviewed by Simply Wall St

As global markets respond to recent economic shifts, the European Central Bank's rate cuts and a generally positive performance in key indices have created an intriguing backdrop for small-cap stocks. Against this dynamic landscape, Sweden offers a fertile ground for discovering undervalued opportunities that could thrive despite broader market volatility. In this article, we explore three Swedish small-cap stocks that stand out for their potential resilience and growth prospects, starting with Clas Ohlson.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

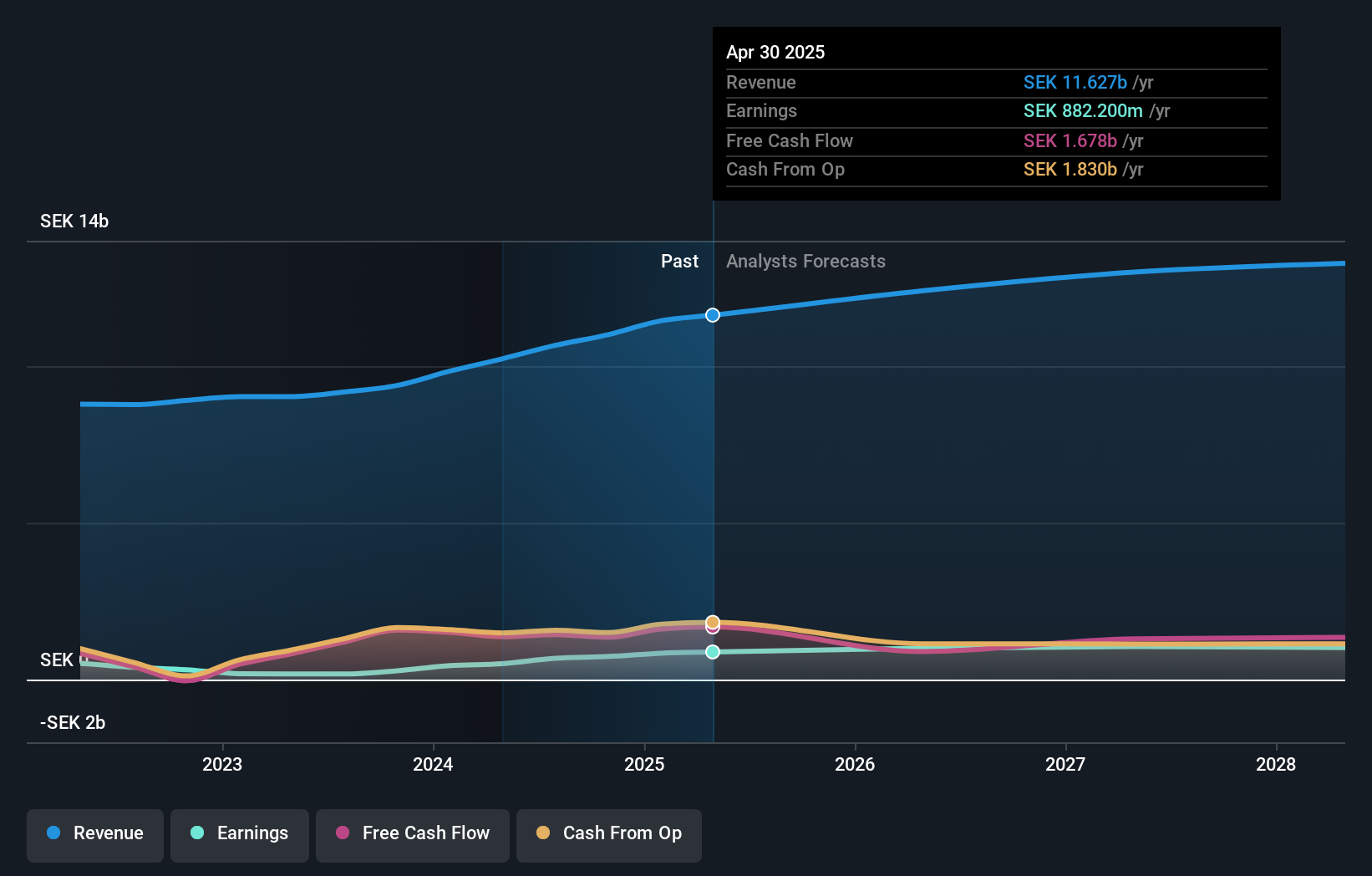

Overview: Clas Ohlson AB (publ) is a retail company that sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally with a market cap of SEK10.62 billion.

Operations: Clas Ohlson generates revenue primarily from its retail segment, amounting to SEK10.66 billion. The company's net profit margin stands at 6.2%.

Clas Ohlson, a Swedish retailer, has shown impressive financial performance recently. Earnings surged 281.8% over the past year, significantly outpacing the Specialty Retail industry’s growth of 21%. The company reported first-quarter sales of SEK 2.62 billion and net income of SEK 145.8 million compared to a net loss last year. Additionally, Clas Ohlson is trading at 65% below its estimated fair value and remains debt-free with high-quality earnings, making it an intriguing investment prospect in Sweden's retail sector.

- Navigate through the intricacies of Clas Ohlson with our comprehensive health report here.

Review our historical performance report to gain insights into Clas Ohlson's's past performance.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

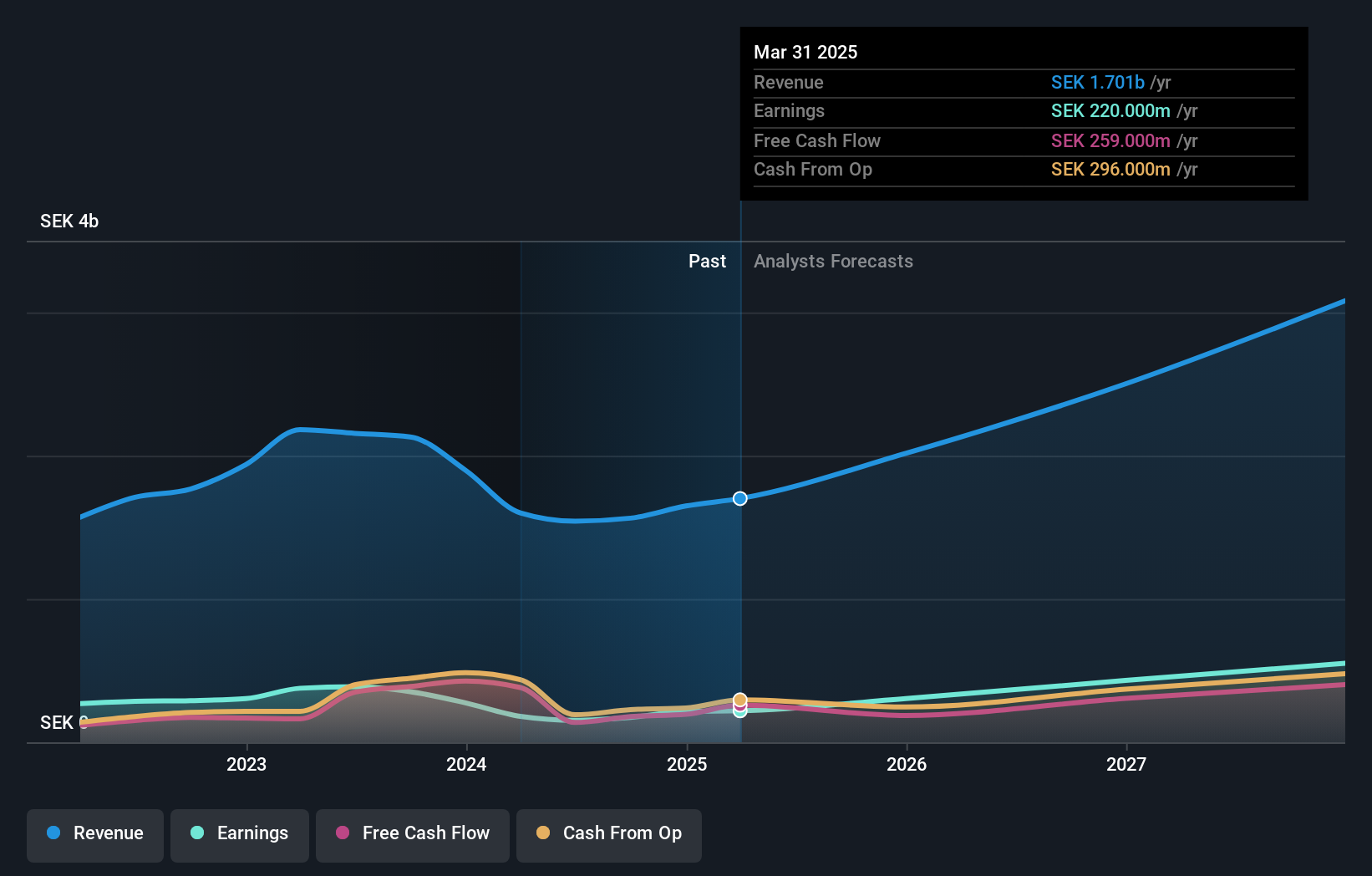

Overview: Engcon AB (publ) designs, produces, and sells excavator tools across various international markets with a market cap of SEK17.76 billion.

Operations: Engcon AB (publ) generates revenue primarily from the sale of construction machinery and equipment, amounting to SEK1.54 billion. The company has a market cap of SEK17.76 billion.

Engcon's recent performance highlights both challenges and strengths. The company's net profit margin fell to 9.9% from 18% last year, while earnings growth plummeted by 60.6%, contrasting sharply with the Machinery industry’s modest increase of 0.9%. Despite this, Engcon has high-quality earnings and a satisfactory net debt to equity ratio of 8.5%. Additionally, EBIT covers interest payments comfortably at a multiple of 20.4x, indicating robust financial health despite lower sales and income in recent quarters.

- Dive into the specifics of engcon here with our thorough health report.

Examine engcon's past performance report to understand how it has performed in the past.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

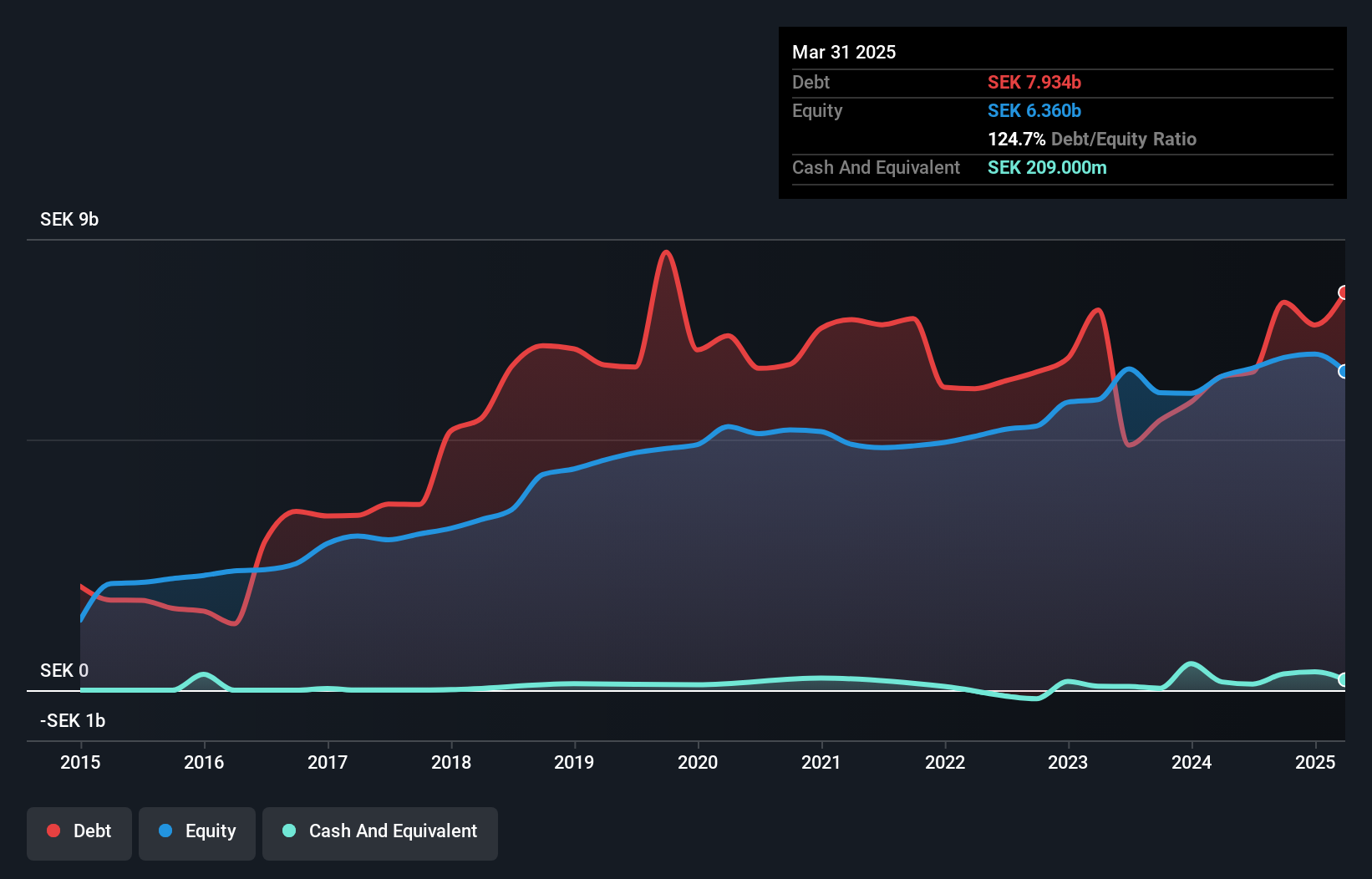

Overview: Hoist Finance AB (publ) is a credit market company that focuses on loan acquisition and management operations across Europe, with a market cap of SEK7.69 billion.

Operations: Hoist Finance generates revenue primarily from its secured and unsecured loan segments, with SEK2.86 billion from unsecured loans and SEK821 million from secured loans. Group items contribute an additional SEK255 million to the total revenue.

Hoist Finance has shown impressive growth, with earnings surging by 210.8% over the past year, outpacing the Consumer Finance industry’s -2.1%. The company’s net debt to equity ratio stands at 96.8%, which is considered high but has improved from 136.1% five years ago. Additionally, Hoist repurchased shares worth SEK 100 million in recent months and reported a net income of SEK 548 million for the first half of 2024, up from SEK 254 million last year.

- Unlock comprehensive insights into our analysis of Hoist Finance stock in this health report.

Explore historical data to track Hoist Finance's performance over time in our Past section.

Key Takeaways

- Reveal the 59 hidden gems among our Swedish Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLAS B

Clas Ohlson

A retail company, sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally.

Outstanding track record with flawless balance sheet.