European Market Highlights 3 Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As the European market continues to show resilience, with the STOXX Europe 600 Index marking its longest streak of weekly gains since 2012, investors are navigating a landscape shaped by mixed inflation data and economic contractions in major economies like Germany and France. Amidst this environment, identifying stocks that are estimated to be trading below their intrinsic value can present opportunities for those seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK55.20 | SEK108.16 | 49% |

| Sword Group (ENXTPA:SWP) | €33.20 | €64.81 | 48.8% |

| CD Projekt (WSE:CDR) | PLN221.60 | PLN441.21 | 49.8% |

| Tinexta (BIT:TNXT) | €7.77 | €15.40 | 49.6% |

| Vestas Wind Systems (CPSE:VWS) | DKK101.40 | DKK202.76 | 50% |

| Canatu Oyj (HLSE:CANATU) | €12.50 | €24.76 | 49.5% |

| Surgical Science Sweden (OM:SUS) | SEK157.50 | SEK310.93 | 49.3% |

| Cint Group (OM:CINT) | SEK6.775 | SEK13.32 | 49.2% |

| Nexstim (HLSE:NXTMH) | €8.48 | €16.75 | 49.4% |

| Better Collective (OM:BETCO) | SEK110.20 | SEK216.76 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

Harvia Oyj (HLSE:HARVIA)

Overview: Harvia Oyj is a company that manufactures and distributes traditional, steam, and infrared saunas, with a market cap of €860.17 million.

Operations: The company's revenue segment is Building Materials - HVAC Equipment, generating €175.21 million.

Estimated Discount To Fair Value: 14.7%

Harvia Oyj, trading at €46.05, is undervalued based on cash flows with an estimated fair value of €53.97. Despite a recent dip in quarterly net income to €5.44 million from €7.23 million, earnings are forecast to grow 16.9% annually, outpacing the Finnish market's 11.4%. The company's proposed dividend increase and strategic leadership changes aim to bolster growth and profitability in Europe, enhancing its appeal as a potential undervalued investment opportunity.

- Our earnings growth report unveils the potential for significant increases in Harvia Oyj's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Harvia Oyj.

Hoist Finance (OM:HOFI)

Overview: Hoist Finance AB (publ) is a credit market company involved in loan acquisition and management operations across Europe, with a market cap of SEK6.61 billion.

Operations: The company's revenue is derived from its loan acquisition and management operations, with SEK1.05 billion coming from secured loans and SEK3.20 billion from unsecured loans.

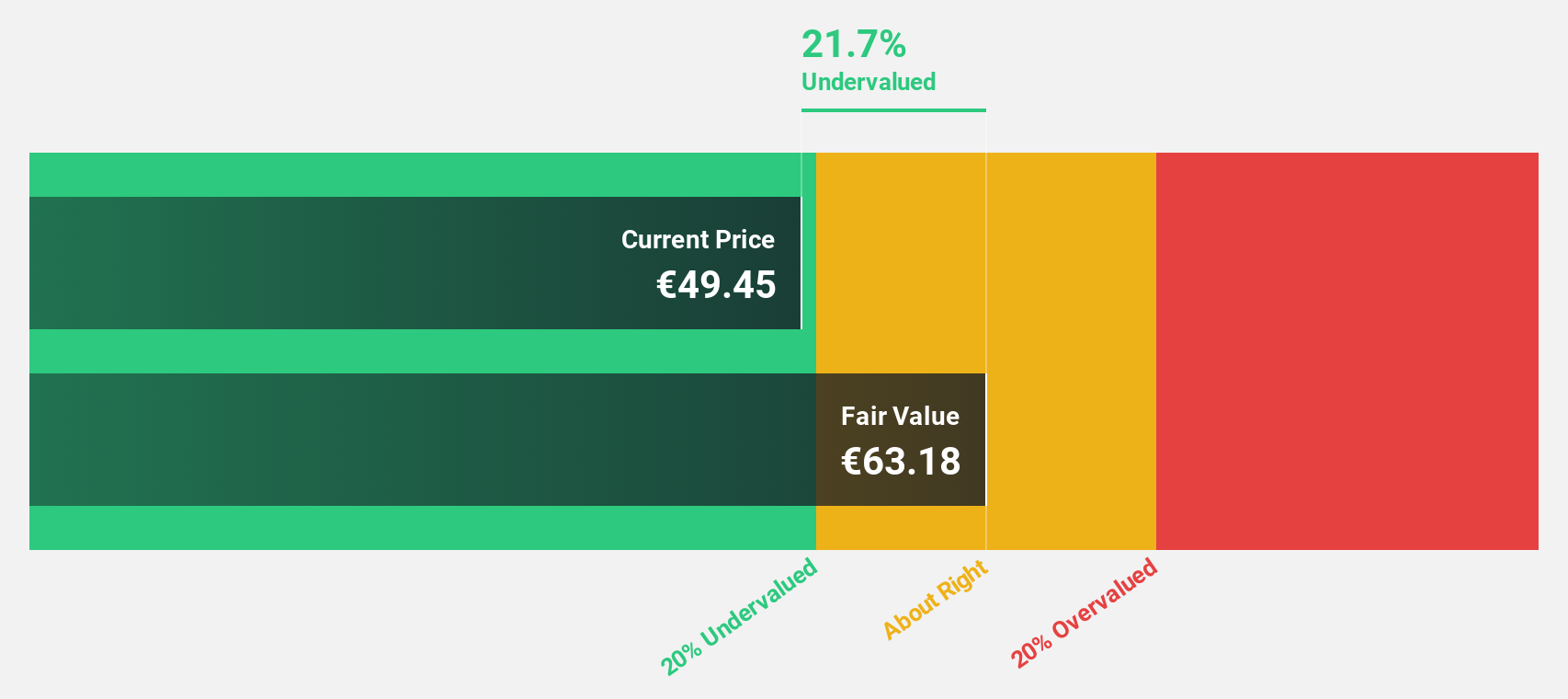

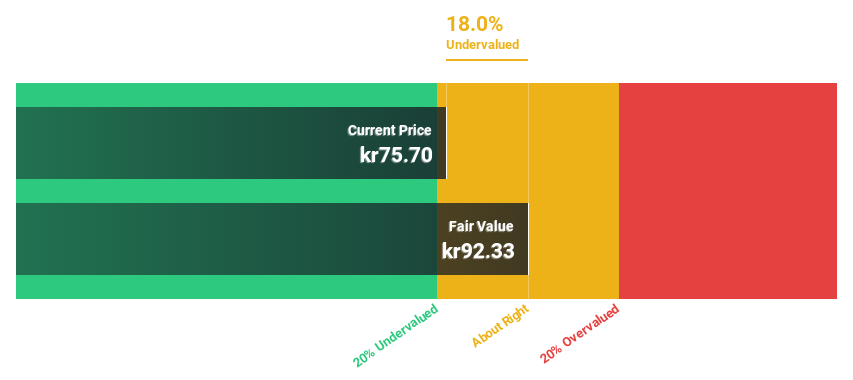

Estimated Discount To Fair Value: 18.1%

Hoist Finance, trading at SEK 75.6, is undervalued based on cash flows with a fair value estimate of SEK 92.34, offering good relative value compared to peers. Despite high debt levels and an unstable dividend track record, its earnings are forecast to grow significantly at 20.3% annually over the next three years, surpassing the Swedish market's growth rate. Recent earnings showed a net income increase to SEK 248 million for Q4 2024 from SEK 173 million a year ago.

- In light of our recent growth report, it seems possible that Hoist Finance's financial performance will exceed current levels.

- Get an in-depth perspective on Hoist Finance's balance sheet by reading our health report here.

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €362.45 million.

Operations: The company's revenue segment includes Wireless Communications Equipment, generating €245.89 million.

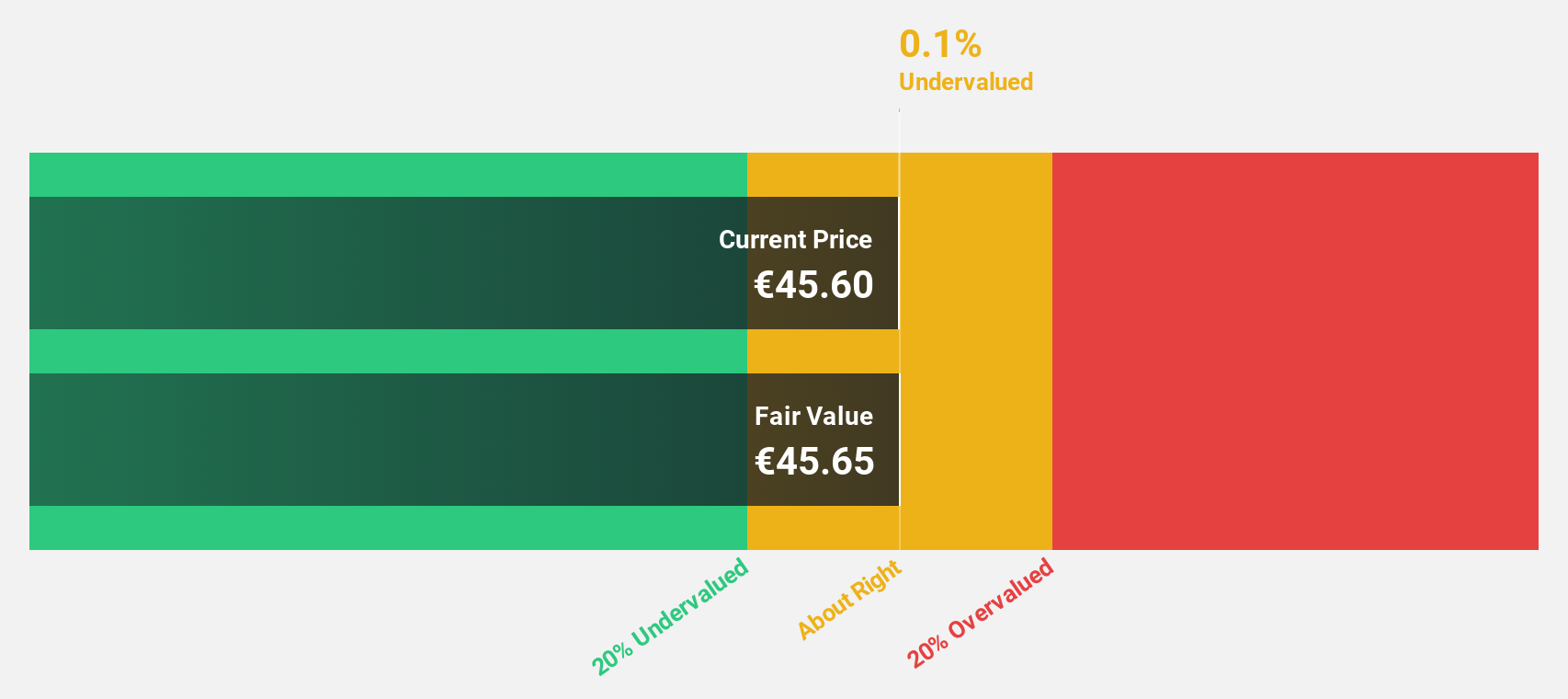

Estimated Discount To Fair Value: 20%

Init innovation in traffic systems is trading at €36.7, below its estimated fair value of €45.87, suggesting it is undervalued based on cash flows. The company's earnings are forecast to grow significantly at 27.8% annually, outpacing the German market's growth rate of 16.9%. While revenue growth is slower than 20% per year, it still exceeds the broader market's pace. However, its dividend yield of 1.91% isn't well covered by free cash flows.

- According our earnings growth report, there's an indication that init innovation in traffic systems might be ready to expand.

- Click here to discover the nuances of init innovation in traffic systems with our detailed financial health report.

Seize The Opportunity

- Gain an insight into the universe of 204 Undervalued European Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives